Introduction:

Welcome to our comprehensive guide on understanding the cost of equity. In this blog post, we will delve into the concept of cost of equity and explore its significance in the world of finance and investment. Whether you are a seasoned investor or just starting out, understanding the cost of equity is crucial for making informed investment decisions. We will discuss various real-life examples, case studies, and numerical illustrations to help you grasp the concept better. So, let’s dive in!

Index:

1. Introduction

2. What is Cost of Equity?

3. Why is Cost of Equity Important?

4. Calculating Cost of Equity

5. Real-Life Examples of Cost of Equity

– Example 1: Company X’s Cost of Equity Calculation

– Example 2: Impact of Market Volatility on Cost of Equity

6. Case Studies on Cost of Equity

– Case Study 1: Tech Startup Financing

– Case Study 2: Valuation of a Publicly Traded Company

7. Cost of Equity in the Indian Context

8. Applications of Cost of Equity

– Application 1: Capital Budgeting Decisions

– Application 2: Valuation of Stocks

9. Cost of Equity vs. Other Measures of Return

10. ConclusionSection

Section 1: What is Cost of Equity?

The cost of equity is a financial metric that measures the rate of return required by investors to hold a company’s stock or equity. It represents the compensation that shareholders expect for taking on the risk of investing in a particular company. Understanding the cost of equity is crucial for both companies and investors, as it helps determine the minimum return necessary to attract and retain investors.

The cost of equity is influenced by various factors, including the company’s financial health, industry risk, market conditions, and investors’ expectations. It is important to note that the cost of equity is different from the cost of debt, which represents the cost of borrowing funds.

Components of Cost of Equity:

1. Risk-Free Rate: The risk-free rate is the theoretical rate of return on an investment with zero risk, typically represented by government bonds or treasury bills. It forms the baseline for calculating the cost of equity, as investors require a higher return for taking on the additional risk associated with equity investments.

2. Equity Risk Premium (ERP): The equity risk premium is the additional return demanded by investors for investing in stocks instead of risk-free assets. It compensates investors for the volatility and uncertainty associated with equity investments. The ERP varies based on market conditions, economic outlook, and industry-specific risks.

3. Beta (β): Beta measures the sensitivity of a company’s stock price to changes in the overall market. It quantifies the systematic risk associated with the company’s equity. A beta greater than 1 indicates higher volatility than the market, while a beta less than 1 suggests lower volatility. The beta is used in the Capital Asset Pricing Model (CAPM) to calculate the cost of equity.

4. Company-Specific Risk: Apart from systematic risk captured by beta, individual companies may have unique risks associated with their operations, such as management quality, competitive landscape, regulatory environment, and financial leverage. These factors impact the cost of equity and are considered in company-specific risk assessments.

Understanding the concept of cost of equity is essential because it helps companies evaluate potential investments, determine the hurdle rate for accepting projects, and make informed decisions regarding capital structure and dividend policy. For investors, it assists in assessing the attractiveness of a company’s stock and comparing investment opportunities across different companies and industries.

Section 2: Why is Cost of Equity Important?

The cost of equity is a crucial metric in finance and investment analysis for both companies and investors. Let’s explore the reasons why understanding the cost of equity is essential:

1. Capital Structure Decisions: The cost of equity plays a significant role in a company’s capital structure decisions. It helps determine the appropriate mix of debt and equity financing by considering the trade-off between the cost of equity and the cost of debt. Companies aim to optimize their capital structure to minimize the overall cost of capital and maximize shareholder value.

2. Required Rate of Return: Investors use the cost of equity to assess the potential returns and risks associated with investing in a particular company. It serves as a benchmark for determining the minimum rate of return required by investors to justify investing in the company’s equity. By comparing the cost of equity with the expected return, investors can make informed decisions about buying, selling, or holding a company’s stock.

3. Valuation of Securities: The cost of equity is used in various valuation models, such as the Dividend Discount Model (DDM) and the Earnings Capitalization Model (ECM). These models estimate the intrinsic value of a company’s stock by discounting future expected dividends or earnings. The cost of equity is a key input in these models and significantly influences the valuation results.

4. Risk Assessment: The cost of equity reflects the risk associated with investing in a particular company. It considers both systematic risk (related to the overall market) and company-specific risk. By analyzing the cost of equity, investors can assess the risk profile of a company and compare it with other investment opportunities. It helps investors make risk-adjusted decisions and diversify their portfolios accordingly.

