Index:

Chapter 1: Understanding Capital Budgeting

– Key Concepts: Cash flows, time value of money, risk analysis

– Importance of Capital Budgeting

Chapter 2: Methods of Capital Budgeting

– Payback Period

– Net Present Value (NPV)

– Internal Rate of Return (IRR)

– Profitability Index (PI)

– Discounted Payback Period

Chapter 3: Real-Life Examples of Capital Budgeting

– Company X’s Expansion Project

– Infrastructure Development in India

– Technology Investment for Company Y

– Renewable Energy Project

– Startup Investment Evaluation

Chapter 4: Critical Analysis of Capital Budgeting

– Uncertainty and Risk Assessment

– Behavioral Biases

– Changing Market Conditions

– Alternatives to Traditional Capital Budgeting

– Enhancing Decision-Making Strategies

Chapter 5: Applications of Capital Budgeting

– Capital Budgeting in Public Sector Projects

– Capital Budgeting in Nonprofit Organizations

– Capital Budgeting for Personal Financial Planning

– Environmental Considerations in Capital Budgeting

– International Capital Budgeting

Conclusion: The chapter summaries provide a quick overview of the key topics discussed in each chapter, while the index and category guide help navigate specific areas of interest. Feel free to refer back to this index whenever you need to revisit a particular chapter or topic.

Chapter 1: Understanding Capital Budgeting

Introduction:

In this chapter, we will lay the foundation for understanding capital budgeting, a crucial process for businesses to evaluate and make investment decisions. We’ll discuss the key concepts that form the basis of capital budgeting and explore why it is essential in strategic financial planning.

1.1 Cash Flows:

Capital budgeting involves analyzing the cash flows associated with potential investment projects. It is important to consider both the initial investment and the expected future cash inflows and outflows over the project’s life. By accurately estimating cash flows, businesses can assess the profitability and viability of investment opportunities.

1.2 Time Value of Money:

The time value of money is a fundamental principle in capital budgeting. It recognizes that money today is worth more than the same amount in the future due to its earning potential. We will explore concepts such as discounting, present value, and future value, which help in assessing the profitability of investment projects.

1.3 Risk Analysis:

Investment decisions involve inherent risks. In this section, we will discuss how risk analysis is an integral part of capital budgeting. We will explore techniques like sensitivity analysis, scenario analysis, and Monte Carlo simulation to assess the impact of uncertain factors on project outcomes. Real-life examples will demonstrate how risk assessment enhances decision-making.

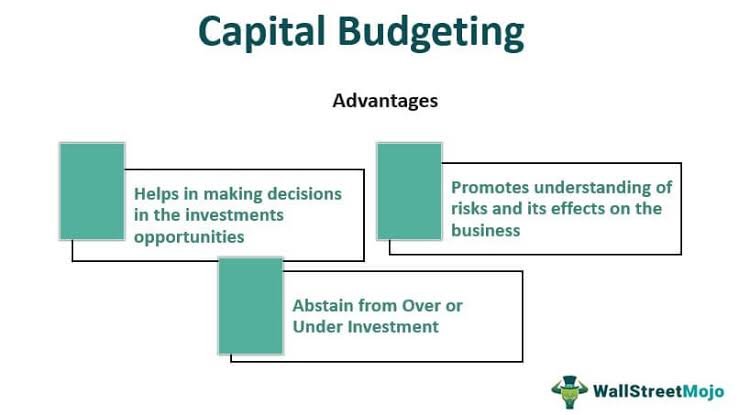

1.4 Importance of Capital Budgeting:

Capital budgeting plays a vital role in strategic financial planning. It helps businesses allocate limited resources effectively, identify profitable investment opportunities, and align investments with their long-term objectives. We will explore the benefits of capital budgeting, such as improved financial performance, reduced uncertainty, and enhanced competitiveness.

