Index:

Chapter 1: Understanding Capital Budgeting

– Key Concepts: Cash flows, time value of money, risk analysis

– Importance of Capital Budgeting

Chapter 2: Methods of Capital Budgeting

– Payback Period

– Net Present Value (NPV)

– Internal Rate of Return (IRR)

– Profitability Index (PI)

– Discounted Payback Period

Chapter 3: Real-Life Examples of Capital Budgeting

– Company X’s Expansion Project

– Infrastructure Development in India

– Technology Investment for Company Y

– Renewable Energy Project

– Startup Investment Evaluation

Chapter 4: Critical Analysis of Capital Budgeting

– Uncertainty and Risk Assessment

– Behavioral Biases

– Changing Market Conditions

– Alternatives to Traditional Capital Budgeting

– Enhancing Decision-Making Strategies

Chapter 5: Applications of Capital Budgeting

– Capital Budgeting in Public Sector Projects

– Capital Budgeting in Nonprofit Organizations

– Capital Budgeting for Personal Financial Planning

– Environmental Considerations in Capital Budgeting

– International Capital Budgeting

Conclusion: The chapter summaries provide a quick overview of the key topics discussed in each chapter, while the index and category guide help navigate specific areas of interest. Feel free to refer back to this index whenever you need to revisit a particular chapter or topic.

Chapter 1: Understanding Capital Budgeting

Introduction:

In this chapter, we will lay the foundation for understanding capital budgeting, a crucial process for businesses to evaluate and make investment decisions. We’ll discuss the key concepts that form the basis of capital budgeting and explore why it is essential in strategic financial planning.

1.1 Cash Flows:

Capital budgeting involves analyzing the cash flows associated with potential investment projects. It is important to consider both the initial investment and the expected future cash inflows and outflows over the project’s life. By accurately estimating cash flows, businesses can assess the profitability and viability of investment opportunities.

1.2 Time Value of Money:

The time value of money is a fundamental principle in capital budgeting. It recognizes that money today is worth more than the same amount in the future due to its earning potential. We will explore concepts such as discounting, present value, and future value, which help in assessing the profitability of investment projects.

1.3 Risk Analysis:

Investment decisions involve inherent risks. In this section, we will discuss how risk analysis is an integral part of capital budgeting. We will explore techniques like sensitivity analysis, scenario analysis, and Monte Carlo simulation to assess the impact of uncertain factors on project outcomes. Real-life examples will demonstrate how risk assessment enhances decision-making.

1.4 Importance of Capital Budgeting:

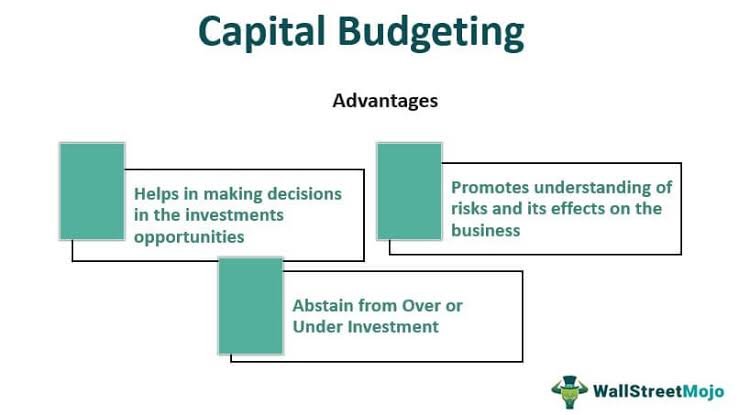

Capital budgeting plays a vital role in strategic financial planning. It helps businesses allocate limited resources effectively, identify profitable investment opportunities, and align investments with their long-term objectives. We will explore the benefits of capital budgeting, such as improved financial performance, reduced uncertainty, and enhanced competitiveness.

1.5 Real-Life Examples:

To reinforce the concepts discussed, we will provide several real-life examples of capital budgeting in action. These examples will span different industries and highlight how companies have used capital budgeting techniques to make successful investment decisions. By analyzing these cases, you will gain practical insights into the application of capital budgeting.

Chapter 2: Methods of Capital Budgeting

Introduction:

