Introduction:

Welcome to our comprehensive guide on risk and returns! In this blog post, we will delve into the intriguing world of finance, exploring the concepts of risk and returns, their significance in both global and Indian contexts, and their real-life applications. Whether you are a seasoned investor or just starting your financial journey, this post will provide you with valuable insights and practical examples to make informed decisions. So, let’s dive in!

Table of Contents:

1-Understanding Risk and Returns

Defining Risk and Returns

The Risk-Return Tradeoff

Types of Risk: Systematic and Unsystematic

Measuring Returns: Absolute and Relative

2- Real-Life Examples of Risk and Returns

Global Economic Crises: Lessons Learned

The Dot-Com Bubble: Excessive Returns and Subsequent Risks

Indian Stock Market Volatility: Navigating Uncertainty

3- Case Studies: Examining Risk and Returns in Action

Case Study 1: Investing in Blue-Chip Stocks

Case Study 2: Real Estate Investments in India

Case Study 3: Assessing Risk in Cryptocurrency Investments

4- Numerical Analysis: Crunching the Numbers

Understanding Risk Metrics: Standard Deviation, Beta, and Sharpe Ratio

Calculating Expected Returns and Portfolio Diversification

5- Applications of Risk and Returns in Real Life

Retirement Planning: Balancing Risk and Returns

Investment Strategies for Different Life Stages

Navigating Market Volatility: Tactical vs. Strategic Approaches

6- Critical Analysis of Risk and Returns

Behavioral Finance: The Role of Emotions in Decision Making

Overcoming Cognitive Biases: Rational Investing

Impact of Regulatory Changes on Risk and Returns

7- Conclusion

Chapter 1: Understanding Risk and Returns

Defining Risk and Returns:

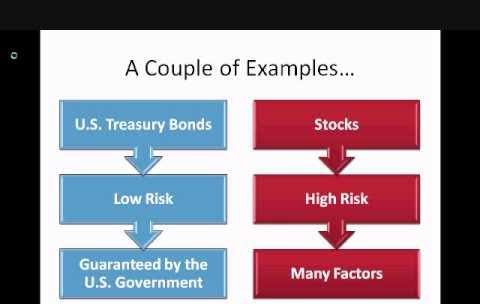

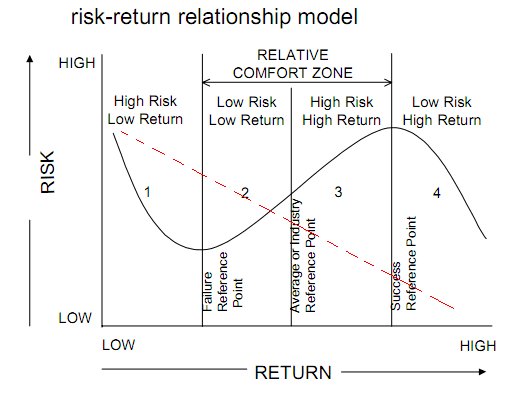

When it comes to investing, risk and returns go hand in hand. Risk refers to the uncertainty and potential for loss associated with an investment, while returns represent the gains or profits that investors aim to achieve. It’s important to note that higher returns typically come with higher levels of risk.

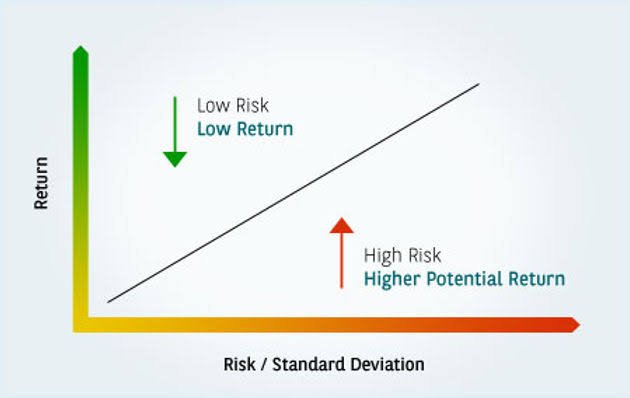

The Risk-Return Tradeoff:

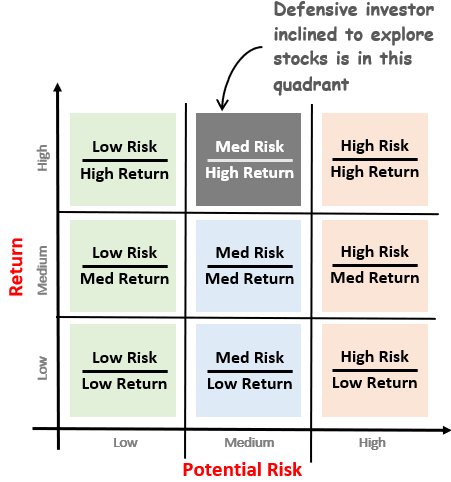

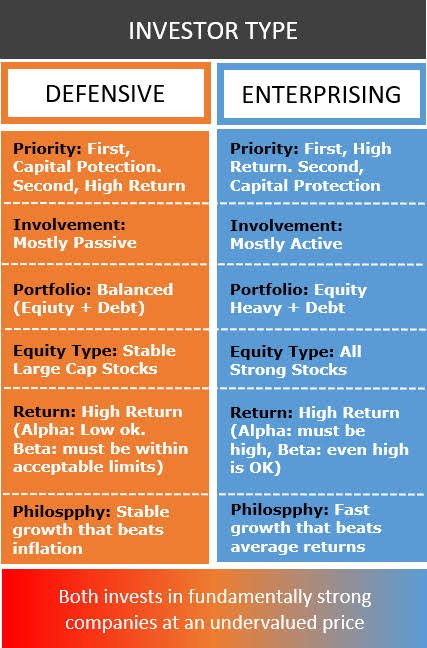

The risk-return tradeoff is a fundamental concept in finance. It states that investments with higher potential returns tend to carry higher levels of risk. Conversely, investments with lower risk often yield lower returns. Understanding this tradeoff is crucial for investors as they seek to strike a balance between risk and reward based on their financial goals and risk tolerance.

Types of Risk: Systematic and Unsystematic:

In the world of investing, there are two main types of risk: systematic and unsystematic. Systematic risk, also known as market risk, is inherent to the entire market or a particular segment of it. Factors such as economic conditions, political events, and interest rates can impact the entire market, causing systematic risk. Unsystematic risk, on the other hand, is specific to a particular investment or industry. It can be mitigated through diversification.

Measuring Returns: Absolute and Relative:

Returns can be measured in two ways: absolute and relative. Absolute returns provide a straightforward measure of the actual gains or losses on an investment. For example, if you invested $1,000 and earned $200, your absolute return would be $200. Relative returns, on the other hand, compare the performance of an investment against a benchmark or similar investments. This helps investors gauge how well their investment performed compared to others in the market.

By understanding these key concepts, investors can better evaluate the potential risks and expected returns associated with their investment decisions. In the next chapter, we will explore real-life examples of risk and returns, examining global economic crises, the dot-com bubble, and Indian stock market volatility. Stay tuned!

Chapter 2: Real-Life Examples of Risk and Returns

Global Economic Crises: Lessons Learned:

One of the most significant examples of risk and returns in a global context is the occurrence of economic crises. The 2008 financial crisis, for instance, had far-reaching implications worldwide. It highlighted the interconnectedness of financial markets and the importance of understanding systemic risk. Investors who had exposure to highly leveraged assets faced substantial losses, while those who were more diversified and had a long-term perspective were better positioned to weather the storm. This example emphasizes the need for risk management and a thorough understanding of the potential risks associated with investments.

The Dot-Com Bubble: Excessive Returns and Subsequent Risks:

During the late 1990s, the dot-com bubble emerged, characterized by a rapid rise in the stock prices of internet-based companies. Investors were lured by the promise of extraordinary returns, leading to inflated valuations. However, when the bubble burst in the early 2000s, many investors suffered significant losses. This example underscores the importance of conducting thorough due diligence and avoiding speculative investments driven solely by hype. It highlights the risks of investing in a rapidly changing and speculative market environment.

Indian Stock Market Volatility: Navigating Uncertainty:

The Indian stock market has experienced its fair share of volatility, presenting investors with both risks and opportunities. For instance, during periods of economic uncertainty, stock prices may exhibit heightened fluctuations. Investors who can identify undervalued stocks during such times and have a long-term investment horizon may benefit from potential returns. However, it’s crucial to consider the associated risks, such as market sentiment, political factors, and regulatory changes that can affect investment outcomes. Analyzing historical data, monitoring market trends, and diversifying portfolios can help mitigate risks in such a dynamic market.

By examining these real-life examples, investors gain valuable insights into the complexities of risk and returns in different market scenarios. In the next chapter, we will delve into case studies that explore risk and returns in specific investment scenarios, including investing in blue-chip stocks, real estate investments in India, and assessing risk in cryptocurrency investments. Stay tuned for practical insights and lessons learned from these case studies!