5. Investor Expectations: The cost of equity reflects the return expectations of investors. Companies need to meet or exceed these expectations to attract and retain shareholders. If the cost of equity is high, companies may face challenges in raising capital or may need to offer higher dividends or share buybacks to compensate shareholders for the perceived risk.

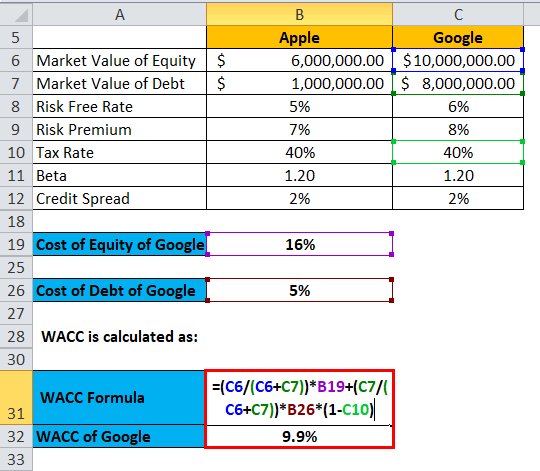

6. Cost of Capital: The cost of equity is an essential component in calculating the weighted average cost of capital (WACC), which represents the overall cost of financing for a company. The WACC is used in capital budgeting decisions to determine the discount rate for evaluating investment projects. A higher cost of equity increases the WACC, making it more difficult for projects to meet the required rate of return.

Understanding the cost of equity enables companies to make informed decisions about financing, investment opportunities, and dividend policies. It also provides investors with insights into the risk and return characteristics of companies, helping them assess investment opportunities and build diversified portfolios.

Section 3: Calculating Cost of Equity

Calculating the cost of equity requires the use of various models and approaches. Let’s explore some commonly used methods:

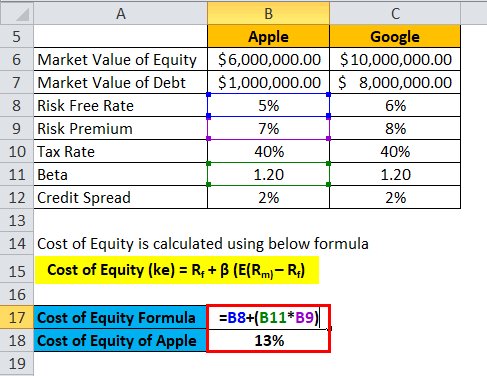

1. Capital Asset Pricing Model (CAPM):

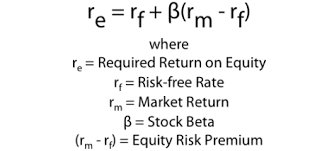

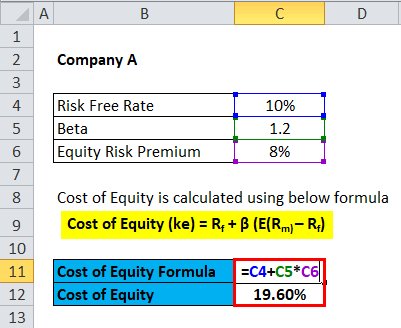

The CAPM is a widely used method for estimating the cost of equity. It considers the relationship between the expected return on a stock and its systematic risk (beta). The formula for calculating the cost of equity using CAPM is as follows:

Cost of Equity = Risk-Free Rate + Beta × Equity Risk Premium

The risk-free rate represents the return on a risk-free investment, such as government bonds. The equity risk premium compensates investors for the additional risk of investing in equities compared to risk-free assets. Beta measures the stock’s sensitivity to market movements.

2. Dividend Discount Model (DDM):

The DDM estimates the value of a stock by discounting the expected future dividends. The cost of equity is the discount rate used in this model. The formula for calculating the cost of equity using DDM is as follows:

Cost of Equity = Dividend / Stock Price + Growth Rate

Here, the dividend represents the expected dividend per share, the stock price is the current market price per share, and the growth rate is the expected growth rate of dividends.

3. Earnings Capitalization Model (ECM):

The ECM estimates the value of a company based on its expected future earnings. The cost of equity is the discount rate used to calculate the present value of those earnings. The formula for calculating the cost of equity using ECM is as follows:

Cost of Equity = Earnings per Share / Stock Price + Growth Rate

Here, earnings per share represents the expected earnings per share, the stock price is the current market price per share, and the growth rate is the expected growth rate of earnings.