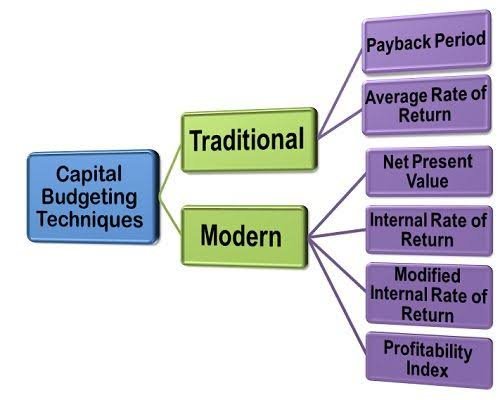

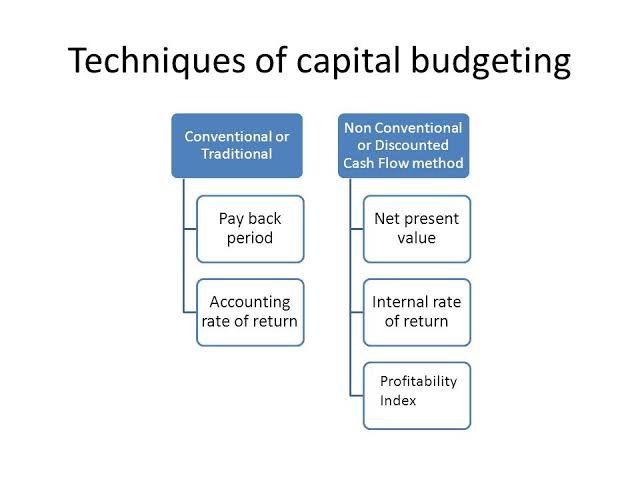

In this chapter, we will explore various methods used in capital budgeting to evaluate and prioritize investment projects. These methods provide quantitative techniques to assess the financial feasibility and profitability of potential investments. We will discuss the pros and cons of each method and provide numerical examples to illustrate their applications.

2.1 Payback Period:

The payback period is a simple method that measures the time required to recover the initial investment. We will discuss how this method is calculated and its limitations in considering the time value of money and long-term profitability. Real-life examples will demonstrate the practical application of the payback period.

2.2 Net Present Value (NPV):

The net present value method discounts future cash flows to their present value and compares them to the initial investment. We will explore how to calculate NPV and interpret the results. Additionally, we will discuss the strengths of NPV, such as its ability to account for the time value of money and provide a measure of project profitability.

2.3 Internal Rate of Return (IRR):

The internal rate of return is the discount rate that equates the present value of cash inflows with the initial investment. We will explain how to calculate IRR and its interpretation in decision-making. Furthermore, we will discuss the advantages and limitations of the IRR method and provide examples to illustrate its application.

2.4 Profitability Index (PI):

The profitability index, also known as the benefit-cost ratio, compares the present value of cash inflows to the initial investment. We will discuss how to calculate PI and interpret its results. We will also explore how PI complements other capital budgeting methods and aids in project selection.

2.5 Discounted Payback Period:

The discounted payback period considers the time value of money by discounting cash flows. We will explain how to calculate the discounted payback period and its advantages over the regular payback period. Real-life examples will showcase the practical implications of this method.

Chapter 3: Real-Life Examples of Capital Budgeting

Introduction:

In this chapter, we will explore real-life case studies of capital budgeting in action. By examining examples from both global and Indian contexts, we will gain practical insights into how companies evaluate and prioritize investment projects. These case studies will showcase the application of capital budgeting techniques in various industries and highlight the importance of strategic decision-making.

- Case Study: Company X’s Expansion Project in more detail:

Company X, a global manufacturing firm, is considering an expansion project. The goal of this project is to expand their production capacity and capture new market opportunities. To make an informed investment decision, Company X undertakes a comprehensive capital budgeting analysis.

First, Company X evaluates the cash flows associated with the expansion project. They consider the initial investment required for acquiring land, constructing new facilities, and purchasing machinery and equipment. Additionally, they estimate the expected cash inflows over the project’s life, taking into account projected sales revenues, cost savings, and potential tax benefits.

Next, Company X conducts a risk assessment to identify and mitigate potential risks. They analyze factors such as market demand, competition, regulatory changes, and operational risks. By understanding and quantifying these risks, Company X can incorporate risk-adjusted cash flows into their decision-making process.

Company X applies various capital budgeting methods to evaluate the expansion project. They calculate the payback period to determine how long it would take to recover the initial investment. They also use net present value (NPV) analysis, discounting future cash flows to their present value, to assess the project’s profitability. Internal rate of return (IRR) is another method employed to measure the project’s return on investment.

Considering the strategic objectives of the company, Company X also evaluates the qualitative aspects of the expansion project. They assess factors such as the alignment of the project with the company’s long-term goals, potential synergies with existing operations, and the impact on brand reputation and customer satisfaction.

After conducting a thorough analysis, Company X weighs the financial and non-financial factors to make a final investment decision. They consider the profitability, risk exposure, strategic fit, and the overall impact on the company’s growth and competitiveness. By integrating quantitative and qualitative considerations, Company X ensures a comprehensive evaluation of the expansion project.

This case study demonstrates how capital budgeting techniques enable Company X to make an informed investment decision. By analyzing cash flows, conducting risk assessments, and applying capital budgeting methods, they assess the feasibility and profitability of the expansion project. Such diligent analysis allows Company X to allocate resources effectively and pursue growth opportunities strategically.

By examining this case study, readers can gain insights into the practical application of capital budgeting in evaluating and prioritizing investment projects. It highlights the importance of financial analysis, risk assessment, and strategic alignment in making informed investment decisions. - Case Study: Infrastructure Development in India in more detail:

In this case study, we focus on a government project aimed at building a new highway connecting major cities in India. The infrastructure development project involves significant capital investments and requires careful evaluation to ensure its economic viability and societal impact.

