Introduction:

Welcome to our comprehensive guide on the valuation of bonds and shares. In this blog post, we will explore the concepts, techniques, and real-life examples of valuing bonds and shares in both the global and Indian context. Whether you are a novice investor or a seasoned professional, understanding the valuation process is essential for making informed investment decisions. So, let’s dive in!

Index:

1-Understanding Bond Valuation

2-Key Factors Affecting Bond Valuation

3-Techniques for Valuing Bonds

a. Present Value Approach

b. Yield-to-Maturity Approach

c. Bond Pricing Models

4-Real-Life Examples of Bond Valuation

a. Government Bonds

b. Corporate Bonds

5-Share Valuation: An Overview

6-Approaches to Valuing Shares

a. Intrinsic Value Approach

b. Relative Valuation Approach

7-Real-Life Examples of Share Valuation

a. Blue-Chip Companies

b. Startups and IPOs

8-Comparing Bond and Share Valuation

9-Case Studies: Bond and Share Valuation in Action

10-Applications of Valuation Techniques

11-Numerical Illustrations: Step-by-Step Examples

12-Critical Analysis: Limitations and Risks

13-Conclusion

Chapter 1: Understanding Bond Valuation

Welcome to Chapter 1 of our comprehensive guide on bond valuation. In this chapter, we will provide you with a solid foundation by explaining the concept of bond valuation and why it is crucial for investors. We will also discuss the key components of a bond and how they influence its valuation. Real-life examples from both global and Indian markets will be used to illustrate these principles.

What is Bond Valuation?

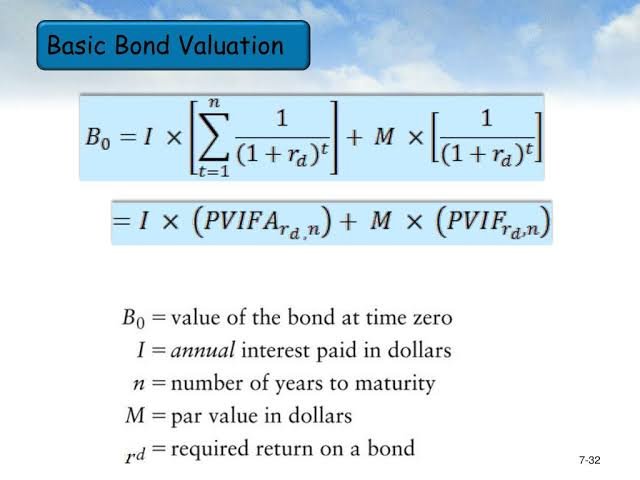

Bond valuation is the process of determining the fair value of a bond, which represents the present value of its future cash flows. It allows investors to assess whether a bond is overvalued or undervalued in the market. By understanding the valuation of bonds, investors can make informed decisions about buying, selling, or holding these fixed-income securities.

Key Components of a Bond:

To understand bond valuation, let’s first explore the key components that make up a bond:

1. Face Value: The face value, also known as the par value or principal, is the amount that the bond issuer promises to repay the bondholder at maturity.

2. Coupon Rate: The coupon rate is the fixed interest rate that the bond issuer agrees to pay the bondholder annually or semi-annually, expressed as a percentage of the bond’s face value.

3. Maturity: The maturity date is the date when the bond reaches its full term, and the bond issuer is obligated to repay the bondholder the face value. Maturities can range from short-term (less than one year) to long-term (up to 30 years or more).

4. Coupon Payments: Coupon payments are the periodic interest payments made to bondholders throughout the life of the bond. They are calculated by multiplying the coupon rate by the face value.

5. Yield-to-Maturity (YTM): The yield-to-maturity is the total return anticipated by an investor who holds the bond until maturity. It takes into account the bond’s current market price, coupon payments, and time to maturity.

Factors Affecting Bond Valuation:

Several factors influence the valuation of bonds. Let’s discuss some of the key ones:

1. Interest Rates: Bond prices and interest rates have an inverse relationship. When interest rates rise, the value of existing bonds decreases, as newly issued bonds offer higher coupon rates. Conversely, when interest rates decline, existing bond prices tend to rise.

2. Credit Rating: The credit rating assigned to a bond by credit rating agencies (such as Moody’s, Standard & Poor’s, and Fitch) reflects the issuer’s creditworthiness. Bonds with higher credit ratings typically have lower default risk, resulting in higher valuations.

3. Market Conditions: Supply and demand dynamics in the bond market affect bond prices. If there is high demand for a particular bond, its price may increase, leading to a higher valuation. Conversely, if there is low demand, the bond’s price may decline, resulting in a lower valuation.