Chapter 3: Case Studies: Examining Risk and Returns in Action

Case Study 1: Investing in Blue-Chip Stocks:

Blue-chip stocks refer to shares of large, well-established companies with a history of stable performance. Investing in blue-chip stocks is often considered a low-risk strategy due to the companies’ strong market positions and consistent dividends. However, there are still risks involved. For example, even established companies can face economic downturns or industry disruptions. By analyzing historical data, assessing financial metrics, and considering market trends, investors can evaluate the risk and return potential of blue-chip stocks. This case study will explore the performance of select blue-chip stocks, their risk profiles, and the returns they have generated over time.

Case Study 2: Real Estate Investments in India:

Real estate investments in India have been a popular choice for investors seeking long-term returns. However, this asset class comes with its own set of risks. Factors such as market fluctuations, regulatory changes, and economic conditions can impact property values and rental income. In this case study, we will examine the risk-return characteristics of different types of real estate investments, such as residential, commercial, and rental properties. We will analyze historical price trends, rental yields, and the impact of external factors on real estate returns in the Indian context.

Case Study 3: Assessing Risk in Cryptocurrency Investments:

Cryptocurrencies have gained significant attention in recent years, offering the potential for high returns. However, the volatile nature of the cryptocurrency market poses substantial risks. This case study will explore the risks and returns associated with investing in cryptocurrencies, such as Bitcoin and Ethereum. We will examine historical price movements, market trends, regulatory developments, and the impact of major events on cryptocurrency values. Through this analysis, investors can gain insights into the risks involved and develop strategies to manage their cryptocurrency investments effectively.

These case studies provide practical examples of risk and returns in specific investment scenarios. By examining real-life data and evaluating the factors that contribute to risk and return, investors can make more informed decisions. In the next chapter, we will dive into numerical analysis, exploring risk metrics such as standard deviation, beta, and the Sharpe ratio. Stay tuned for a deeper understanding of quantitative measures used to assess risk and returns!

Chapter 4: Numerical Analysis: Crunching the Numbers

Understanding Risk Metrics: Standard Deviation, Beta, and Sharpe Ratio:

Numerical analysis plays a crucial role in evaluating risk and returns. In this chapter, we will explore three important risk metrics: standard deviation, beta, and the Sharpe ratio.

1. Standard Deviation:

Standard deviation measures the volatility or variability of an investment’s returns. A higher standard deviation indicates a greater degree of risk associated with the investment. By calculating the standard deviation of historical returns, investors can assess the level of uncertainty and potential fluctuations in their investment performance.

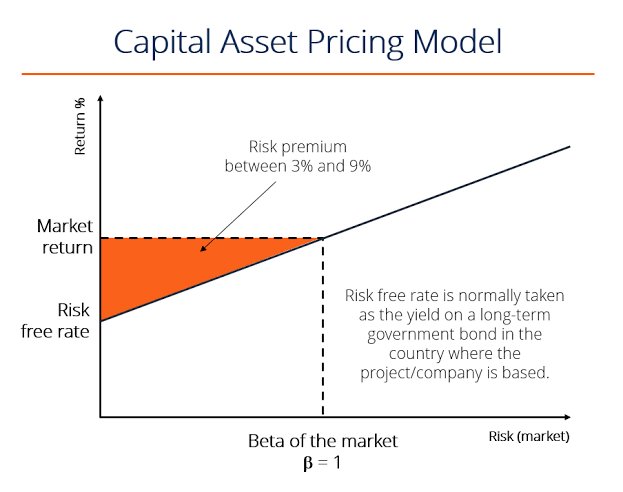

2. Beta:

Beta measures the sensitivity of an investment’s returns to changes in the overall market. A beta of 1 indicates that the investment’s returns move in line with the market. A beta greater than 1 suggests that the investment is more volatile than the market, while a beta less than 1 implies lower volatility. Beta helps investors understand the systematic risk of an investment and its potential correlation with market movements.

3. Sharpe Ratio:

The Sharpe ratio combines risk and return by considering the excess return of an investment relative to its risk. It is calculated by dividing the difference between the investment’s average return and the risk-free rate by its standard deviation. A higher Sharpe ratio indicates a better risk-adjusted return. Investors can use the Sharpe ratio to compare the performance of different investments and assess whether the returns adequately compensate for the risk taken.