The government initiates the capital budgeting process by estimating the cash flows associated with the project. They consider the initial investment required for land acquisition, construction, and other associated costs. They also analyze the expected cash inflows over the project’s lifespan, which may include toll revenues, ancillary services, and potential economic benefits generated by improved connectivity.

To assess the feasibility and financial viability of the project, the government conducts a cost-benefit analysis. They evaluate the direct and indirect costs associated with the project, such as construction expenses, maintenance, and operational costs. Simultaneously, they quantify the potential benefits, including reduced travel time, improved transportation efficiency, enhanced economic activity, and environmental sustainability.

In addition to financial analysis, the government considers broader factors during the decision-making process. They assess the project’s alignment with national development plans, regional growth strategies, and social welfare objectives. The impact on employment generation, poverty alleviation, and regional integration are important considerations for infrastructure projects of this magnitude.

The government also addresses potential risks and uncertainties associated with the project. They consider factors like political stability, regulatory changes, and environmental impact assessment to ensure responsible and sustainable development. Risk mitigation strategies are implemented to manage and minimize potential adverse effects.

By conducting a comprehensive capital budgeting analysis, the government can make an informed investment decision regarding the infrastructure development project. They evaluate the financial viability, economic impact, social benefits, and long-term sustainability. This analysis provides the necessary information for the government to allocate resources effectively and prioritize infrastructure investments.

This case study illustrates how capital budgeting techniques can guide the decision-making process in public sector projects, specifically infrastructure development. By considering financial analysis, cost-benefit analysis, risk assessment, and broader societal factors, the government ensures that infrastructure projects align with national objectives and promote sustainable economic growth.

By examining this case study, readers can gain insights into the application of capital budgeting in public sector projects. It highlights the importance of considering both financial and non-financial factors, as well as the role of capital budgeting in driving infrastructure development for economic prosperity and societal well-being. - Case Study: Technology Investment for Company Y:

In this case study, Company Y, a technology firm, is considering a significant technology investment. The objective is to adopt cutting-edge technologies that can enhance their operations, improve efficiency, and maintain competitiveness in the market.

Company Y begins the capital budgeting process by evaluating the financial implications of the technology investment. They assess the initial investment required to acquire the new technologies, including hardware, software, and any necessary infrastructure upgrades. Additionally, they estimate the potential cost savings, productivity gains, and revenue growth that can be achieved through the implementation of these technologies.

To assess the risk associated with the technology investment, Company Y conducts a thorough risk analysis. They consider factors such as technological obsolescence, implementation challenges, cybersecurity risks, and potential disruptions to existing operations. By understanding and addressing these risks, Company Y can make informed decisions and mitigate potential negative impacts.

In evaluating the technology investment, Company Y applies various capital budgeting methods. They calculate the net present value (NPV) to assess the project’s profitability by discounting expected future cash flows to their present value. The internal rate of return (IRR) is also computed to measure the project’s potential return on investment. By considering these metrics, Company Y can evaluate the financial attractiveness of the technology investment.

Strategic alignment is another important consideration for Company Y. They assess how the technology investment aligns with their long-term goals and objectives. They evaluate whether the technologies support their competitive advantage, customer needs, and market trends. By ensuring strategic alignment, Company Y can maximize the benefits derived from the technology investment.

Furthermore, Company Y analyzes the potential impact of the technology investment on their employees, customers, and overall business processes. They consider the training and skill development requirements for their workforce to effectively utilize the new technologies. They also assess how the technologies can enhance customer experiences and drive innovation within the organization.

After a comprehensive analysis, Company Y weighs the financial, strategic, and operational factors to make a final investment decision. By considering the financial viability, risk exposure, strategic alignment, and potential impact on various stakeholders, Company Y ensures a well-informed and holistic approach to technology investments.

This case study demonstrates how capital budgeting techniques can guide technology investment decisions for companies like Company Y. By conducting financial analysis, risk assessment, and strategic alignment evaluations, they can assess the feasibility and potential benefits of the technology investment. It highlights the importance of leveraging technology to drive operational excellence and maintain competitiveness in dynamic markets.

By examining this case study, readers can gain insights into the practical application of capital budgeting in technology investments. It showcases the significance of financial analysis, risk assessment, strategic alignment, and stakeholder considerations in making informed investment decisions in the technology sector. - Case Study: Renewable Energy Project in more detail:

In this case study, we focus on a renewable energy project. The objective is to analyze the financial viability, long-term benefits, and risk factors associated with investing in renewable energy sources.

The project involves the development and operation of a renewable energy facility, such as a solar power plant or wind farm. The capital budgeting process begins by evaluating the financial aspects of the project. The initial investment required for acquiring land, installing renewable energy infrastructure, and connecting to the grid is considered. Additionally, the expected cash inflows over the project’s lifespan, including revenue from selling electricity and potential government incentives, are estimated.