It’s important to note that the CAPM is widely used due to its consideration of systematic risk through beta. However, the DDM and ECM can be used when reliable dividend or earnings projections are available.

When applying these models, it’s essential to consider factors such as market conditions, industry-specific risks, and company-specific factors that may affect the cost of equity. Additionally, sensitivity analysis can be conducted by adjusting inputs, such as the risk-free rate or growth rate, to understand the impact on the cost of equity.

Section 4: Real-Life Examples of Cost of Equity

In this section, we will present real-life examples of companies calculating their cost of equity using various methods. These examples will help illustrate the practical application of estimating the cost of equity in different scenarios. Let’s explore two examples:

Example 1: Company X’s Cost of Equity Calculation (CAPM)

Company X operates in the technology sector and has a beta of 1.5. The risk-free rate is 3%, and the equity risk premium is 8%.

Cost of Equity = Risk-Free Rate + Beta × Equity Risk Premium

Cost of Equity = 3% + 1.5 × 8%

Cost of Equity = 3% + 12%

Cost of Equity = 15%

In this example, the cost of equity for Company X is determined to be 15% using the CAPM. This indicates that shareholders of Company X would require a minimum return of 15% to justify holding the company’s stock, considering its systematic risk.

Example 2: Impact of Market Volatility on Cost of Equity (DDM)

Company Y is a stable utility company that consistently pays dividends. The company’s current stock price is $50, and it pays an annual dividend of $2 per share. The expected dividend growth rate is 5%.

Cost of Equity = Dividend / Stock Price + Growth Rate

Cost of Equity = $2 / $50 + 5%

Cost of Equity = 4% + 5%

Cost of Equity = 9%

In this example, the cost of equity for Company Y is calculated to be 9% using the DDM. This indicates that investors expect a 9% return on their investment in Company Y, considering the current dividend and expected growth rate.

It’s important to note that these examples are simplified for illustrative purposes. In real-life scenarios, additional factors and adjustments may be considered to calculate the cost of equity accurately, such as company-specific risk assessments and adjustments for market conditions.

By calculating the cost of equity, companies can evaluate the attractiveness of potential investment projects, determine hurdle rates for accepting projects, and make informed decisions regarding capital structure and dividend policies. Investors can use the cost of equity to assess the risk and return characteristics of companies, compare investment opportunities, and make well-informed investment decisions.

Section 5: Cost of Equity in the Indian Context

In this section, we will discuss the specific considerations and challenges related to calculating and applying the cost of equity in the Indian market. Understanding the cost of equity in the Indian context is important for investors and companies operating in the Indian financial landscape. Let’s explore some key aspects:

1. Market Conditions: The Indian market has its unique characteristics, including market volatility, regulatory frameworks, and economic factors. These factors can impact the risk and return expectations of investors, which in turn affect the cost of equity. It is important to consider the prevailing market conditions and incorporate them into the cost of equity calculations.

2. Interest Rates and Risk-Free Rate: The interest rate environment in India, as determined by the Reserve Bank of India (RBI), plays a significant role in determining the risk-free rate used in cost of equity calculations. Changes in the interest rates can have an impact on the required rate of return for investors and, subsequently, the cost of equity.

3. Industry-Specific Risks: Different sectors in India may have varying levels of risk associated with them. Factors such as government policies, regulatory frameworks, competitive landscape, and economic trends can impact the risk profile of industries. When estimating the cost of equity for companies operating in specific sectors, it is important to consider these industry-specific risks.

4. Emerging Market Considerations: India is classified as an emerging market, which brings its own set of opportunities and risks. Emerging markets tend to have higher levels of volatility and uncertainty compared to developed markets. This higher risk perception can influence the cost of equity for Indian companies.

5. Investor Sentiment and Expectations: Investor sentiment and expectations regarding the Indian market and specific companies can influence the cost of equity. Positive or negative sentiment, market trends, and economic outlook can impact the risk perception and return expectations of investors, thereby affecting the cost of equity.

When calculating the cost of equity in the Indian context, it is important to consider these factors and adapt the models and approaches accordingly. Incorporating local market data, industry-specific risks, and investor expectations can provide a more accurate estimation of the cost of equity for Indian companies.

