Introduction:

Welcome to this comprehensive blog post on capital budgeting evaluation—a crucial process for businesses and individuals alike. In this chapter-by-chapter guide, we’ll delve into the world and Indian context of capital budgeting, providing user-friendly explanations, real-life examples, case studies, numericals, and applications. Together, we’ll explore how to make well-informed investment decisions that drive success. Let’s dive in!

INDEX

Chapter 1: Understanding Capital Budgeting

Chapter 2: Methods of Capital Budgeting

Chapter 3: Risk Assessment in Capital Budgeting

Chapter 4: Capital Budgeting in the Global Context

Chapter 5: Capital Budgeting in the Indian Context

Chapter 6: Integrating Sustainability in Capital Budgeting

Chapter 7: Case Studies – Capital Budgeting Triumphs and Pitfalls

Chapter 8: Implementing Capital Budgeting in Your Business

Conclusion

Chapter 1: Understanding Capital Budgeting

In this chapter, we will explore the fundamental concepts of capital budgeting and its significance in financial decision-making. Let’s dive into the key points:

1.1 What is Capital Budgeting?

Capital budgeting is the process of evaluating and selecting long-term investment projects that involve significant financial outlays. These investments can include acquiring new assets, expanding existing operations, or developing new products or services. It plays a crucial role in the strategic planning of businesses and individuals, as it determines the allocation of resources to projects with the highest potential returns.

1.2 Importance of Capital Budgeting

Effective capital budgeting is vital for several reasons:

– Allocation of Scarce Resources: Capital budgeting ensures that limited resources are allocated to projects that create the most value and align with the organization’s objectives.

– Long-Term Planning: It facilitates long-term financial planning and ensures that investments contribute to sustainable growth.

– Risk Management: Careful evaluation of investment opportunities helps identify and manage risks associated with each project.

– Competitive Advantage: Sound capital budgeting decisions can lead to a competitive edge and improved market positioning.

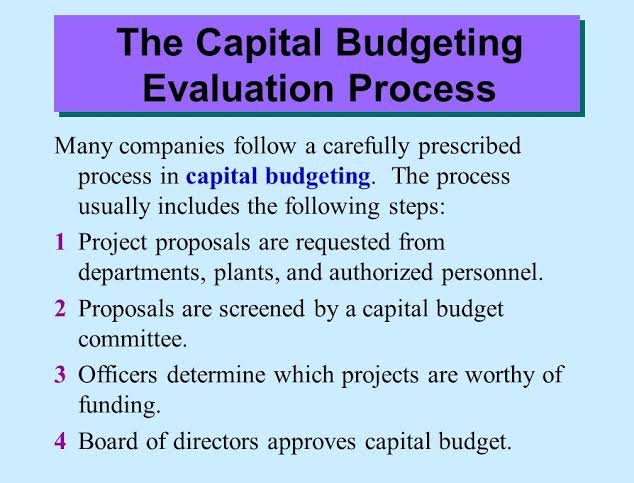

1.3 The Capital Budgeting Process

The capital budgeting process involves several stages:

– Identification of Investment Opportunities: Potential investment opportunities are identified based on strategic goals and market research.

– Project Evaluation: Various capital budgeting techniques are employed to evaluate the feasibility of each project. Common methods include NPV, IRR, Payback Period, and Profitability Index.

– Risk Analysis: Risks associated with each investment are assessed to understand potential challenges and uncertainties.

– Decision Making: After thorough analysis, investment decisions are made, and projects are prioritized based on their potential returns and risk profiles.

– Implementation and Monitoring: Successful projects are implemented, and their progress is monitored to ensure they deliver the expected outcomes.

1.4 Real-Life Examples

To grasp the practical implications of capital budgeting, we’ll explore real-life examples of companies that made strategic investment decisions. These case studies will illustrate the positive impact of effective capital budgeting on business growth and profitability.

Conclusion

In Chapter 1, we’ve laid the foundation for understanding capital budgeting. You now have a clear grasp of what capital budgeting is, its importance in financial planning, the steps involved in the evaluation process, and how it contributes to achieving long-term goals. Armed with this knowledge, you are ready to explore various capital budgeting methods in the upcoming chapters.

Chapter 2: Methods of Capital Budgeting

In this chapter, we will explore various methods used in capital budgeting to evaluate potential investment opportunities. These methods play a crucial role in making informed decisions about long-term investments. Let’s delve into the key points:

1. Net Present Value (NPV)

Net Present Value is a widely used method that assesses the profitability of an investment by comparing the present value of cash inflows with the present value of cash outflows. A positive NPV indicates a potentially profitable project.