1.5 Real-Life Examples:

To reinforce the concepts discussed, we will provide several real-life examples of capital budgeting in action. These examples will span different industries and highlight how companies have used capital budgeting techniques to make successful investment decisions. By analyzing these cases, you will gain practical insights into the application of capital budgeting.

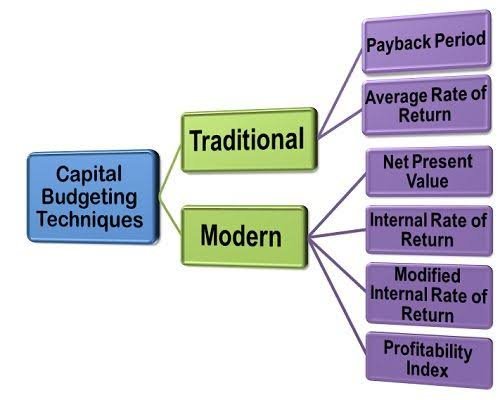

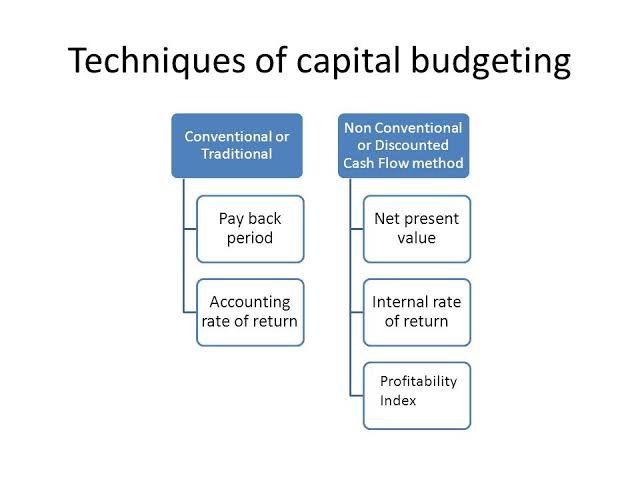

Chapter 2: Methods of Capital Budgeting

Introduction:

In this chapter, we will explore various methods used in capital budgeting to evaluate and prioritize investment projects. These methods provide quantitative techniques to assess the financial feasibility and profitability of potential investments. We will discuss the pros and cons of each method and provide numerical examples to illustrate their applications.

2.1 Payback Period:

The payback period is a simple method that measures the time required to recover the initial investment. We will discuss how this method is calculated and its limitations in considering the time value of money and long-term profitability. Real-life examples will demonstrate the practical application of the payback period.

2.2 Net Present Value (NPV):

The net present value method discounts future cash flows to their present value and compares them to the initial investment. We will explore how to calculate NPV and interpret the results. Additionally, we will discuss the strengths of NPV, such as its ability to account for the time value of money and provide a measure of project profitability.

2.3 Internal Rate of Return (IRR):

The internal rate of return is the discount rate that equates the present value of cash inflows with the initial investment. We will explain how to calculate IRR and its interpretation in decision-making. Furthermore, we will discuss the advantages and limitations of the IRR method and provide examples to illustrate its application.

2.4 Profitability Index (PI):

The profitability index, also known as the benefit-cost ratio, compares the present value of cash inflows to the initial investment. We will discuss how to calculate PI and interpret its results. We will also explore how PI complements other capital budgeting methods and aids in project selection.

2.5 Discounted Payback Period:

The discounted payback period considers the time value of money by discounting cash flows. We will explain how to calculate the discounted payback period and its advantages over the regular payback period. Real-life examples will showcase the practical implications of this method.

Chapter 3: Real-Life Examples of Capital Budgeting

Introduction:

In this chapter, we will explore real-life case studies of capital budgeting in action. By examining examples from both global and Indian contexts, we will gain practical insights into how companies evaluate and prioritize investment projects. These case studies will showcase the application of capital budgeting techniques in various industries and highlight the importance of strategic decision-making.