By understanding the nuances of the Indian market and incorporating them into the cost of equity calculations, investors and companies can make better-informed decisions regarding investment opportunities, financing strategies, and overall capital allocation.

Section 6: Applications of Cost of Equity

The cost of equity has several applications in financial decision-making. In this section, we will explore two key applications: capital budgeting decisions and stock valuation. Understanding how the cost of equity is utilized in these contexts provides valuable insights for investors and companies. Let’s explore:

1. Capital Budgeting Decisions:

The cost of equity is an essential input in capital budgeting, which involves evaluating and selecting investment projects. When estimating the potential returns of investment projects, companies compare them to their cost of equity to determine if the projects meet the required rate of return.

If the expected return on a project is higher than the cost of equity, it suggests that the project is potentially profitable and may create value for shareholders. On the other hand, if the expected return falls below the cost of equity, the project may not meet the company’s investment criteria and may be considered too risky or not financially viable.

By incorporating the cost of equity in capital budgeting decisions, companies can allocate capital efficiently, prioritize projects with higher potential returns, and maximize shareholder value.

2. Stock Valuation:

The cost of equity is a key component in valuing stocks. Various valuation models, such as the Dividend Discount Model (DDM) or the Earnings Capitalization Model (ECM), require the cost of equity to estimate the intrinsic value of a company’s stock.

These models estimate the present value of expected future cash flows, such as dividends or earnings, by discounting them at the cost of equity. The higher the cost of equity, the lower the present value of future cash flows, which affects the valuation of the stock.

By using the cost of equity in stock valuation, investors can assess whether a stock is undervalued or overvalued relative to its intrinsic value. This information can guide investment decisions, helping investors identify opportunities for potential gains or avoid overpriced stocks.

Comparing the cost of equity with the expected returns of investment projects or using it in stock valuation provides a basis for making informed investment decisions. It helps companies and investors evaluate the attractiveness and profitability of investments and determine the appropriate pricing for stocks.

Section 7: Cost of Equity vs. Other Measures of Return

In this section, we will compare the cost of equity with other measures of return, namely the cost of debt and the weighted average cost of capital (WACC). Understanding the distinctions between these measures provides valuable insights into their respective roles and applications. Let’s explore:

1. Cost of Equity:

The cost of equity represents the rate of return required by investors to hold a company’s equity. It reflects the compensation that shareholders demand for taking on the risk associated with equity investments. The cost of equity is influenced by factors such as the risk-free rate, equity risk premium, beta, and company-specific risk. It is primarily used in evaluating investment opportunities, determining hurdle rates for accepting projects, and valuing stocks.