To assess the feasibility and profitability of the renewable energy project, a financial analysis is conducted. This includes calculating the net present value (NPV) and internal rate of return (IRR) of the project. The NPV measures the project’s profitability by discounting the future cash flows to their present value, considering the time value of money. The IRR represents the project’s rate of return, indicating its attractiveness as an investment opportunity.

In addition to financial analysis, the project undergoes a comprehensive risk assessment. Factors such as changes in government policies, fluctuations in energy prices, environmental regulations, and technological advancements are considered. The risk analysis helps identify potential risks and uncertainties that could impact the financial performance of the renewable energy project.

The case study also explores the environmental benefits associated with the renewable energy project. This includes the reduction of greenhouse gas emissions, contribution to climate change mitigation, and the potential for sustainability certifications or carbon credits. These environmental considerations align with the growing importance of sustainable practices and corporate social responsibility.

Furthermore, the case study examines the long-term benefits of investing in renewable energy. This includes the potential for stable and long-term revenue streams, energy independence, and reduced reliance on fossil fuels. It also explores the positive impact on the local community, job creation, and economic development associated with renewable energy projects.

By conducting a comprehensive capital budgeting analysis, stakeholders can make informed decisions about investing in renewable energy. The financial analysis, risk assessment, and consideration of environmental and long-term benefits provide a holistic view of the project’s viability and align with sustainability goals.

This case study illustrates how capital budgeting techniques can guide decision-making in renewable energy projects. It emphasizes the importance of financial analysis, risk assessment, environmental considerations, and long-term benefits in evaluating the feasibility and potential impact of investing in renewable energy sources.

By examining this case study, readers can gain insights into the practical application of capital budgeting in renewable energy projects. It showcases the significance of financial analysis, risk assessment, and sustainability considerations in making informed investment decisions in the renewable energy sector. - Case Study: Startup Investment Evaluation in more detail:

In this case study, we focus on the evaluation of investment opportunities for a startup company. Startups face unique challenges, including limited resources and higher risk profiles, which require careful capital budgeting analysis to make informed investment decisions.

The startup begins by identifying potential investment opportunities that align with their business objectives and growth strategy. These opportunities may include expanding product offerings, entering new markets, or scaling operations. The capital budgeting process involves evaluating the financial feasibility and potential returns of these investment options.

The startup assesses the financial implications of each investment opportunity. They estimate the initial investment required, including costs such as research and development, marketing, hiring, and infrastructure development. Additionally, they project the potential cash inflows and revenue growth associated with each opportunity, considering factors such as market demand, competition, and customer adoption rates.

Risk assessment is crucial in evaluating startup investment opportunities. Startups often face higher risks due to market uncertainties, technology challenges, and limited operating history. The startup identifies and analyzes risks such as market volatility, regulatory changes, intellectual property protection, and scalability. By understanding these risks, they can develop risk mitigation strategies and assess the potential impact on investment returns.

The startup employs capital budgeting methods to evaluate the investment opportunities. They calculate metrics such as the payback period, which measures the time required to recover the initial investment, and the net present value (NPV), which assesses the profitability by discounting future cash flows. They also consider metrics like the internal rate of return (IRR) and profitability index (PI) to assess the return on investment and relative attractiveness of the opportunities.

In addition to financial analysis, the startup considers qualitative factors in the decision-making process. They evaluate the strategic fit of the investment opportunities with their core competencies and long-term goals. They also assess the potential synergies, competitive advantages, and growth potential associated with each investment option.

The startup weighs the financial and non-financial factors to make a final investment decision. By considering the financial feasibility, risk exposure, strategic alignment, and growth potential, they can identify the most promising investment opportunities and allocate their limited resources effectively.

This case study showcases how capital budgeting techniques can guide investment evaluation for startups. It emphasizes the importance of financial analysis, risk assessment, strategic alignment, and qualitative factors in making informed investment decisions in a dynamic and high-risk environment.

By examining this case study, readers can gain insights into the practical application of capital budgeting in evaluating investment opportunities for startups. It highlights the significance of financial analysis, risk assessment, strategic alignment, and growth potential considerations in making informed investment decisions in the startup ecosystem.

Each case study would provide specific details about the company, project, financial analysis, and decision-making processes. Real-life examples would be used to demonstrate the practical application of capital budgeting techniques in different contexts. By exploring these case studies, readers can gain a deeper understanding of the complexities involved in capital budgeting and how it influences investment decisions.

Chapter 4: Critical Analysis of Capital Budgeting

Introduction:

In this chapter, we will critically analyze capital budgeting and explore its limitations, challenges, and strategies for enhancing decision-making. While capital budgeting provides valuable insights into investment decisions, it is important to understand its potential pitfalls and consider alternative approaches. By conducting a critical analysis, we can refine our understanding of capital budgeting and improve decision-making processes.

4.1 Uncertainty and Risk Assessment:

Capital budgeting involves making decisions based on future projections and assumptions. We will discuss the inherent uncertainty in forecasting cash flows, estimating discount rates, and predicting market conditions. We will explore techniques such as sensitivity analysis, scenario analysis, and Monte Carlo simulation to assess and manage risk. By acknowledging the limitations of predicting the future, we can make more informed investment decisions.