2. Internal Rate of Return (IRR)

The Internal Rate of Return is the discount rate at which the NPV of an investment becomes zero. It represents the project’s effective rate of return, and higher IRR suggests better investment prospects.

3. Payback Period

The Payback Period calculates the time required for an investment to recoup its initial cost. Shorter payback periods are generally preferred, as they indicate faster return on investment.

4. Profitability Index

Profitability Index (PI) is the ratio of the present value of cash inflows to the present value of cash outflows. It helps in ranking projects based on their profitability per unit of investment.

5. Discounted Payback Period

Similar to the payback period, the discounted payback period considers the time needed to recover the initial investment, but it takes into account discounted cash flows.

6. Accounting Rate of Return (ARR)

The Accounting Rate of Return calculates the average annual profit generated by an investment as a percentage of the initial investment.

7. Modified Internal Rate of Return (MIRR)

MIRR addresses the issues with conventional IRR by assuming that cash flows are reinvested at a specific rate instead of the project’s IRR.

8. Equivalent Annual Annuity (EAA)

EAA helps compare projects with different lifespans by converting their cash flows into an equivalent uniform annual series.

It’s crucial to understand the strengths and limitations of each method to choose the most suitable one for a specific investment scenario. By applying these techniques, businesses and individuals can make well-informed capital budgeting decisions.

Conclusion

In Chapter 2, we explored the key methods used in capital budgeting to evaluate investment opportunities. Each method offers unique insights into the feasibility and profitability of projects. By mastering these techniques, you will be better equipped to analyze potential investments and drive successful financial outcomes.

Stay tuned for the next chapter, where we will delve into risk assessment in capital budgeting and how to mitigate potential challenges in your investment decisions.

Chapter 3: Risk Assessment in Capital Budgeting

In this chapter, we will delve into the critical aspect of risk assessment in capital budgeting. Evaluating and managing risks associated with potential investment projects is essential to make informed decisions and safeguard the financial health of businesses and individuals. Let’s explore the key points:

1. Understanding Investment Risks

Before embarking on any investment project, it’s crucial to identify and comprehend the various types of risks involved. These risks can include market risk, technological risk, economic risk, regulatory risk, and project-specific risks. Each risk type poses unique challenges and uncertainties that need to be carefully considered during the evaluation process.

2. Sensitivity Analysis

Sensitivity analysis involves examining how changes in specific variables, such as sales volumes, costs, or interest rates, affect the project’s financial outcomes. By performing sensitivity analysis, decision-makers can understand the project’s vulnerability to changes in key factors and plan accordingly.

3. Scenario Analysis

Scenario analysis evaluates the impact of different possible future scenarios on the investment project. Decision-makers create multiple scenarios based on different market conditions and assumptions to assess how the project’s performance may vary under various circumstances.

4. Monte Carlo Simulation

Monte Carlo simulation is a sophisticated method that uses random sampling to model a range of possible outcomes for an investment project. By incorporating probabilities and uncertainties, it provides a comprehensive view of the project’s potential performance and risk exposure.

5. Risk-Adjusted Discount Rate

The risk-adjusted discount rate accounts for the project’s risk level by applying a higher discount rate to riskier projects and a lower discount rate to less risky ones. This method ensures that riskier projects are adequately compensated for their higher uncertainty.

6. Mitigating Risks

Once risks are identified, effective risk mitigation strategies can be implemented. These strategies may include diversification, insurance coverage, contingency planning, and risk-sharing agreements with partners or stakeholders.

7. Importance of Flexibility

In uncertain environments, maintaining flexibility in investment decisions is crucial. Having the ability to adapt and adjust projects as new information emerges can reduce the impact of unforeseen risks.

Conclusion

In Chapter 3, we explored the vital aspect of risk assessment in capital budgeting. Understanding and managing risks are essential for making prudent investment decisions. By employing sensitivity analysis, scenario analysis, Monte Carlo simulation, and risk-adjusted discount rates, decision-makers can gain valuable insights into potential risks and uncertainties.

Stay tuned for Chapter 4, where we will examine capital budgeting in the global context and explore how cross-border investments and foreign exchange considerations impact investment decisions.

Chapter 4: Capital Budgeting in the Global Context

In this chapter, we will explore capital budgeting from a global perspective. As businesses expand their operations internationally and individuals seek cross-border investment opportunities, understanding the unique challenges and opportunities in the global context becomes essential. Let’s delve into the key points:

1. Cross-Border Investments

With globalization, businesses and investors increasingly seek opportunities beyond their home countries. We’ll explore the benefits and risks associated with cross-border investments, including access to new markets, diversification, currency fluctuations, regulatory differences, and political uncertainties.