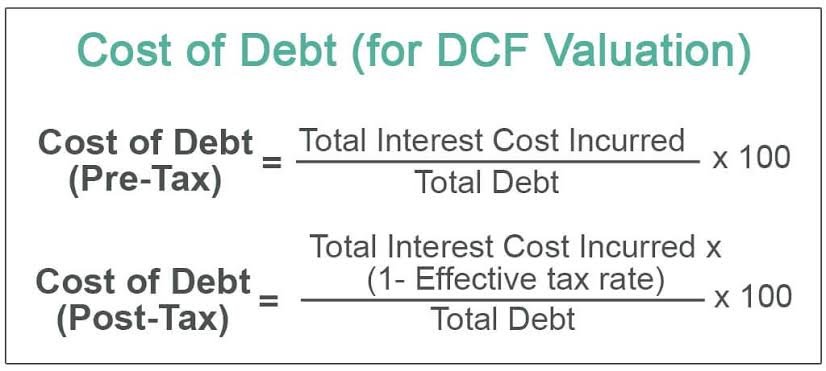

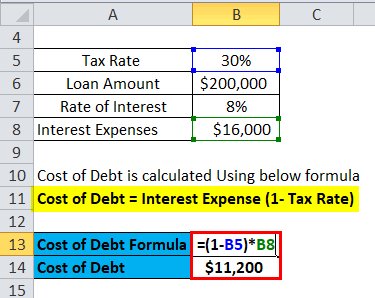

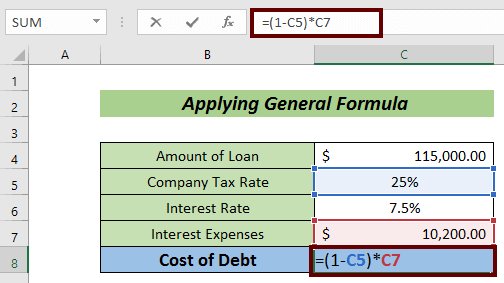

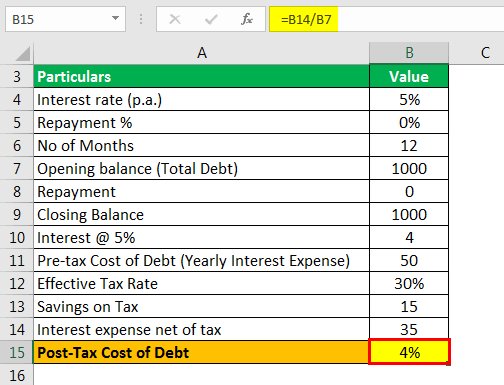

2. Cost of Debt:

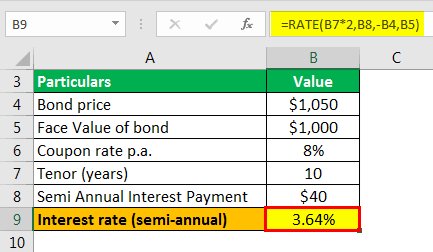

The cost of debt represents the interest expense a company incurs on its outstanding debt obligations. It is calculated by considering the interest rate on the debt and any associated fees. The cost of debt is typically lower than the cost of equity because debt is considered a less risky form of financing. It is used in estimating the interest expense for debt financing and determining the overall cost of capital.

3. Weighted Average Cost of Capital (WACC):

The WACC is a weighted average of the cost of equity and the cost of debt, taking into account the proportion of each in a company’s capital structure. The weights are based on the market value or book value of equity and debt. The WACC represents the average rate of return required by a company to finance its operations and investments. It is used in capital budgeting decisions to determine the discount rate for evaluating projects. Companies aim to minimize their WACC to maximize shareholder value.

While the cost of equity and cost of debt are specific measures of return associated with equity and debt financing, respectively, the WACC provides an overall measure that considers the entire capital structure of a company. It incorporates the relative weightings of equity and debt in the cost of capital calculation.

The cost of equity is generally higher than the cost of debt due to the higher risk associated with equity investments. The WACC combines these costs, reflecting the overall cost of financing for a company. It helps companies evaluate investment opportunities, assess the viability of projects, and make decisions about capital structure and financing options.

By understanding the differences between the cost of equity, cost of debt, and WACC, companies can make informed decisions regarding their capital structure, financing strategies, and investment evaluations.

Section 8: Conclusion

In this comprehensive guide, we explored the concept of the cost of equity and its significance in the world of finance and investment. We discussed its components, including the risk-free rate, equity risk premium, beta, and company-specific risk. We learned about the various methods used to calculate the cost of equity, such as the CAPM, DDM, and ECM.

Additionally, we explored real-life examples and case studies that illustrated the practical application of the cost of equity in different contexts, including tech startup financing and stock valuation. We also discussed the specific considerations and challenges associated with calculating the cost of equity in the Indian market.

Furthermore, we examined the applications of the cost of equity in capital budgeting decisions and stock valuation, highlighting its role in evaluating investment opportunities and determining the appropriate pricing for stocks. We compared the cost of equity with other measures of return, such as the cost of debt and the WACC, to understand their respective roles and applications.

Understanding the cost of equity is essential for companies and investors to make informed decisions regarding financing, capital budgeting, and investment evaluations. It helps companies optimize their capital structure, evaluate potential investment projects, and determine the required rate of return for shareholders. For investors, it assists in assessing the risk and return characteristics of companies, comparing investment opportunities, and making well-informed investment decisions.

As the financial landscape continues to evolve, it’s important to stay updated on market conditions, industry-specific risks, and investor expectations that can impact the cost of equity. By incorporating these factors and utilizing appropriate models and approaches, companies and investors can navigate the complexities of the cost of equity and make sound financial decisions.

Remember to consult with financial professionals and conduct thorough research when applying the concepts of the cost of equity to specific investment scenarios. The cost of equity serves as a valuable tool in the toolkit of investors and companies, empowering them to make informed choices and drive long-term value.

Leave a comment