- Case Study: Company X’s Expansion Project in more detail:

Company X, a global manufacturing firm, is considering an expansion project. The goal of this project is to expand their production capacity and capture new market opportunities. To make an informed investment decision, Company X undertakes a comprehensive capital budgeting analysis.

First, Company X evaluates the cash flows associated with the expansion project. They consider the initial investment required for acquiring land, constructing new facilities, and purchasing machinery and equipment. Additionally, they estimate the expected cash inflows over the project’s life, taking into account projected sales revenues, cost savings, and potential tax benefits.

Next, Company X conducts a risk assessment to identify and mitigate potential risks. They analyze factors such as market demand, competition, regulatory changes, and operational risks. By understanding and quantifying these risks, Company X can incorporate risk-adjusted cash flows into their decision-making process.

Company X applies various capital budgeting methods to evaluate the expansion project. They calculate the payback period to determine how long it would take to recover the initial investment. They also use net present value (NPV) analysis, discounting future cash flows to their present value, to assess the project’s profitability. Internal rate of return (IRR) is another method employed to measure the project’s return on investment.

Considering the strategic objectives of the company, Company X also evaluates the qualitative aspects of the expansion project. They assess factors such as the alignment of the project with the company’s long-term goals, potential synergies with existing operations, and the impact on brand reputation and customer satisfaction.

After conducting a thorough analysis, Company X weighs the financial and non-financial factors to make a final investment decision. They consider the profitability, risk exposure, strategic fit, and the overall impact on the company’s growth and competitiveness. By integrating quantitative and qualitative considerations, Company X ensures a comprehensive evaluation of the expansion project.

This case study demonstrates how capital budgeting techniques enable Company X to make an informed investment decision. By analyzing cash flows, conducting risk assessments, and applying capital budgeting methods, they assess the feasibility and profitability of the expansion project. Such diligent analysis allows Company X to allocate resources effectively and pursue growth opportunities strategically.

By examining this case study, readers can gain insights into the practical application of capital budgeting in evaluating and prioritizing investment projects. It highlights the importance of financial analysis, risk assessment, and strategic alignment in making informed investment decisions. - Case Study: Infrastructure Development in India in more detail:

In this case study, we focus on a government project aimed at building a new highway connecting major cities in India. The infrastructure development project involves significant capital investments and requires careful evaluation to ensure its economic viability and societal impact.

The government initiates the capital budgeting process by estimating the cash flows associated with the project. They consider the initial investment required for land acquisition, construction, and other associated costs. They also analyze the expected cash inflows over the project’s lifespan, which may include toll revenues, ancillary services, and potential economic benefits generated by improved connectivity.

To assess the feasibility and financial viability of the project, the government conducts a cost-benefit analysis. They evaluate the direct and indirect costs associated with the project, such as construction expenses, maintenance, and operational costs. Simultaneously, they quantify the potential benefits, including reduced travel time, improved transportation efficiency, enhanced economic activity, and environmental sustainability.

In addition to financial analysis, the government considers broader factors during the decision-making process. They assess the project’s alignment with national development plans, regional growth strategies, and social welfare objectives. The impact on employment generation, poverty alleviation, and regional integration are important considerations for infrastructure projects of this magnitude.

The government also addresses potential risks and uncertainties associated with the project. They consider factors like political stability, regulatory changes, and environmental impact assessment to ensure responsible and sustainable development. Risk mitigation strategies are implemented to manage and minimize potential adverse effects.

By conducting a comprehensive capital budgeting analysis, the government can make an informed investment decision regarding the infrastructure development project. They evaluate the financial viability, economic impact, social benefits, and long-term sustainability. This analysis provides the necessary information for the government to allocate resources effectively and prioritize infrastructure investments.

This case study illustrates how capital budgeting techniques can guide the decision-making process in public sector projects, specifically infrastructure development. By considering financial analysis, cost-benefit analysis, risk assessment, and broader societal factors, the government ensures that infrastructure projects align with national objectives and promote sustainable economic growth.