2. Foreign Exchange Considerations

When investing internationally, fluctuations in foreign exchange rates can significantly impact returns. We’ll discuss how businesses and investors can manage exchange rate risk through hedging strategies and currency risk assessment.

3. Cultural and Legal Factors

Operating in different countries requires understanding cultural nuances and legal frameworks. We’ll explore how these factors influence investment decisions and how businesses adapt their strategies to ensure success in diverse environments.

4. International Case Studies

Examining real-life case studies of companies that have successfully navigated global capital budgeting will provide valuable insights into the best practices and lessons learned from their experiences.

5. Global Investment Regulations

Different countries have varying investment regulations, tax structures, and reporting requirements. Understanding and complying with these regulations are vital to avoid legal pitfalls and ensure smooth operations in foreign markets.

6. Strategic Partnerships and Joint Ventures

Forming strategic partnerships and joint ventures can provide a competitive advantage when entering new markets. We’ll discuss how collaborative arrangements can mitigate risks and enhance project success.

7. Political and Economic Stability

Political and economic stability play a significant role in investment decisions. We’ll explore how geopolitical events and macroeconomic conditions can impact cross-border investments and how investors can assess and mitigate associated risks.

Conclusion

In Chapter 4, we’ve explored capital budgeting in the global context. Understanding the complexities of cross-border investments, foreign exchange considerations, cultural and legal factors, and international regulations is essential for making successful global investment decisions.

In the next chapter, we’ll shift our focus to capital budgeting in the Indian context. We’ll examine the unique aspects of investing in India, the regulatory environment, and real-life examples of Indian companies that have made strategic investment choices. Stay tuned to broaden your understanding of capital budgeting in the diverse Indian business landscape.

Chapter 5: Capital Budgeting in the Indian Context

In this chapter, we will explore the unique aspects of capital budgeting in the Indian business landscape. India’s dynamic economy, diverse industries, and specific regulatory environment influence investment decisions. Let’s delve into the key points:

1. Economic Outlook of India

We’ll provide an overview of India’s economic growth, major sectors driving the economy, and the potential for investment opportunities. Understanding India’s economic landscape is crucial for assessing the viability of investment projects.

2. Government Policies and Incentives

India’s government offers various policies and incentives to promote investments in specific sectors. We’ll explore how these policies impact capital budgeting decisions and how businesses can benefit from government support.

3. Regulatory Framework

India has a unique regulatory environment that businesses must navigate. We’ll discuss the legal and financial regulations that influence investment decisions, including taxation, foreign direct investment (FDI) regulations, and compliance requirements.

4. Cultural and Social Factors

Cultural and social factors play a significant role in the Indian context. Understanding the cultural nuances and consumer behavior is vital for businesses planning to invest in the Indian market.

5. Real-Life Examples of Indian Companies

We’ll explore case studies of successful Indian companies that have made strategic capital budgeting decisions, showcasing how effective investment planning can lead to substantial growth and market success.

6. Infrastructural and Technological Advancements

India’s infrastructural and technological advancements impact investment decisions, especially in sectors like IT, manufacturing, and renewable energy. We’ll analyze how businesses leverage these advancements for competitive advantages.

7. Challenges and Opportunities

Capital budgeting in India comes with its set of challenges, such as bureaucratic hurdles, infrastructure gaps, and regulatory complexities. However, it also presents vast opportunities due to the country’s large consumer base, emerging markets, and skilled workforce.

Conclusion

In Chapter 5, we explored capital budgeting in the Indian context, considering the economic outlook, government policies, regulatory framework, cultural factors, and real-life examples. Businesses looking to invest in India must be well-informed about the specificities of the Indian market to make informed and successful investment decisions.

In the next chapter, we’ll focus on integrating sustainability in capital budgeting. We’ll explore how Environmental, Social, and Governance (ESG) factors impact investment decisions and how businesses can incorporate sustainability principles into their financial planning for a better future. Stay tuned for valuable insights on responsible investment practices.

Chapter 6: Integrating Sustainability in Capital Budgeting

In this chapter, we will explore the growing importance of sustainability in capital budgeting. With increasing awareness of environmental and social concerns, businesses and investors are recognizing the significance of making responsible and sustainable investment decisions. Let’s delve into the key points:

1. Understanding Environmental, Social, and Governance (ESG) Factors

ESG factors are crucial in assessing the long-term impact of investment projects. We’ll discuss how environmental factors, such as carbon footprint and resource usage, social factors like employee welfare and community impact, and governance principles, including transparency and ethical practices, influence investment decisions.