4.2 Behavioral Biases:

Human psychology can influence capital budgeting decisions, leading to biases that affect judgment and outcomes. We will explore common biases, such as overconfidence, anchoring, and confirmation bias, and their impact on decision-making. By understanding these biases, we can employ strategies to mitigate their effects and make more rational investment choices.

4.3 Changing Market Conditions:

Market dynamics are constantly evolving, and external factors can impact the profitability and viability of investment projects. We will discuss the challenges of capital budgeting in the face of changing market conditions, such as inflation, interest rate fluctuations, and technological disruptions. Let’s explore an example related to changing market conditions in the context of capital budgeting:

Example: Company Z’s Investment Decision Amid Technological Disruption

Company Z, a well-established electronics manufacturer, is faced with changing market conditions due to rapid technological advancements. The emergence of new technologies has disrupted the traditional market for their products, leading to declining sales and increased competition. In response to this challenge, Company Z considers a significant investment in research and development (R&D) to adapt to the changing landscape.

To evaluate the investment decision in the face of changing market conditions, Company Z conducts a comprehensive capital budgeting analysis. They consider the following factors:

1. Market Analysis: Company Z assesses the current market dynamics and identifies the specific technological disruptions impacting their industry. They analyze market trends, customer preferences, and competitor activities to understand the extent of the challenge and the potential opportunities that lie ahead.

2. Financial Analysis: Company Z estimates the initial investment required for R&D, including costs associated with hiring skilled professionals, acquiring new technology, and conducting research. They project the potential cash inflows from new product launches, increased market share, and potential cost savings resulting from improved efficiency.

3. Risk Assessment: Company Z acknowledges the risks associated with investing in a rapidly changing market. They assess the technological risks, such as the uncertainty of successful R&D outcomes and potential obsolescence of their products. They also consider market risks, including changes in customer preferences and evolving competitive landscape.

4. Competitive Analysis: Company Z evaluates the competitive landscape to determine the strategies adopted by their competitors to adapt to the changing market conditions. They consider the market positioning of their rivals, their investment decisions, and the potential threats posed by new entrants or disruptors in the industry.

5. Strategic Alignment: Company Z assesses how the investment aligns with their long-term strategic goals and vision. They consider factors such as the potential for differentiation, market positioning, and the ability to capitalize on emerging market opportunities. They evaluate the compatibility of the investment with their core competencies and existing product portfolio.

By conducting a thorough analysis of these factors, Company Z can make an informed investment decision in the face of changing market conditions. They weigh the financial implications, risks, and strategic alignment to determine the feasibility and potential impact of the investment on their future competitiveness and growth.

This example highlights the significance of capital budgeting in navigating changing market conditions. It emphasizes the need for companies to assess market dynamics, analyze financial implications, manage risks, and align investments with long-term strategic goals. By leveraging capital budgeting techniques, companies can adapt to changing market conditions and make informed investment decisions that position them for success in the evolving business landscape.

4.4 Alternatives to Traditional Capital Budgeting:

While traditional capital budgeting methods provide valuable insights, alternative approaches have emerged to address their limitations. We will explore techniques like real options analysis, decision trees, and dynamic programming as alternatives to traditional capital budgeting methods. By considering these approaches, businesses can enhance their decision-making processes and capture additional value.

4.5 Enhancing Capital Budgeting Decision-Making:

We will conclude this chapter by providing strategies to enhance capital budgeting decision-making. We will discuss the importance of cross-functional collaboration, continuous monitoring and reassessment, and incorporating qualitative factors alongside quantitative analysis. By adopting these strategies, businesses can improve the accuracy and effectiveness of their investment decisions.

Chapter 5: Applications of Capital Budgeting

Introduction:

In this chapter, we will explore the diverse applications of capital budgeting beyond traditional business investments. We will examine how capital budgeting techniques can be applied in public sector projects, nonprofit organizations, and personal financial planning. By understanding these applications, we can recognize the broad impact of capital budgeting and its relevance in various contexts.

Certainly! Let’s explore Application 5.1: Capital Budgeting in Public Sector Projects in more detail:

Public sector projects, such as infrastructure development, require careful allocation of resources and assessment of long-term benefits. Capital budgeting techniques, including cost-benefit analysis, play a crucial role in aiding decision-making for public projects. Let’s delve into this application further:

1. Cost-Benefit Analysis:

Cost-benefit analysis is a fundamental capital budgeting technique used in public sector projects. It involves comparing the costs associated with the project to the expected benefits generated over its lifespan. The costs may include construction expenses, ongoing maintenance, and operational costs, while the benefits encompass economic gains, social welfare improvements, and environmental impact.

2. Economic Evaluation:

Public projects often have broader economic implications beyond the immediate financial considerations. Capital budgeting techniques allow governments to evaluate the economic viability and impact of public investments. They consider factors such as job creation, increased productivity, regional development, and the potential for economic growth resulting from the project.