Calculating Expected Returns and Portfolio Diversification:

In addition to risk metrics, it’s important to calculate expected returns and consider portfolio diversification. Expected returns estimate the average returns an investor can anticipate from an investment. By analyzing historical data, economic factors, and market conditions, investors can estimate the potential returns of their investments.

Diversification is another crucial aspect of managing risk and returns. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the impact of any single investment’s performance on their overall portfolio. Diversification helps mitigate unsystematic risk and potentially enhances returns.

By employing numerical analysis techniques and understanding risk metrics, investors can gain insights into the risks and expected returns associated with their investments. In the next chapter, we will explore practical applications of risk and returns in real-life scenarios, such as retirement planning, investment strategies for different life stages, and navigating market volatility. Stay tuned for valuable insights and strategies!

Chapter 5: Applications of Risk and Returns in Real Life

Retirement Planning: Balancing Risk and Returns:

One of the most critical applications of understanding risk and returns is in retirement planning. Balancing risk and returns is crucial to ensure that your investments grow steadily while providing the necessary funds for a comfortable retirement. Depending on your risk tolerance and time horizon, you may allocate your investments across different asset classes, such as stocks, bonds, and real estate. Understanding the potential risks and returns associated with each asset class is essential for designing a retirement portfolio that aligns with your financial goals.

Investment Strategies for Different Life Stages:

Risk and return considerations also vary based on an individual’s life stage. Younger investors with a longer investment horizon can generally afford to take on more risk in pursuit of higher returns. As they approach retirement, the focus often shifts towards preserving capital and generating stable income. By adjusting their investment strategies based on their life stages, investors can align their risk and return expectations with their financial objectives.

Navigating Market Volatility: Tactical vs. Strategic Approaches:

Market volatility is an inevitable part of investing. During periods of volatility, it is crucial to have a clear investment strategy. Some investors adopt a tactical approach, taking advantage of short-term market fluctuations to make strategic investment decisions. Others follow a strategic approach, focusing on long-term goals and maintaining a well-diversified portfolio. Both approaches have their pros and cons, and the choice depends on an individual’s risk tolerance, investment objectives, and market outlook.

By applying the principles of risk and returns to real-life scenarios, investors can make informed decisions to achieve their financial goals. In the final chapter, we will provide a critical analysis of risk and returns, exploring the role of behavioral finance, overcoming cognitive biases, and the impact of regulatory changes. Stay tuned for a deeper understanding of these critical aspects!

Chapter 6: Critical Analysis of Risk and Returns

In this final chapter, we will critically analyze the concepts of risk and returns, considering the role of behavioral finance, cognitive biases, and the impact of regulatory changes. Let’s delve into these important aspects:

Behavioral Finance: The Role of Emotions in Decision Making

Behavioral finance acknowledges that human emotions and biases can significantly influence investment decisions. Emotions such as fear, greed, and overconfidence can lead to irrational choices that deviate from rational risk and return analysis. Recognizing the impact of emotions and developing strategies to mitigate their influence is crucial for successful investing. By adopting a disciplined approach, conducting thorough research, and maintaining a long-term perspective, investors can reduce the impact of emotions on their decision-making process.

Overcoming Cognitive Biases: Promoting Rational Investing

Cognitive biases are inherent biases that affect our judgment and decision-making. In the context of risk and returns, several cognitive biases can impact investment choices. Confirmation bias, loss aversion, anchoring bias, and herd mentality are a few examples. Overcoming these biases requires self-awareness, critical thinking, and a commitment to rational investing. By seeking diverse perspectives, challenging assumptions, and basing decisions on comprehensive analysis rather than biases, investors can make more informed choices aligned with risk and return objectives.

Impact of Regulatory Changes on Risk and Returns

Regulatory changes can significantly impact the risk and return dynamics of investments. New laws, regulations, or policy shifts can introduce new risks or alter the risk-reward tradeoff for various asset classes. Investors must stay informed about regulatory developments that affect their investments. By understanding the potential impact of regulatory changes, investors can proactively adjust their investment strategies, manage risks effectively, and seize opportunities within the evolving regulatory landscape.

A critical analysis of risk and returns allows investors to recognize and address the psychological and regulatory factors that can influence investment outcomes. By staying cognizant of behavioral biases, investors can strive for more rational decision-making and better manage their risk-return tradeoff. Additionally, keeping abreast of regulatory changes enables investors to adapt to the evolving financial landscape and align their investment strategies with changing regulations.