2. Benefits of Sustainable Investments

Integrating sustainability into capital budgeting offers several benefits, including enhanced reputation and brand value, reduced operational risks, access to a growing market of environmentally conscious consumers, and increased resilience in the face of environmental and regulatory changes.

3. ESG Reporting and Standards

We’ll explore the various frameworks and standards available for ESG reporting, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). These frameworks help businesses measure, report, and disclose their sustainability performance.

4. Case Studies of Sustainable Investments

Real-life case studies of companies that have successfully integrated sustainability into their capital budgeting decisions will showcase how such initiatives can drive financial success while making a positive impact on society and the environment.

5. Sustainable Finance and Green Bonds

The rise of sustainable finance and green bonds provides avenues for funding projects with a focus on environmental and social objectives. We’ll discuss how businesses can tap into these financial instruments to support sustainable initiatives.

6. Aligning Sustainability with Business Goals

Integrating sustainability into capital budgeting requires aligning environmental and social objectives with overall business strategies. We’ll explore how businesses can set clear sustainability goals and incorporate them into their investment decision-making process.

7. Sustainable Risk Assessment

Sustainability risks, such as reputational damage from environmental controversies or supply chain disruptions due to social issues, should be considered in the risk assessment process. We’ll discuss how businesses can effectively identify and manage these risks.

Conclusion

In Chapter 6, we explored the importance of integrating sustainability into capital budgeting. Embracing Environmental, Social, and Governance (ESG) factors offers numerous benefits, fostering responsible and resilient investments that positively impact society and the planet.

In the next chapter, we’ll delve into case studies of both successful and unsuccessful capital budgeting decisions. By analyzing real-life examples, we can gain valuable insights into the factors that contribute to triumphs and pitfalls in investment choices. Stay tuned for a comprehensive analysis of capital budgeting successes and failures.

Chapter 7: Case Studies – Capital Budgeting Triumphs and Pitfalls

In this chapter, we’ll delve into real-life case studies of companies and individuals that have experienced both successful and unsuccessful capital budgeting decisions. By analyzing these examples, we can gain valuable insights into the factors that contribute to triumphs and pitfalls in investment choices. Let’s explore these case studies:

1. Triumph: Company X’s Expansion Strategy

Company X, a tech startup, carefully evaluated various expansion opportunities using the NPV and IRR methods. They identified a lucrative market in a neighboring country and decided to invest in establishing a new branch. Through thorough risk analysis, they mitigated potential regulatory and market risks. The venture turned out to be a tremendous success, significantly boosting the company’s revenue and market share.

Key takeaways:

– Proper evaluation of investment opportunities using reliable capital budgeting methods.

– In-depth risk analysis and mitigation strategies for cross-border expansion.

2. Pitfall: Retailer Y’s Misjudged Expansion

Retailer Y, a national chain, decided to rapidly expand its presence by opening multiple stores in various locations. However, they neglected to conduct a detailed analysis of each location’s potential and competition. The lack of proper evaluation led to underperforming stores, loss of resources, and damaged brand reputation.

Key takeaways:

– Careful consideration of market potential and competition before expanding.

– Avoiding hasty investment decisions without thorough analysis.

3. Triumph: Renewable Energy Project Z

Project Z, a solar energy initiative, faced initial skepticism due to high setup costs and uncertain returns. However, through detailed analysis and the use of Monte Carlo simulation, the investors assessed the risk and potential profitability accurately. Their sustainable investment decision paid off as solar technology advancements and government incentives resulted in significant long-term gains.

Key takeaways:

– Embracing sustainable investments with long-term potential.

– Utilizing advanced analytical tools like Monte Carlo simulation for risk assessment.

4. Pitfall: Manufacturer A’s Technology Misstep

Manufacturer A decided to invest heavily in adopting new manufacturing technology without a comprehensive risk assessment. Unexpected technical challenges and market changes resulted in delays and cost overruns, impacting profitability and market competitiveness.

Key takeaways:

– Thoroughly assessing the potential challenges and risks associated with adopting new technology.

– Maintaining flexibility and contingency plans for unforeseen hurdles.