By examining this case study, readers can gain insights into the application of capital budgeting in public sector projects. It highlights the importance of considering both financial and non-financial factors, as well as the role of capital budgeting in driving infrastructure development for economic prosperity and societal well-being. - Case Study: Technology Investment for Company Y in more detail:

In this case study, Company Y, a technology firm, is considering a significant technology investment. The objective is to adopt cutting-edge technologies that can enhance their operations, improve efficiency, and maintain competitiveness in the market.

Company Y begins the capital budgeting process by evaluating the financial implications of the technology investment. They assess the initial investment required to acquire the new technologies, including hardware, software, and any necessary infrastructure upgrades. Additionally, they estimate the potential cost savings, productivity gains, and revenue growth that can be achieved through the implementation of these technologies.

To assess the risk associated with the technology investment, Company Y conducts a thorough risk analysis. They consider factors such as technological obsolescence, implementation challenges, cybersecurity risks, and potential disruptions to existing operations. By understanding and addressing these risks, Company Y can make informed decisions and mitigate potential negative impacts.

In evaluating the technology investment, Company Y applies various capital budgeting methods. They calculate the net present value (NPV) to assess the project’s profitability by discounting expected future cash flows to their present value. The internal rate of return (IRR) is also computed to measure the project’s potential return on investment. By considering these metrics, Company Y can evaluate the financial attractiveness of the technology investment.

Strategic alignment is another important consideration for Company Y. They assess how the technology investment aligns with their long-term goals and objectives. They evaluate whether the technologies support their competitive advantage, customer needs, and market trends. By ensuring strategic alignment, Company Y can maximize the benefits derived from the technology investment.

Furthermore, Company Y analyzes the potential impact of the technology investment on their employees, customers, and overall business processes. They consider the training and skill development requirements for their workforce to effectively utilize the new technologies. They also assess how the technologies can enhance customer experiences and drive innovation within the organization.

After a comprehensive analysis, Company Y weighs the financial, strategic, and operational factors to make a final investment decision. By considering the financial viability, risk exposure, strategic alignment, and potential impact on various stakeholders, Company Y ensures a well-informed and holistic approach to technology investments.

This case study demonstrates how capital budgeting techniques can guide technology investment decisions for companies like Company Y. By conducting financial analysis, risk assessment, and strategic alignment evaluations, they can assess the feasibility and potential benefits of the technology investment. It highlights the importance of leveraging technology to drive operational excellence and maintain competitiveness in dynamic markets.

By examining this case study, readers can gain insights into the practical application of capital budgeting in technology investments. It showcases the significance of financial analysis, risk assessment, strategic alignment, and stakeholder considerations in making informed investment decisions in the technology sector. - Case Study: Renewable Energy Project in more detail:

In this case study, we focus on a renewable energy project. The objective is to analyze the financial viability, long-term benefits, and risk factors associated with investing in renewable energy sources.

The project involves the development and operation of a renewable energy facility, such as a solar power plant or wind farm. The capital budgeting process begins by evaluating the financial aspects of the project. The initial investment required for acquiring land, installing renewable energy infrastructure, and connecting to the grid is considered. Additionally, the expected cash inflows over the project’s lifespan, including revenue from selling electricity and potential government incentives, are estimated.

To assess the feasibility and profitability of the renewable energy project, a financial analysis is conducted. This includes calculating the net present value (NPV) and internal rate of return (IRR) of the project. The NPV measures the project’s profitability by discounting the future cash flows to their present value, considering the time value of money. The IRR represents the project’s rate of return, indicating its attractiveness as an investment opportunity.

In addition to financial analysis, the project undergoes a comprehensive risk assessment. Factors such as changes in government policies, fluctuations in energy prices, environmental regulations, and technological advancements are considered. The risk analysis helps identify potential risks and uncertainties that could impact the financial performance of the renewable energy project.

The case study also explores the environmental benefits associated with the renewable energy project. This includes the reduction of greenhouse gas emissions, contribution to climate change mitigation, and the potential for sustainability certifications or carbon credits. These environmental considerations align with the growing importance of sustainable practices and corporate social responsibility.