Real-Life Examples:

1-Let’s consider a real-life example to understand bond valuation better. Suppose Company XYZ issues a 10-year bond with a face value of $1,000, a coupon rate of 5% (annual payments), and a current market interest rate of 4%. Using the present value approach, we can calculate the bond’s fair value as follows:

– Step 1: Determine the present value of coupon payments:

PV of Coupon Payments = (Coupon Payment) / (1 + Market Interest Rate)^n

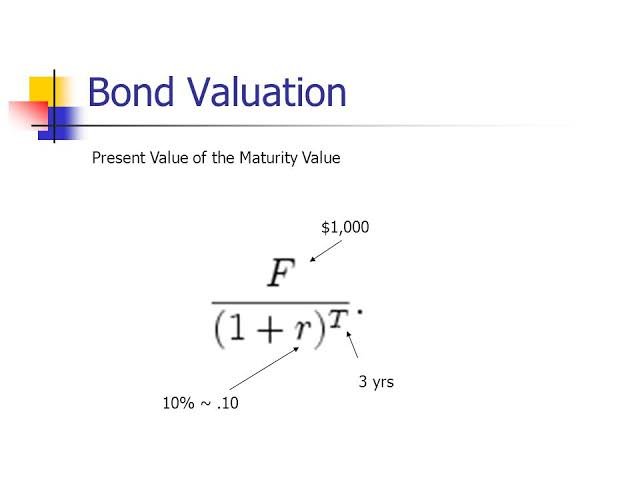

– Step 2: Determine the present value of the face value:

PV of Face Value = (Face Value) / (1 + Market Interest Rate)^n

– Step 3: Sum the present values of coupon payments and face value to obtain the fair value of the bond.

By applying this calculation, we can determine whether the bond is trading at a premium (above fair value) or a discount (below fair value).

2- Numerical Example: Bond Valuation

Let’s consider a 5-year bond with a face value of $1,000, a coupon rate of 6% (annual payments), and a market interest rate of 5%. We will use the present value approach to calculate the fair value of this bond.

Step 1: Determine the Expected Cash Flows

For a 5-year bond with an annual coupon payment of 6%, the cash flows would be as follows:

Year 1: Coupon payment = 6% * $1,000 = $60

Year 2: Coupon payment = 6% * $1,000 = $60

Year 3: Coupon payment = 6% * $1,000 = $60

Year 4: Coupon payment = 6% * $1,000 = $60

Year 5: Coupon payment = 6% * $1,000 + Face value = $60 + $1,000 = $1,060

Step 2: Determine the Appropriate Discount Rate

In this example, the market interest rate is 5%, which we will use as the discount rate for discounting the bond’s cash flows.

Step 3: Calculate the Present Value of Each Cash Flow

Using the discount rate of 5%, we can calculate the present value of each cash flow:

Year 1: Present value = $60 / (1 + 0.05)^1 = $57.14

Year 2: Present value = $60 / (1 + 0.05)^2 = $54.50

Year 3: Present value = $60 / (1 + 0.05)^3 = $51.90

Year 4: Present value = $60 / (1 + 0.05)^4 = $49.33

Year 5: Present value = $1,060 / (1 + 0.05)^5 = $783.53

Step 4: Sum the Present Values

Adding up the present values of all cash flows, we get:

$57.14 + $54.50 + $51.90 + $49.33 + $783.53 = $996.40

Therefore, the fair value of this bond, based on the present value approach, is approximately $996.40.

This calculation shows that if the market price of the bond is below $996.40, it may be considered undervalued, and if it is above $996.40, it may be considered overvalued.

Please note that this is a simplified numerical example for illustrative purposes. In practice, bond valuation involves more complex considerations, such as yield curves, credit spreads, and market expectations. The example above provides a basic understanding of the present value approach for bond valuation.

I hope this numerical example helps to clarify the bond valuation process. If you have any further questions or require additional examples, please let me know!

Conclusion:

In this chapter, we explored the fundamental concepts of bond valuation. Understanding the components of a bond and the factors that influence its valuation is essential for investors. By assessing bond valuations, investors can make informed decisions based on their risk tolerance and investment objectives. Stay tuned for the upcoming chapters, where we will discuss valuation techniques and real-life examples of bond valuation in more detail.

Chapter 2: Key Factors Affecting Bond Valuation

Welcome to Chapter 2 of our comprehensive guide on bond valuation. In this chapter, we will delve deeper into the key factors that influence the valuation of bonds. Understanding these factors is crucial for investors as they assess the attractiveness of bond investments. We will explore the impact of interest rates, credit ratings, and market conditions on bond valuation, providing real-life examples from both global and Indian contexts.

1. Interest Rates:

Interest rates have a significant impact on bond valuation. Bonds are fixed-income securities, meaning they provide a predetermined stream of cash flows in the form of coupon payments. When interest rates rise, new bonds with higher coupon rates become available, making existing bonds with lower coupon rates less attractive. As a result, the prices of existing bonds tend to decrease, leading to lower valuations. Conversely, when interest rates decline, existing bonds with higher coupon rates become more desirable, driving up their prices and valuations.

Example: Let’s say you own a bond with a fixed coupon rate of 5% in a rising interest rate environment where new bonds with similar risk profiles offer coupon rates of 7%. As a result, the market value of your bond may decrease, reflecting the lower demand for lower coupon-paying bonds.

2. Credit Ratings:

Credit ratings assigned to bonds by rating agencies play a crucial role in bond valuation. These ratings assess the creditworthiness of bond issuers, indicating the probability of default. Bonds with higher credit ratings are generally considered less risky, resulting in higher valuations. Conversely, bonds with lower credit ratings or those considered to be higher risk will have lower valuations.