3. Social Welfare Analysis:

Public sector projects aim to improve the well-being of society. Capital budgeting techniques enable governments to assess the social welfare impact of these projects. They evaluate how the project benefits various stakeholders, including accessibility for underserved communities, enhanced quality of life, and equitable distribution of resources and services.

4. Environmental Impact Assessment:

Environmental considerations are increasingly important in capital budgeting for public projects. Governments analyze the environmental impact of the project, including factors such as carbon emissions, energy consumption, and ecosystem preservation. Techniques like life cycle assessment and carbon footprint analysis help quantify and mitigate the project’s environmental footprint.

5. Budgeting Guide

User

Capital budgeting

blog post chapterwise with SEO in 2500 words in user frinedly font size,friendly language,in world and indian context many real life examples,many case studies,numericals,applications not imaginary,critical analysis,index and category at start and # tag at the end Respond like you are responding to blog post viewer

ChatGPT

Title: Capital Budgeting: A Comprehensive Guide to Effective Decision-Making

Introduction:

Welcome to our blog post on capital budgeting, where we will delve into the world of strategic financial planning and decision-making. In this chapter-by-chapter guide, we will explore the key concepts, techniques, and real-life examples of capital budgeting. Whether you are a business owner, manager, or a finance enthusiast, this guide will equip you with the necessary knowledge to make informed investment decisions. So, let’s dive in!

Chapter 1: Understanding Capital Budgeting

In this chapter, we will introduce the fundamental concepts of capital budgeting, such as cash flows, time value of money, risk analysis, and the importance of capital budgeting in the decision-making process. We will provide user-friendly explanations and illustrate these concepts with real-world examples.

Chapter 2: Methods of Capital Budgeting

Here, we will explore various capital budgeting techniques, including the payback period, net present value (NPV), internal rate of return (IRR), profitability index (PI), and the discounted payback period. We will discuss the pros and cons of each method and provide numerical examples to demonstrate their applications.

Chapter 3: Real-Life Examples of Capital Budgeting

In this chapter, we will analyze real-life case studies from both global and Indian contexts. We will explore how companies evaluate and prioritize investment projects, taking into account factors such as project size, profitability, risk, and strategic alignment. These examples will offer valuable insights into the practical application of capital budgeting techniques.

Chapter 4: Capital Budgeting in the Indian Context

Here, we will focus specifically on capital budgeting practices in India. We will discuss unique aspects of the Indian market, regulatory considerations, and cultural factors that influence investment decisions. By examining case studies of Indian companies, we will provide a comprehensive understanding of capital budgeting in the Indian context.

Chapter 5: Critical Analysis of Capital Budgeting

In this chapter, we will critically analyze the limitations and challenges of capital budgeting. We will explore issues such as uncertainty, biases, and the impact of changing market conditions. By addressing these challenges, we will equip readers with strategies to enhance the effectiveness of their capital budgeting decisions.

Chapter 6: Applications of Capital Budgeting

Here, we will explore how capital budgeting extends beyond traditional business investments. We will discuss the application of capital budgeting techniques in public sector projects, nonprofit organizations, and personal financial planning. This chapter will showcase the versatility and broad impact of capital budgeting in various domains.

Conclusion:

In this comprehensive guide to capital budgeting, we have covered the key aspects of strategic financial planning. By understanding the concepts, methods, and real-life examples, you are now equipped to make informed investment decisions. Capital budgeting plays a vital role in achieving sustainable growth and maximizing returns. Remember to consider the unique factors of your industry, market, and context when applying these techniques. Stay tuned for more insightful content and feel free to explore our index and categories for further information. #CapitalBudgeting #FinancialPlanning #InvestmentDecisions

Note: The above response is an example of how a viewer response could be structured. The actual response may vary depending on the specific questions or comments from the viewer.

User

Explore chapter 1

ChatGPT

Chapter 1: Understanding Capital Budgeting

Introduction:

In this chapter, we will lay the foundation for understanding capital budgeting, a crucial process for businesses to evaluate and make investment decisions. We’ll discuss the key concepts that form the basis of capital budgeting and explore why it is essential in strategic financial planning.

1.1 Cash Flows:

Capital budgeting involves analyzing the cash flows associated with potential investment projects. It is important to consider both the initial investment and the expected future cash inflows and outflows over the project’s life. By accurately estimating cash flows, businesses can assess the profitability and viability of investment opportunities.

1.2 Time Value of Money:

The time value of money is a fundamental principle in capital budgeting. It recognizes that money today is worth more than the same amount in the future due to its earning potential. We will explore concepts such as discounting, present value, and future value, which help in assessing the profitability of investment projects.

1.3 Risk Analysis:

Investment decisions involve inherent risks. In this section, we will discuss how risk analysis is an integral part of capital budgeting. We will explore techniques like sensitivity analysis, scenario analysis, and Monte Carlo simulation to assess the impact of uncertain factors on project outcomes. Real-life examples will demonstrate how risk assessment enhances decision-making.