Furthermore, the case study examines the long-term benefits of investing in renewable energy. This includes the potential for stable and long-term revenue streams, energy independence, and reduced reliance on fossil fuels. It also explores the positive impact on the local community, job creation, and economic development associated with renewable energy projects.

By conducting a comprehensive capital budgeting analysis, stakeholders can make informed decisions about investing in renewable energy. The financial analysis, risk assessment, and consideration of environmental and long-term benefits provide a holistic view of the project’s viability and align with sustainability goals.

This case study illustrates how capital budgeting techniques can guide decision-making in renewable energy projects. It emphasizes the importance of financial analysis, risk assessment, environmental considerations, and long-term benefits in evaluating the feasibility and potential impact of investing in renewable energy sources.

By examining this case study, readers can gain insights into the practical application of capital budgeting in renewable energy projects. It showcases the significance of financial analysis, risk assessment, and sustainability considerations in making informed investment decisions in the renewable energy sector. - Case Study: Certainly! Let’s explore Case Study: Startup Investment Evaluation in more detail:

In this case study, we focus on the evaluation of investment opportunities for a startup company. Startups face unique challenges, including limited resources and higher risk profiles, which require careful capital budgeting analysis to make informed investment decisions.

The startup begins by identifying potential investment opportunities that align with their business objectives and growth strategy. These opportunities may include expanding product offerings, entering new markets, or scaling operations. The capital budgeting process involves evaluating the financial feasibility and potential returns of these investment options.

The startup assesses the financial implications of each investment opportunity. They estimate the initial investment required, including costs such as research and development, marketing, hiring, and infrastructure development. Additionally, they project the potential cash inflows and revenue growth associated with each opportunity, considering factors such as market demand, competition, and customer adoption rates.

Risk assessment is crucial in evaluating startup investment opportunities. Startups often face higher risks due to market uncertainties, technology challenges, and limited operating history. The startup identifies and analyzes risks such as market volatility, regulatory changes, intellectual property protection, and scalability. By understanding these risks, they can develop risk mitigation strategies and assess the potential impact on investment returns.

The startup employs capital budgeting methods to evaluate the investment opportunities. They calculate metrics such as the payback period, which measures the time required to recover the initial investment, and the net present value (NPV), which assesses the profitability by discounting future cash flows. They also consider metrics like the internal rate of return (IRR) and profitability index (PI) to assess the return on investment and relative attractiveness of the opportunities.

In addition to financial analysis, the startup considers qualitative factors in the decision-making process. They evaluate the strategic fit of the investment opportunities with their core competencies and long-term goals. They also assess the potential synergies, competitive advantages, and growth potential associated with each investment option.

The startup weighs the financial and non-financial factors to make a final investment decision. By considering the financial feasibility, risk exposure, strategic alignment, and growth potential, they can identify the most promising investment opportunities and allocate their limited resources effectively.

This case study showcases how capital budgeting techniques can guide investment evaluation for startups. It emphasizes the importance of financial analysis, risk assessment, strategic alignment, and qualitative factors in making informed investment decisions in a dynamic and high-risk environment.

By examining this case study, readers can gain insights into the practical application of capital budgeting in evaluating investment opportunities for startups. It highlights the significance of financial analysis, risk assessment, strategic alignment, and growth potential considerations in making informed investment decisions in the startup ecosystem.

Each case study would provide specific details about the company, project, financial analysis, and decision-making processes. Real-life examples would be used to demonstrate the practical application of capital budgeting techniques in different contexts. By exploring these case studies, readers can gain a deeper understanding of the complexities involved in capital budgeting and how it influences investment decisions.

Chapter 4: Critical Analysis of Capital Budgeting

Introduction:

In this chapter, we will critically analyze capital budgeting and explore its limitations, challenges, and strategies for enhancing decision-making. While capital budgeting provides valuable insights into investment decisions, it is important to understand its potential pitfalls and consider alternative approaches. By conducting a critical analysis, we can refine our understanding of capital budgeting and improve decision-making processes.