Example: Suppose you are comparing two corporate bonds, one issued by a financially stable blue-chip company with a high credit rating and another issued by a startup with a relatively low credit rating. Investors will typically demand a higher yield for the startup bond due to its higher risk, leading to a lower valuation compared to the blue-chip company bond.

3. Market Conditions:

Supply and demand dynamics within the bond market can significantly impact bond valuations. When there is high demand for a particular bond, its price tends to rise, resulting in a higher valuation. Conversely, if the market demand for a bond decreases, its price may decline, leading to a lower valuation.

Example: Government bonds are generally considered low-risk investments. During times of economic uncertainty or market downturns, investors often seek the safety of government bonds, increasing their demand. As a result, the prices of government bonds may rise, leading to higher valuations.

It’s important to note that the interplay of these factors is complex, and their influence on bond valuation can vary in different market conditions and economic environments.

Conclusion:

In this chapter, we explored the key factors that affect bond valuation. Interest rates, credit ratings, and market conditions all play crucial roles in determining the attractiveness and value of bonds. By understanding these factors and their impact, investors can better assess the potential risks and returns associated with bond investments. Stay tuned for the upcoming chapters, where we will discuss various techniques for valuing bonds and provide real-life examples of bond valuation in action.

Chapter 3: Techniques for Valuing Bonds

Welcome to Chapter 3 of our comprehensive guide on bond valuation. In this chapter, we will explore various techniques used to value bonds. Understanding these techniques is essential for investors to determine the fair value of a bond and make informed investment decisions. We will cover the present value approach, the yield-to-maturity approach, and bond pricing models. Real-life examples and numerical illustrations will be provided to enhance understanding.

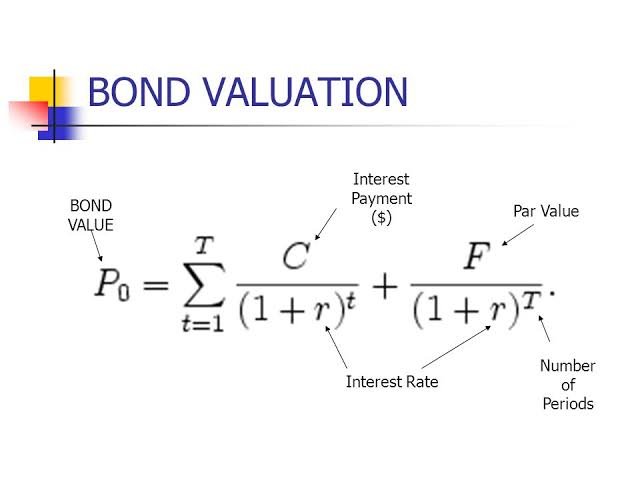

1. Present Value Approach:

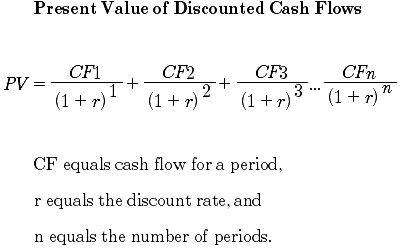

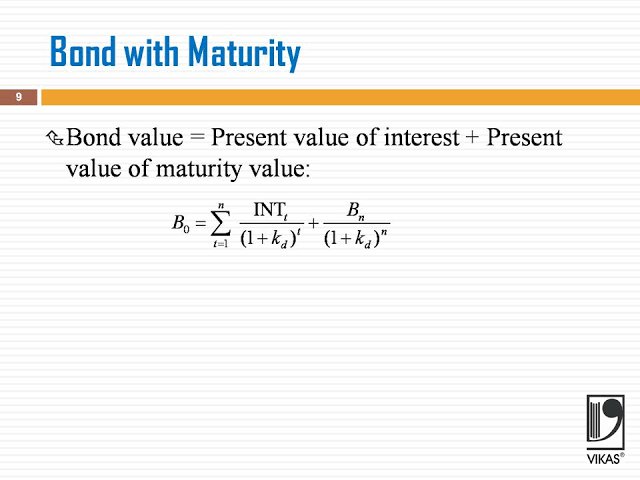

The present value approach is a fundamental technique used to value bonds. It involves calculating the present value of future cash flows generated by the bond and discounting them to their present values. The present value is determined by discounting the bond’s future cash flows using an appropriate discount rate, which is typically the market interest rate for bonds with similar characteristics.

The steps involved in the present value approach are as follows:

– Determine the expected cash flows: Identify the coupon payments and the face value to be received at maturity.

– Determine the appropriate discount rate: The discount rate should reflect the market interest rate for bonds with similar risk profiles and maturities.

– Calculate the present value of each cash flow: Discount each cash flow to its present value using the discount rate.

– Sum the present values: Add up the present values of all cash flows to obtain the fair value of the bond.

Real-Life Example: Consider a 5-year bond with a face value of $1,000, a coupon rate of 4% (annual payments), and a market interest rate of 5%. By applying the present value approach, the cash flows can be discounted back to their present values, and the sum of these present values will give the fair value of the bond.