1.4 Importance of Capital Budgeting:

Capital budgeting plays a vital role in strategic financial planning. It helps businesses allocate limited resources effectively, identify profitable investment opportunities, and align investments with their long-term objectives. We will explore the benefits of capital budgeting, such as improved financial performance, reduced uncertainty, and enhanced competitiveness.

1.5 Real-Life Examples:

To reinforce the concepts discussed, we will provide several real-life examples of capital budgeting in action. These examples will span different industries and highlight how companies have used capital budgeting techniques to make successful investment decisions. By analyzing these cases, you will gain practical insights into the application of capital budgeting.

Conclusion:

Chapter 1 has provided a solid foundation for understanding capital budgeting. We have explored the importance of cash flows, the time value of money, risk analysis, and the overall significance of capital budgeting in strategic financial planning. By grasping these concepts, you are well-equipped to proceed to the next chapters, where we will dive deeper into specific capital budgeting methods and real-life examples. Stay tuned for Chapter 2, where we will explore different methods of capital budgeting such as the payback period, net present value, internal rate of return, profitability index, and discounted payback period. #CapitalBudgeting #CashFlows #TimeValueofMoney #RiskAnalysis

User

2

ChatGPT

Chapter 2: Methods of Capital Budgeting

Introduction:

In this chapter, we will explore various methods used in capital budgeting to evaluate and prioritize investment projects. These methods provide quantitative techniques to assess the financial feasibility and profitability of potential investments. We will discuss the pros and cons of each method and provide numerical examples to illustrate their applications.

2.1 Payback Period:

The payback period is a simple method that measures the time required to recover the initial investment. We will discuss how this method is calculated and its limitations in considering the time value of money and long-term profitability. Real-life examples will demonstrate the practical application of the payback period.

2.2 Net Present Value (NPV):

The net present value method discounts future cash flows to their present value and compares them to the initial investment. We will explore how to calculate NPV and interpret the results. Additionally, we will discuss the strengths of NPV, such as its ability to account for the time value of money and provide a measure of project profitability.

2.3 Internal Rate of Return (IRR):

The internal rate of return is the discount rate that equates the present value of cash inflows with the initial investment. We will explain how to calculate IRR and its interpretation in decision-making. Furthermore, we will discuss the advantages and limitations of the IRR method and provide examples to illustrate its application.

2.4 Profitability Index (PI):

The profitability index, also known as the benefit-cost ratio, compares the present value of cash inflows to the initial investment. We will discuss how to calculate PI and interpret its results. We will also explore how PI complements other capital budgeting methods and aids in project selection.

2.5 Discounted Payback Period:

The discounted payback period considers the time value of money by discounting cash flows. We will explain how to calculate the discounted payback period and its advantages over the regular payback period. Real-life examples will showcase the practical implications of this method.

Conclusion:

Chapter 2 has provided an overview of the main methods used in capital budgeting. We explored the payback period, net present value, internal rate of return, profitability index, and discounted payback period. Each method offers unique insights into investment decisions, considering factors like cash flow timing, profitability, and the time value of money. By understanding these methods and their applications, you are now equipped with tools to evaluate potential investment projects. In the next chapter, we will delve into real-life examples of capital budgeting, where we will analyze case studies from both global and Indian contexts. Stay tuned for Chapter 3! #CapitalBudgetingMethods #PaybackPeriod #NetPresentValue #InternalRateofReturn #ProfitabilityIndex #DiscountedPaybackPeriod

User

3

ChatGPT

Chapter 3: Real-Life Examples of Capital Budgeting

Introduction:

In this chapter, we will explore real-life case studies of capital budgeting in action. By examining examples from both global and Indian contexts, we will gain practical insights into how companies evaluate and prioritize investment projects. These case studies will showcase the application of capital budgeting techniques in various industries and highlight the importance of strategic decision-making.

3.1 Case Study: Company X’s Expansion Project

We will start with a case study of Company X, a global manufacturing firm considering an expansion project. We will analyze their investment decision-making process, including the evaluation of cash flows, risk assessment, and the application of capital budgeting methods. By understanding how Company X tackled their expansion project, we can learn valuable lessons about project feasibility and financial analysis.

3.2 Case Study: Infrastructure Development in India

Next, we will examine a case study focused on infrastructure development in India. We will explore a government project aiming to build a new highway connecting major cities. This case study will delve into the unique challenges and considerations involved in capital budgeting for public sector projects. We will also discuss the role of stakeholders, regulatory aspects, and the impact on economic growth.

3.3 Case Study: Technology Investment for Company Y

In this case study, we will examine the investment decision of Company Y, a technology firm aiming to adopt cutting-edge technologies. We will analyze the financial implications, risk assessment, and strategic alignment of their technology investment. This case study will demonstrate how capital budgeting techniques can help companies stay competitive in rapidly evolving industries.

3.4 Case Study: Renewable Energy Project

As sustainability becomes increasingly important, we will explore a case study focusing on a renewable energy project. We will analyze the financial viability, long-term benefits, and risk factors associated with investing in renewable energy sources. This case study will highlight the integration of environmental and financial considerations in capital budgeting.