Conclusion

In Chapter 7, we examined various case studies of both successful and unsuccessful capital budgeting decisions. These examples highlight the significance of utilizing proper evaluation techniques, conducting comprehensive risk assessments, and aligning investments with long-term objectives. Learning from these experiences can enhance decision-makers’ abilities to make sound capital budgeting choices and maximize returns while minimizing risks.

In the final chapter, we’ll provide practical guidance on implementing capital budgeting in your business. Stay tuned for valuable insights on incorporating effective capital budgeting practices to drive growth and success.

Chapter 8: Implementing Capital Budgeting in Your Business

In this final chapter, we’ll provide practical guidance on how to implement capital budgeting effectively in your business. Capital budgeting is a critical process that requires careful planning and execution to make informed investment decisions. Let’s delve into the key points:

1. Define Clear Investment Objectives

Start by defining your business’s investment objectives. Clearly outline your financial goals, growth targets, and risk tolerance. Having well-defined objectives will guide your capital budgeting decisions and ensure they align with your long-term vision.

2. Identify Potential Investment Opportunities

Conduct a thorough analysis of potential investment opportunities. Consider both internal projects, such as expansion and technology upgrades, and external opportunities, like acquisitions or joint ventures. Assess each project’s potential returns and risks to prioritize your investment portfolio.

3. Utilize Multiple Capital Budgeting Methods

Don’t rely on a single capital budgeting method. Instead, use a combination of techniques like NPV, IRR, Payback Period, and others to gain a comprehensive view of each investment’s viability. This approach will help you make well-informed decisions and reduce the impact of biases associated with individual methods.

4. Conduct Sensitivity and Scenario Analysis

Perform sensitivity analysis to understand how changes in key variables impact your investment projects. Additionally, conduct scenario analysis to assess the projects’ performance under various market conditions. These analyses will enhance your decision-making process and identify potential risks and opportunities.

5. Integrate Sustainability Considerations

Incorporate Environmental, Social, and Governance (ESG) factors into your capital budgeting process. Assess the potential environmental and social impact of each investment and align them with your organization’s commitment to sustainability.

6. Develop Risk Mitigation Strategies

Identify and assess the risks associated with each investment project. Develop risk mitigation strategies to address potential challenges. Having contingency plans in place will safeguard your investments and minimize negative impacts.

7. Monitor and Evaluate Investments

The capital budgeting process doesn’t end with the investment decision. Continuously monitor and evaluate the performance of your projects. Compare actual results with projected outcomes and adjust your strategies accordingly. Regularly reviewing your investments will help you identify any deviations and take corrective actions.

8. Foster Collaboration Among Departments

Encourage collaboration among various departments within your organization during the capital budgeting process. Finance, operations, marketing, and other teams should work together to ensure a comprehensive assessment of investment opportunities and to align with the company’s overall objectives.

Conclusion

In Chapter 8, we provided practical guidance on implementing capital budgeting in your business. By defining clear objectives, identifying potential opportunities, utilizing multiple evaluation methods, integrating sustainability considerations, and developing risk mitigation strategies, you can make well-informed investment decisions that drive growth and success.

Remember that capital budgeting is an iterative process, and continuous monitoring and evaluation are essential for successful outcomes. With a robust capital budgeting framework in place, you can navigate the complexities of investment decisions and position your business for a prosperous future.

Thank you for joining us on this journey through capital budgeting evaluation. We hope this comprehensive guide has empowered you with the knowledge and tools to make informed investment choices and achieve your financial goals. Happy investing!

Continuation…

In the world of capital budgeting, there will always be new challenges and opportunities. Staying up-to-date with the latest industry trends, technological advancements, and regulatory changes is crucial for making well-informed decisions. Additionally, seeking advice from financial experts and consulting with industry peers can provide valuable insights and different perspectives.

As you embark on your investment journey, remember that capital budgeting is not solely about financial calculations and numbers. It involves understanding the broader economic landscape, the impact on society, and the sustainable use of resources. Embracing sustainable investment practices can not only lead to better financial outcomes but also contribute positively to the environment and society.

Lastly, always be open to learning from both successes and failures. Every investment decision, whether it leads to triumph or pitfalls, offers valuable lessons. Continuous improvement and adaptability are key to navigating the ever-changing business landscape.

We hope that this blog post has been informative, user-friendly, and inspiring. Capital budgeting is a powerful tool that can shape the future of businesses and individuals alike. By combining rigorous analysis, thoughtful evaluation, and a long-term vision, you can make decisions that drive growth, success, and positive impact.

Thank you for being a part of this journey, and we wish you all the best in your future capital budgeting endeavors. Happy investing and creating a brighter future for yourself and your business.

Leave a comment