2. Yield-to-Maturity Approach:

The yield-to-maturity (YTM) approach is another commonly used technique for valuing bonds. It involves calculating the yield that would make the present value of a bond’s cash flows equal to its current market price. The YTM takes into account the bond’s coupon payments, the face value, the time to maturity, and the market price.

The steps involved in the yield-to-maturity approach are as follows:

– Estimate the bond’s yield-to-maturity: Use trial and error or financial calculators to find the yield that equates the present value of the bond’s cash flows to its market price.

– Compare the estimated YTM with other investment opportunities: Assess the estimated YTM in relation to the prevailing interest rates and other investment options to determine if the bond is undervalued or overvalued.

Real-Life Example: Suppose a bond with a face value of $1,000, a coupon rate of 6% (annual payments), and 5 years remaining to maturity is currently trading in the market at $950. By using the yield-to-maturity approach, the yield that equates the present value of the bond’s cash flows to its market price can be calculated.

3. Bond Pricing Models:

Bond pricing models, such as the binomial model and the Black-Scholes model, are used for valuing more complex bonds, including bonds with embedded options (such as call or put options). These models take into account factors such as interest rate volatility, expected cash flows, and the probability of different future interest rate scenarios.

These models employ advanced mathematical calculations to determine the fair value of complex bonds based on various assumptions and inputs. They are particularly useful for valuing bonds with features that may impact their cash flows, such as convertible bonds or bonds with embedded call options.

Real-Life Example: Consider valuing a convertible bond that provides the bondholder with the option to convert the bond into a specified number of shares of the issuer’s stock. A bond pricing model can be used to calculate the bond’s value, considering factors such as the current stock price, conversion ratio, interest rates, and expected stock price movements.

Conclusion:

In this chapter, we explored several techniques for valuing bonds. The present value approach, yield-to-maturity approach, and bond pricing models provide investors with different methodologies to determine the fair value of bonds. By applying these techniques, investors can assess whether a bond is overvalued or undervalued in the market. Stay tuned for the upcoming chapters, where we will provide real-life examples of bond valuation and discuss their applications in different contexts.

Chapter 4: Real-Life Examples of Bond Valuation

Welcome to Chapter 4 of our comprehensive guide on bond valuation. In this chapter, we will explore real-life examples of bond valuation to illustrate how the principles and techniques discussed earlier apply in practice. We will examine the valuation of government bonds and corporate bonds, considering factors such as credit ratings, interest rate movements, and economic indicators. These examples will provide valuable insights into the bond valuation process in both global and Indian contexts.

1. Valuation of Government Bonds:

Government bonds are widely considered low-risk investments due to the backing of the government. Let’s consider an example of valuing a 10-year government bond with a face value of $1,000, a coupon rate of 3% (annual payments), and a current market interest rate of 2.5%.

Using the present value approach, we can calculate the present value of the bond’s cash flows (coupon payments and face value) by discounting them to their present values using the market interest rate. By summing up these present values, we can determine the fair value of the government bond.

Real-time economic indicators such as GDP growth, inflation rates, and central bank policies can influence the valuation of government bonds. For instance, if the economy is experiencing high inflation, bond investors may demand a higher yield to compensate for the erosion of purchasing power. This increased yield requirement would result in a decrease in the fair value of government bonds.

2. Valuation of Corporate Bonds:

Corporate bonds are issued by companies to raise capital. The valuation of corporate bonds involves assessing the creditworthiness of the issuing company and considering market conditions.

Let’s consider an example of valuing a corporate bond issued by Company XYZ. The bond has a face value of $1,000, a coupon rate of 5% (annual payments), and a remaining maturity of 5 years. The market interest rate for bonds with similar risk profiles is 6%.

Applying the present value approach, we discount the bond’s cash flows (coupon payments and face value) using the market interest rate. The sum of these present values provides the fair value of the corporate bond.

Factors such as the credit rating of the issuing company, industry conditions, and market sentiment can influence the valuation of corporate bonds. A higher credit rating indicates lower default risk, resulting in higher valuations. Conversely, if the market perceives increased default risk for the issuing company, the fair value of the corporate bond may decrease.

Real-life examples of corporate bond valuations can involve analyzing the financial health and performance of the issuing company, assessing its ability to generate cash flows to meet its debt obligations, and monitoring market factors that may impact the company’s creditworthiness.

Conclusion:

In this chapter, we explored real-life examples of bond valuation, focusing on government bonds and corporate bonds. By applying the principles and techniques discussed earlier, investors can determine the fair value of bonds in different contexts. Valuing government bonds involves considering economic indicators and market conditions, while valuing corporate bonds involves analyzing credit ratings, industry factors, and company-specific information. These examples highlight the practical application of bond valuation techniques in real-world investment scenarios.

Stay tuned for the upcoming chapters, where we will delve deeper into share valuation, provide real-life examples, and compare bond and share valuation techniques.