4.1 Uncertainty and Risk Assessment:

Capital budgeting involves making decisions based on future projections and assumptions. We will discuss the inherent uncertainty in forecasting cash flows, estimating discount rates, and predicting market conditions. We will explore techniques such as sensitivity analysis, scenario analysis, and Monte Carlo simulation to assess and manage risk. By acknowledging the limitations of predicting the future, we can make more informed investment decisions.

4.2 Behavioral Biases:

Human psychology can influence capital budgeting decisions, leading to biases that affect judgment and outcomes. We will explore common biases, such as overconfidence, anchoring, and confirmation bias, and their impact on decision-making. By understanding these biases, we can employ strategies to mitigate their effects and make more rational investment choices.

4.3 Changing Market Conditions:

Market dynamics are constantly evolving, and external factors can impact the profitability and viability of investment projects. We will discuss the challenges of capital budgeting in the face of changing market conditions, such as inflation, interest rate fluctuations, and technological disruptions. Real-life examples will illustrate how companies adapt their capital budgeting strategies to navigate these challenges.

4.4 Alternatives to Traditional Capital Budgeting:

While traditional capital budgeting methods provide valuable insights, alternative approaches have emerged to address their limitations. We will explore techniques like real options analysis, decision trees, and dynamic programming as alternatives to traditional capital budgeting methods. By considering these approaches, businesses can enhance their decision-making processes and capture additional value.

4.5 Enhancing Capital Budgeting Decision-Making:

We will conclude this chapter by providing strategies to enhance capital budgeting decision-making. We will discuss the importance of cross-functional collaboration, continuous monitoring and reassessment, and incorporating qualitative factors alongside quantitative analysis. By adopting these strategies, businesses can improve the accuracy and effectiveness of their investment decisions.

.

Chapter 5: Applications of Capital Budgeting

Introduction:

In this chapter, we will explore the diverse applications of capital budgeting beyond traditional business investments. We will examine how capital budgeting techniques can be applied in public sector projects, nonprofit organizations, and personal financial planning. By understanding these applications, we can recognize the broad impact of capital budgeting and its relevance in various contexts.

5.1 Capital Budgeting in Public Sector Projects:

Public sector projects, such as infrastructure development, require careful allocation of resources and assessment of long-term benefits. We will discuss how capital budgeting techniques, including cost-benefit analysis, can aid in decision-making for public projects. Case studies will highlight successful applications of capital budgeting in public sector investments.

5.2 Capital Budgeting in Nonprofit Organizations:

Nonprofit organizations face unique challenges in allocating limited resources for maximum social impact. We will explore how capital budgeting techniques can help nonprofits assess investment opportunities, evaluate program effectiveness, and measure social returns. Real-life examples will illustrate how capital budgeting contributes to strategic planning in the nonprofit sector.

5.3 Capital Budgeting for Personal Financial Planning:

Capital budgeting principles can also be applied to personal finance decisions. We will discuss how individuals can use capital budgeting techniques to evaluate investment opportunities, such as buying a home, starting a business, or planning for retirement. By understanding the time value of money, risk assessment, and financial goal setting, individuals can make informed personal financial decisions.

5.4 Environmental Considerations in Capital Budgeting:

Given the increasing importance of sustainability, we will explore how capital budgeting can integrate environmental considerations. We will discuss methods such as environmental impact assessments, carbon footprint analysis, and life cycle costing. By incorporating environmental factors into capital budgeting, businesses and organizations can align their investments with sustainable practices.

5.5 International Capital Budgeting:

Expanding into the global market requires evaluating investment opportunities across different countries and currencies. We will examine the challenges and techniques involved in international capital budgeting, including exchange rate risk, political stability, and cultural factors. Real-world examples will demonstrate how companies navigate international capital budgeting decisions.

Leave a comment