We hope this critical analysis of risk and returns has provided you with a deeper understanding of the complexities involved in investment decision-making. Remember, maintaining a disciplined and objective approach, being aware of behavioral biases, and staying informed about regulatory changes are essential for optimizing risk-adjusted returns. Thank you for joining us on this journey through risk and returns, and we wish you success in your future investment endeavors!

cognitive biases in the context of risk and returns include:

1. Confirmation Bias: This bias occurs when individuals seek information that confirms their preexisting beliefs or opinions, while ignoring or discounting information that contradicts them. In the context of investing, confirmation bias can lead investors to selectively focus on information that supports their desired risk and return outcomes, potentially leading to poor investment decisions.

2. Loss Aversion: Loss aversion refers to the tendency of individuals to feel the pain of losses more acutely than the pleasure of gains. As a result, investors may be more averse to taking risks that could lead to losses, even if the potential for higher returns exists. This bias can hinder portfolio diversification and prevent investors from maximizing their long-term investment potential.

3. Anchoring Bias: Anchoring bias occurs when individuals rely too heavily on an initial piece of information (the anchor) when making subsequent judgments or decisions. In investing, this bias can manifest as investors basing their expectations of future returns on past performance, without considering other relevant factors. Failing to update their expectations based on current market conditions can lead to misjudgments and suboptimal investment choices.

4. Herd Mentality: Herd mentality refers to the tendency of individuals to follow the actions and decisions of the majority, even if it may not be based on rational analysis. In investing, herd mentality can lead to market bubbles and crashes, as investors collectively rush into or out of investments based on the actions of others, rather than a careful evaluation of risk and return prospects.

It is important for investors to be aware of these cognitive biases and consciously make efforts to overcome them. By engaging in thorough research, seeking diverse perspectives, and maintaining a disciplined approach to investing, individuals can strive for more rational decision-making and better manage risk and returns.

Impact of Regulatory Changes on Risk and Returns:

Regulatory changes can significantly impact the risk and return dynamics of investments. Changes in tax laws, financial regulations, and market structures can introduce new risks or alter the risk-reward tradeoff for various asset classes. Investors need to stay informed about regulatory developments and adapt their investment strategies accordingly. Understanding the potential impact of regulatory changes on risk and returns is crucial for making informed investment decisions and managing portfolios effectively.

By critically analyzing the role of behavioral finance and cognitive biases, as well as considering the impact of regulatory changes, investors can enhance their understanding of risk and returns and make more informed investment decisions. This concludes our exploration of risk and returns. We hope you found this guide insightful and valuable. Remember to seek professional advice and conduct thorough research before making any investment decisions. Happy investing!

Conclusion:

In this comprehensive guide, we have explored the intricate concepts of risk and returns in the world of finance. We started by defining risk and returns, emphasizing the risk-return tradeoff and the types of risk investors face. We then examined real-life examples, such as global economic crises, the dot-com bubble, and Indian stock market volatility, to understand the practical implications of risk and returns in different contexts.

Further, we dived into case studies that explored risk and returns in specific investment scenarios, including investing in blue-chip stocks, real estate investments in India, and assessing risk in cryptocurrency investments. These case studies provided valuable insights into the risk-return profiles of different investment options, helping investors make informed decisions.

Numerical analysis played a crucial role in our exploration, where we discussed risk metrics like standard deviation, beta, and the Sharpe ratio. By understanding these metrics, investors can quantitatively evaluate the risks and potential returns of their investments. We also explored the importance of expected returns and portfolio diversification as key components of risk management.

In the realm of practical applications, we discussed retirement planning, investment strategies for different life stages, and navigating market volatility. These applications provided guidance on balancing risk and returns based on individual circumstances and goals.

Finally, we delved into the critical aspects of behavioral finance, highlighting the role of emotions and cognitive biases in decision-making. By understanding these biases and the impact they can have on risk and return analysis, investors can strive for more rational and objective decision-making.

We concluded by discussing the impact of regulatory changes on risk and returns, emphasizing the need to stay informed about evolving regulations and adapt investment strategies accordingly.

By integrating the knowledge gained from this guide into your investment approach, you can navigate the financial landscape more confidently. Remember, investing always carries inherent risks, and it’s important to conduct thorough research, seek professional advice, and stay informed about market developments. With a disciplined and informed approach, you can aim to optimize your risk-adjusted returns and achieve your financial goals.

Thank you for joining us on this journey through the world of risk and returns. We hope this guide has provided you with valuable insights and practical strategies. Should you have any questions or wish to share your thoughts, feel free to leave a comment or engage with us on social media using the hashtag #RiskAndReturns. Happy investing!

Leave a comment