Chapter 5: Share Valuation: An Overview

Welcome to Chapter 5 of our comprehensive guide on valuation, where we shift our focus to share valuation. In this chapter, we will provide an overview of share valuation and explain why it is crucial for investors. We will explore the primary factors that influence share prices, including earnings, dividends, growth prospects, and market conditions. Throughout the chapter, we will provide real-life examples from the global and Indian stock markets to enhance your understanding.

Why is Share Valuation Important?

Share valuation is essential for investors as it helps determine the fair value of a company’s stock. By valuing shares, investors can make informed decisions about buying, selling, or holding stocks in their investment portfolios. Share valuation provides insights into whether a stock is undervalued (trading below its intrinsic value) or overvalued (trading above its intrinsic value). This knowledge allows investors to identify potential investment opportunities or avoid overpaying for a stock.

Factors Affecting Share Valuation:

Several factors influence the valuation of shares. Understanding these factors is crucial for investors to assess the potential risks and returns associated with investing in stocks. Here are the primary factors that impact share valuation:

1. Earnings and Profits: The earnings and profits generated by a company play a vital role in share valuation. Investors analyze a company’s financial statements, such as its income statement and cash flow statement, to assess its profitability and growth potential. Higher earnings and profits generally lead to higher valuations, as they indicate a company’s ability to generate returns for shareholders.

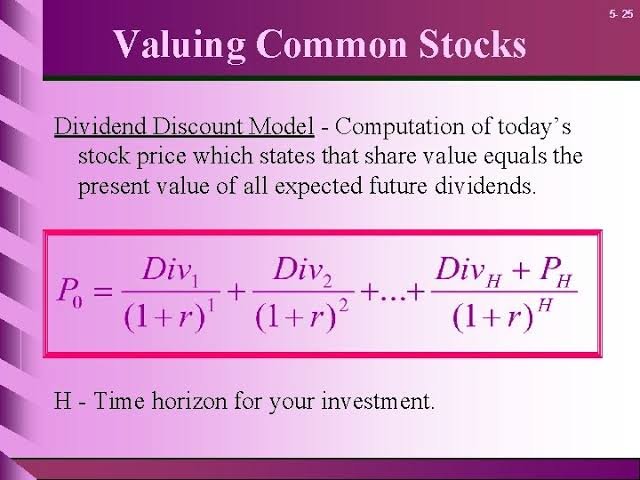

2. Dividends and Shareholder Returns: Dividends are cash payments made by a company to its shareholders as a portion of its earnings. The presence and stability of dividends can positively impact share valuation, as they provide a direct return to investors. Companies with a track record of consistent dividend payments may be valued higher by income-focused investors.

3. Growth Prospects: The growth prospects of a company influence its share valuation. Investors assess factors such as the company’s industry position, market share, competitive advantage, and potential for future expansion. Companies with strong growth prospects may command higher valuations, reflecting the potential for higher future earnings and returns.

4. Market Conditions and Investor Sentiment: Market conditions and investor sentiment can impact share valuations. Factors such as overall economic conditions, interest rates, geopolitical events, and market trends influence investor behavior and market sentiment. Positive market conditions and bullish sentiment can drive share prices higher, resulting in higher valuations. Conversely, negative market conditions and bearish sentiment may lead to lower share valuations.

Real-Life Examples:

Let’s consider a couple of real-life examples to illustrate the impact of factors on share valuation:

Example 1: Company ABC, a technology company, announces better-than-expected earnings and revenue growth for the quarter. As a result, investors become more optimistic about the company’s future prospects, driving up the demand for its shares. The increased demand pushes the share price higher, leading to a higher share valuation.

Example 2: Company XYZ, a manufacturing company, faces a significant product recall due to safety concerns. The negative news affects investor confidence, resulting in a sell-off of the company’s shares. The decreased demand for the shares leads to a decline in the share price and a lower share valuation.

Conclusion:

In this chapter, we provided an overview of share valuation and highlighted the factors that influence the valuation of shares. Earnings, dividends, growth prospects, and market conditions all play crucial roles in determining share valuations. By understanding these factors and their impact, investors can make informed decisions about investing in stocks. Stay tuned for the upcoming chapters, where we will delve into different approaches to valuing shares and provide real-life examples of share valuation in action.

Chapter 6: Approaches to Valuing Shares

Welcome to Chapter 6 of our comprehensive guide on valuation. In this chapter, we will explore two common approaches to valuing shares: the intrinsic value approach and the relative valuation approach. Understanding these approaches is essential for investors to assess the fair value of a company’s stock. We will discuss the underlying principles of each approach, their strengths, limitations, and provide real-life examples from both global and Indian markets.

1. Intrinsic Value Approach:

The intrinsic value approach to share valuation focuses on estimating the underlying value of a company based on its fundamentals. It involves analyzing the company’s financial statements, industry position, growth prospects, and other qualitative and quantitative factors to determine its intrinsic worth.

Key steps involved in the intrinsic value approach:

– Fundamental Analysis: Conduct a thorough analysis of the company’s financial statements, including its income statement, balance sheet, and cash flow statement. Assess the company’s revenue, earnings, profit margins, cash flows, and growth rates.

– Discounted Cash Flow (DCF) Analysis: Estimate the future cash flows the company is expected to generate and discount them back to their present value using an appropriate discount rate. The discount rate reflects the risk associated with the company’s cash flows.