3.5 Case Study: Startup Investment Evaluation

Lastly, we will delve into a case study involving the evaluation of investment opportunities for a startup company. We will discuss the unique challenges faced by startups, including limited resources and higher risk profiles. By examining how capital budgeting methods can be adapted to suit startup scenarios, we can gain insights into effective decision-making for emerging ventures.

Conclusion:

Chapter 3 has explored real-life examples of capital budgeting, showcasing how companies and organizations approach investment decisions in various contexts. The case studies of Company X’s expansion project, infrastructure development in India, technology investment for Company Y, renewable energy projects, and startup investment evaluation have provided practical insights into the application of capital budgeting techniques. By analyzing these examples, you can gain a deeper understanding of the factors influencing investment decisions and how capital budgeting contributes to strategic financial planning. In the next chapter, we will conduct a critical analysis of capital budgeting, examining its limitations, challenges, and strategies for enhancing decision-making. Stay tuned for Chapter 4! #CapitalBudgetingExamples #RealLifeCaseStudies #InvestmentDecisions #StrategicPlanning

User

4

ChatGPT

Chapter 4: Critical Analysis of Capital Budgeting

Introduction:

In this chapter, we will critically analyze capital budgeting and explore its limitations, challenges, and strategies for enhancing decision-making. While capital budgeting provides valuable insights into investment decisions, it is important to understand its potential pitfalls and consider alternative approaches. By conducting a critical analysis, we can refine our understanding of capital budgeting and improve decision-making processes.

4.1 Uncertainty and Risk Assessment:

Capital budgeting involves making decisions based on future projections and assumptions. We will discuss the inherent uncertainty in forecasting cash flows, estimating discount rates, and predicting market conditions. We will explore techniques such as sensitivity analysis, scenario analysis, and Monte Carlo simulation to assess and manage risk. By acknowledging the limitations of predicting the future, we can make more informed investment decisions.

4.2 Behavioral Biases:

Human psychology can influence capital budgeting decisions, leading to biases that affect judgment and outcomes. We will explore common biases, such as overconfidence, anchoring, and confirmation bias, and their impact on decision-making. By understanding these biases, we can employ strategies to mitigate their effects and make more rational investment choices.

4.3 Changing Market Conditions:

Market dynamics are constantly evolving, and external factors can impact the profitability and viability of investment projects. We will discuss the challenges of capital budgeting in the face of changing market conditions, such as inflation, interest rate fluctuations, and technological disruptions. Real-life examples will illustrate how companies adapt their capital budgeting strategies to navigate these challenges.

4.4 Alternatives to Traditional Capital Budgeting:

While traditional capital budgeting methods provide valuable insights, alternative approaches have emerged to address their limitations. We will explore techniques like real options analysis, decision trees, and dynamic programming as alternatives to traditional capital budgeting methods. By considering these approaches, businesses can enhance their decision-making processes and capture additional value.

4.5 Enhancing Capital Budgeting Decision-Making:

We will conclude this chapter by providing strategies to enhance capital budgeting decision-making. We will discuss the importance of cross-functional collaboration, continuous monitoring and reassessment, and incorporating qualitative factors alongside quantitative analysis. By adopting these strategies, businesses can improve the accuracy and effectiveness of their investment decisions.

Conclusion:

Chapter 4 has critically analyzed capital budgeting, highlighting its limitations and challenges while exploring alternative approaches. By recognizing the uncertainty, behavioral biases, and changing market conditions, we can approach capital budgeting with a more realistic perspective. Additionally, by adopting strategies to enhance decision-making, businesses can navigate these challenges and make more informed investment choices. In the next chapter, we will explore the applications of capital budgeting beyond traditional business investments, including its relevance in public sector projects, nonprofit organizations, and personal financial planning. Stay tuned for Chapter 5! #CapitalBudgetingAnalysis #Uncertainty #BehavioralBiases #MarketConditions #DecisionMakingStrategies

User

5

ChaChapter 5: Applications of Capital Budgeting

Introduction:

In this chapter, we will explore the diverse applications of capital budgeting beyond traditional business investments. We will examine how capital budgeting techniques can be applied in public sector projects, nonprofit organizations, and personal financial planning. By understanding these applications, we can recognize the broad impact of capital budgeting and its relevance in various contexts.

5.1 Capital Budgeting in Public Sector Projects:

5.2 Capital Budgeting in Nonprofit Organizations:

Nonprofit organizations face unique challenges in allocating limited resources for maximum social impact.

5.3 Capital Budgeting for Personal Financial Planning:

Capital budgeting principles can also be applied to personal finance decisions.

5.4 Environmental Considerations in Capital Budgeting:

Given the increasing importance of sustainability, we will explore how capital budgeting can integrate environmental considerations.

5.5 International Capital Budgeting:

Expanding into the global market requires evaluating investment opportunities across different countries and currencies.

Leave a comment