– Terminal Value Calculation: Determine the terminal value, which represents the value of the company beyond the explicit forecast period. This is typically done using a terminal multiple or perpetuity growth rate.

– Sum of Parts Analysis: For companies with multiple business segments or divisions, a sum of parts analysis may be conducted to value each segment individually and then sum them up to arrive at the total intrinsic value of the company.

Strengths of the Intrinsic Value Approach:

– Focuses on the underlying value of the company based on its fundamentals.

– Incorporates the company’s future cash flows, growth prospects, and risk profile.

– Provides a long-term perspective on share valuation.

Limitations of the Intrinsic Value Approach:

– Requires making assumptions about future cash flows and growth rates, which may be subject to uncertainty.

– Sensitivity to the selection of discount rate and terminal value calculation.

– Relies on accurate financial information and forecasts.

2. Relative Valuation Approach:

The relative valuation approach compares the valuation of a company’s shares to similar companies in the same industry or market. It involves using various valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-book (P/B) ratios, to assess the relative attractiveness of the company’s stock.

Key steps involved in the relative valuation approach:

– Identify Comparable Companies: Select a group of companies in the same industry or market that are similar in terms of size, business model, growth prospects, and risk profile.

– Calculate Valuation Multiples: Calculate relevant valuation multiples (P/E, P/S, P/B) for the selected comparable companies by dividing their market price by a relevant financial metric (e.g., earnings, sales, book value).

– Apply Valuation Multiples: Apply the calculated valuation multiples to the corresponding financial metric of the company being valued. This provides an estimate of the fair value of the company’s shares based on the market’s perception of similar companies.

Strengths of the Relative Valuation Approach:

– Simpler and more straightforward than the intrinsic value approach.

– Relies on market prices and valuation multiples readily available for comparable companies.

– Provides a benchmark to assess the relative attractiveness of a company’s shares.

Limitations of the Relative Valuation Approach:

– Relies on the availability of comparable companies and accurate market prices.

– Ignores company-specific factors and future growth prospects.

– May be influenced by market sentiment and short-term fluctuations.

Real-Life Examples:

Let’s consider a real-life example to illustrate the two approaches:

Example: Company ABC, a software company, is being valued using both the intrinsic value and relative valuation approaches.

– Intrinsic Value Approach: Through fundamental analysis and DCF analysis, the estimated intrinsic value of Company ABC’s shares is $50 based on expected future cash flows and growth rates.

– Relative Valuation Approach: Comparable companies in the software industry have an average P/E ratio of 20. Applying this ratio to Company ABC’s earnings per share gives an estimated fair value of $30 per share.

In this example, the intrinsic value approach suggests a higher valuation for Company ABC, considering its future cash flows and growth prospects. However, the relative valuation approach indicates a lower valuation based on market perceptions and comparable company multiples.

Conclusion:

In this chapter, we explored two approaches to valuing shares: the intrinsic value approach and the relative valuation approach. Each approach has its strengths and limitations, and investors can choose the most suitable approach based on their investment philosophy and available information. By understanding these valuation approaches, investors can make informed decisions about buying, selling, or holding shares in their investment portfolios. Stay tuned for the upcoming chapters, where we will provide real-life examples of share valuation and delve deeper into each approach.

Chapter 7: Real-Life Examples of Share Valuation

Welcome to Chapter 7 of our comprehensive guide on valuation. In this chapter, we will explore real-life examples of share valuation to illustrate how the principles and approaches discussed earlier apply in practice. We will examine the valuation of shares in the context of blue-chip companies and startups, considering factors such as financial performance, growth prospects, market conditions, and investor sentiment. These examples will provide valuable insights into the share valuation process in both global and Indian markets.

1. Valuation of Blue-Chip Companies:

Blue-chip companies are large, well-established, and financially stable companies with a history of consistent performance. Let’s consider an example of valuing shares of a blue-chip company, Company XYZ.

– Intrinsic Value Approach: Through fundamental analysis and discounted cash flow (DCF) analysis, the estimated intrinsic value of Company XYZ’s shares is calculated to be $100 based on expected future cash flows, growth rates, and risk considerations.

– Relative Valuation Approach: Comparable blue-chip companies in the same industry trade at an average price-to-earnings (P/E) ratio of 15. Applying this ratio to Company XYZ’s earnings per share gives an estimated fair value of $80 per share.

By combining the results from both approaches, investors can assess whether Company XYZ’s shares are undervalued or overvalued in the market. If the estimated fair value is higher than the current market price, the shares may be considered undervalued and potentially attractive for investment.

2. Valuation of Startups and IPOs:

Startups and companies going public through initial public offerings (IPOs) present unique challenges in share valuation due to limited operating history and uncertainty surrounding their future prospects. Let’s consider an example of valuing shares of a technology startup, Startup ABC.

– Intrinsic Value Approach: Valuing shares of a startup using the intrinsic value approach requires making assumptions about future cash flows and growth rates. Investors typically focus on the startup’s business plan, target market, competitive advantage, and revenue projections. By estimating future cash flows and applying a suitable discount rate, the intrinsic value of Startup ABC’s shares can be calculated.

– Relative Valuation Approach: Since startups often lack comparable companies, the relative valuation approach becomes more challenging. However, investors may look at the valuations of similar startups in the industry or consider benchmarks such as revenue multiples or user metrics.

In valuing startups, it is essential to consider the risks associated with their early-stage nature, including market acceptance, competition, scalability, and execution capabilities. Investors often apply a higher discount rate to reflect the higher risk profile of startups.

Real-life examples of share valuations in the context of blue-chip companies and startups demonstrate the application of different approaches and the considerations involved in determining fair values. It is important for investors to conduct thorough research, consider multiple perspectives, and reassess valuations as new information becomes available.

Conclusion:

In this chapter, we explored real-life examples of share valuation, focusing on blue-chip companies and startups. By applying the principles and approaches discussed earlier, investors can assess the fair value of shares in different contexts. Valuing shares of blue-chip companies involves analyzing their financial performance, growth prospects, and market conditions. For startups, valuation becomes more challenging due to limited operating history and higher risk. By understanding the nuances of share valuation, investors can make informed investment decisions in the dynamic stock market environment.

Chapter 8: Comparing Bond and Share Valuation

Welcome to Chapter 8 of our comprehensive guide on valuation. In this chapter, we will compare and contrast the valuation of bonds and shares. Both bonds and shares are important investment assets, but they differ in terms of risk, return, and valuation methodologies. By understanding the differences between bond and share valuation, investors can make well-informed decisions about constructing their investment portfolios.

1. Risk and Return:

– Bonds: Bonds are generally considered lower-risk investments compared to shares. When you invest in a bond, you are essentially lending money to the bond issuer (such as a government or corporation) in exchange for periodic coupon payments and the return of the principal amount at maturity. Bonds provide a fixed income stream and have predetermined cash flows, making them relatively more stable. However, bond investments may still be exposed to credit risk, interest rate risk, and market fluctuations.

– Shares: Shares represent ownership in a company, entitling the shareholder to a portion of the company’s profits and assets. Shares offer the potential for capital appreciation and dividend income. However, share prices are subject to greater volatility and uncertainty compared to bonds. The returns from shares are influenced by various factors such as company performance, industry trends, market conditions, and investor sentiment.

2. Valuation Methodologies:

– Bonds: Bond valuation primarily relies on discounting future cash flows using the present value approach or yield-to-maturity approach. Bonds have fixed coupon payments and a known face value at maturity, making their valuation more straightforward. Factors such as interest rates, credit ratings, and market conditions play key roles in bond valuation.

– Shares: Share valuation is often more subjective and relies on estimating the intrinsic value or comparing the stock’s valuation to similar companies in the market. Intrinsic value approaches involve analyzing the company’s financials, growth prospects, and future cash flows. Relative valuation approaches use multiples such as price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) ratios to compare the stock’s valuation to its peers.

3. Investment Considerations:

– Bonds: Bonds are commonly used for income generation, capital preservation, and diversification in investment portfolios. Investors seeking stable income streams, lower volatility, and lower risk may allocate a portion of their portfolio to bonds. Bond investments can help balance the overall risk and return profile of an investment portfolio.

– Shares: Shares are typically considered for long-term capital appreciation and wealth creation. Investors with a higher risk appetite, seeking higher returns, and willing to withstand market volatility may invest in shares. Shares also provide the opportunity to participate in the growth of successful companies and benefit from dividend payments.

It is important to note that the optimal allocation between bonds and shares in an investment portfolio depends on an individual’s risk tolerance, investment goals, time horizon, and market conditions. Diversification across different asset classes, including bonds and shares, is often recommended to manage risk and capture opportunities.

Conclusion:

In this chapter, we compared and contrasted the valuation of bonds and shares. Bonds are generally considered lower-risk investments with fixed income streams, while shares offer the potential for higher returns but come with greater volatility. The valuation methodologies for bonds and shares differ, with bonds relying on present value or yield-to-maturity approaches, and shares utilizing intrinsic value or relative valuation approaches. By understanding the characteristics and valuation techniques of bonds and shares, investors can build well-diversified portfolios that align with their investment objectives and risk tolerance.

Chapter 9: Practical Applications of Bond and Share Valuation

Welcome to Chapter 9 of our comprehensive guide on valuation. In this chapter, we will explore practical applications of bond and share valuation in real-world investment scenarios. We will provide case studies, numerical illustrations, and discuss how valuation techniques can be used to make informed investment decisions. By understanding these practical applications, investors can apply valuation concepts effectively and enhance their investment decision-making process.

1. Case Study: Bond Valuation in a Changing Interest Rate Environment:

Consider a scenario where interest rates are expected to rise due to improving economic conditions. This can have a significant impact on bond valuations. Let’s examine a 10-year corporate bond issued by Company XYZ with a face value of $1,000, a coupon rate of 4% (annual payments), and a current market interest rate of 3%.

– Present Value Approach: Using the present value approach, we can calculate the present value of the bond’s cash flows (coupon payments and face value) by discounting them at the market interest rate. If interest rates increase to 4%, the bond’s present value may decrease, resulting in a lower valuation.

– Sensitivity Analysis: Conducting a sensitivity analysis can help assess the impact of different interest rate scenarios on bond valuations. By recalculating the present value of the bond’s cash flows using varying interest rates, investors can gain insights into the bond’s sensitivity to changes in interest rates and make appropriate investment decisions.

2. Numerical Illustration: Share Valuation Using Intrinsic Value Approach:

Let’s consider a numerical illustration of valuing shares using the intrinsic value approach. Company ABC is a technology company with expected earnings per share (EPS) of $5 and a required rate of return of 10%. By applying a price-to-earnings (P/E) ratio of 15, we can estimate the intrinsic value of Company ABC’s shares.

– Intrinsic Value Calculation: Intrinsic Value = EPS x P/E Ratio = $5 x 15 = $75 per share.

If the current market price of Company ABC’s shares is below $75, it may indicate that the shares are undervalued and potentially attractive for investment. On the other hand, if the market price exceeds $75, it may suggest that the shares are overvalued.

3. Investment Decision-Making: Balancing Risk and Return:

Valuation techniques for bonds and shares play a crucial role in investment decision-making. Investors often seek a balance between risk and return when constructing their portfolios. By considering the valuation of both bonds and shares, investors can allocate their capital to different asset classes based on their risk tolerance, investment goals, and market conditions.

For example, investors may allocate a portion of their portfolio to bonds to preserve capital, generate income, and mitigate overall portfolio risk. At the same time, they may allocate another portion to shares to pursue capital appreciation and participate in the growth potential of successful companies.

Conclusion:

In this chapter, we explored practical applications of bond and share valuation. Through case studies and numerical illustrations, we demonstrated how valuation techniques can be applied to real-world investment scenarios. Whether it’s assessing the impact of changing interest rates on bond valuations or using the intrinsic value approach to value shares, investors can leverage valuation concepts to make informed investment decisions. By considering the specific characteristics of bonds and shares and applying appropriate valuation techniques, investors can enhance their understanding and effectiveness in the investment process.

Chapter 10: Key Takeaways and Closing Thoughts

Welcome to the final chapter of our comprehensive guide on valuation. In this chapter, we will summarize the key takeaways from our discussions on bond and share valuation and offer closing thoughts on the importance of valuation in investment decision-making. We hope that this guide has provided you with valuable insights into the principles, techniques, and practical applications of valuation in the context of bonds and shares.

Key Takeaways:

1. Bonds: Bonds are fixed-income securities that provide a predetermined stream of cash flows. Factors such as interest rates, credit ratings, and market conditions impact bond valuation. Valuation techniques such as the present value approach and yield-to-maturity approach help determine the fair value of bonds.

2. Shares: Shares represent ownership in a company and offer the potential for capital appreciation and dividend income. Share valuation involves assessing earnings, growth prospects, and market conditions. Valuation methodologies such as the intrinsic value approach and relative valuation approach aid in determining the fair value of shares.

3. Risk and Return: Bonds are generally lower-risk investments with stable income streams, while shares offer higher returns but come with greater volatility. Investors should consider their risk tolerance, investment goals, and time horizon when allocating between bonds and shares in their portfolios.

4. Practical Applications: Valuation techniques have practical applications in investment decision-making. Through case studies, numerical illustrations, and sensitivity analyses, investors can assess the impact of various factors on bond and share valuations, make informed investment decisions, and balance risk and return.

Closing Thoughts:

Valuation is a fundamental aspect of investment decision-making. Whether you are considering bonds or shares, understanding the principles and techniques of valuation helps you assess the attractiveness of investment opportunities, determine fair values, and make informed decisions. It allows you to align your investment choices with your risk tolerance, investment goals, and market conditions.

Remember that valuation is not an exact science and involves making assumptions and forecasts based on available information. It requires ongoing analysis, monitoring, and reassessment as market conditions and company fundamentals evolve. Regularly reviewing and updating your valuations is crucial to maintaining an accurate understanding of the fair values of your investments.

We hope this guide has provided you with valuable insights into the world of bond and share valuation. By applying the knowledge gained from this guide and continuously learning about the ever-changing investment landscape, you can navigate the markets with greater confidence and make sound investment decisions.

Additional Resources:

To further enhance your understanding of valuation, we recommend exploring the following resources:

– Books: “Security Analysis” by Benjamin Graham and David Dodd, “Valuation: Measuring and Managing the Value of Companies” by McKinsey & Company, and “Investment Valuation: Tools and Techniques for Determining the Value of Any Asset” by Aswath Damodaran.

– Online Courses: Websites like Coursera, Udemy, and Khan Academy offer various courses on finance and valuation that can deepen your knowledge in this field.

– Financial News and Research Platforms: Stay updated with financial news and research platforms that provide insights into valuation techniques, market trends, and company-specific analysis.

Thank you for joining us on this journey through bond and share valuation. We hope this guide has been informative and valuable to you as an investor. Remember to continue exploring and expanding your knowledge to enhance your investment decision-making skills. Happy investing!

Leave a comment