Table of Contents:

1 Introduction

2 The Concept of Value

3 Types of Returns

4 Factors Influencing Value and Returns

5 Real-Life Examples and Case Studies

5.1. World Context

5.2. Indian Context

6 Numerical Applications and Analysis

7 Critical Analysis of Value and Returns

8 Conclusion

Chapter 1: Introduction

In this introductory chapter, we will provide an overview of the concepts of value and returns and highlight their significance in various contexts. Understanding the principles behind value and returns is essential for making informed decisions, whether it’s in personal finance, business investments, or societal impact. We will explain the relevance of these concepts in both the global and Indian scenarios, demonstrating their universal applicability.

Value refers to the worth, usefulness, or desirability of something. It can be subjective, as different individuals or entities may perceive value differently based on their needs, preferences, and circumstances. Value can manifest in various forms, such as financial value, social value, environmental value, or a combination of these factors.

Returns, on the other hand, encompass the benefits or gains obtained from an investment, decision, or action. Returns can be financial, where they involve monetary gains or losses, or they can be non-financial, such as social or environmental benefits. Evaluating returns allows us to assess the effectiveness and efficiency of an investment or decision-making process.

Understanding value and returns is crucial because they play a pivotal role in shaping our choices and actions. For individuals, it impacts personal finance decisions like investments, savings, and spending habits. In the business world, value and returns determine the profitability, sustainability, and success of organizations. In a broader societal context, value and returns influence policy-making, resource allocation, and social impact initiatives.

Chapter 2: The Concept of Value

In this chapter, we will delve into the concept of value, exploring its definition, components, and methodologies for determining value. Understanding value is crucial because it forms the basis for decision-making processes and influences our perceptions of worth and desirability. By examining value from different perspectives, we can gain insights into its multifaceted nature and its implications in various domains.

1. Definition of Value:

– We will begin by defining value in a broad sense, encompassing its subjective and objective aspects. We will explore how value is created and perceived, taking into account individual, societal, and economic perspectives.

2. Components of Value:

– Value comprises various components that contribute to its overall assessment. We will examine these components, such as economic value, social value, environmental value, and cultural value.

– By understanding these components, readers will gain a comprehensive understanding of value and its multidimensional nature.

3. Methodologies for Determining Value:

– Assessing and quantifying value can be challenging due to its subjectivity and diversity. We will explore different methodologies used to determine value, such as market-based approaches, cost-based approaches, and intrinsic value assessment.

4. Value in Different Contexts:

– Value can vary depending on the context and stakeholders involved. We will examine how value is perceived and evaluated in different sectors, such as finance, technology, healthcare, and sustainability.

Chapter 3: Types of Returns

In this chapter, we will explore the different types of returns that are relevant in various domains, such as finance, social impact, and environmental sustainability. Understanding the types of returns allows us to evaluate the benefits and outcomes associated with investments, actions, and decisions. By examining these types of returns, we can gain insights into their measurement, evaluation, and impact on stakeholders.

1. Financial Returns:

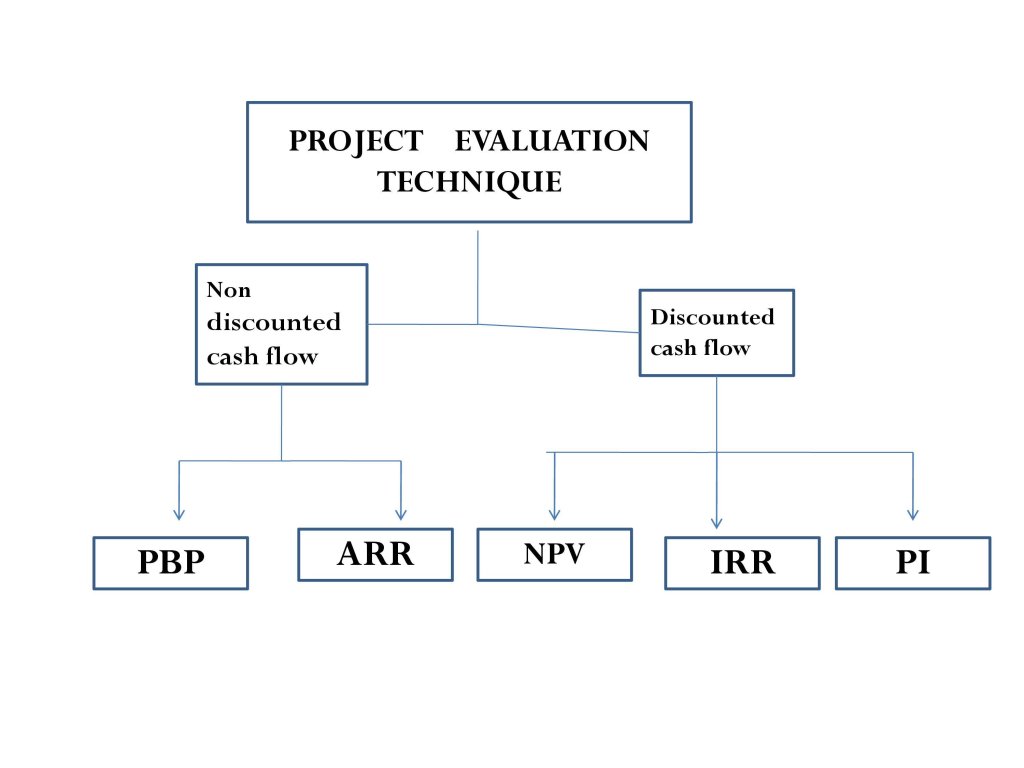

– Financial returns refer to the gains or losses in monetary terms resulting from an investment or financial decision. We will explore various financial return metrics, such as return on investment (ROI), net present value (NPV), internal rate of return (IRR), and cash flow analysis.

2. Social Returns:

– Social returns capture the non-financial benefits and impacts generated by an investment or action. We will explore how social returns are measured and evaluated, considering factors such as social value, community impact, and stakeholder engagement.

3. Environmental Returns:

– Environmental returns focus on the positive outcomes and benefits related to ecological sustainability and environmental conservation. We will discuss how environmental returns are assessed, considering factors such as carbon footprint reduction, resource efficiency, and biodiversity preservation.

4. Integrated Returns:

– Integrated returns take into account the financial, social, and environmental aspects collectively. We will explore frameworks and approaches that enable the evaluation and optimization of integrated returns, such as impact investing, triple bottom line, and sustainability reporting.

Chapter 4: Factors Influencing Value and Returns

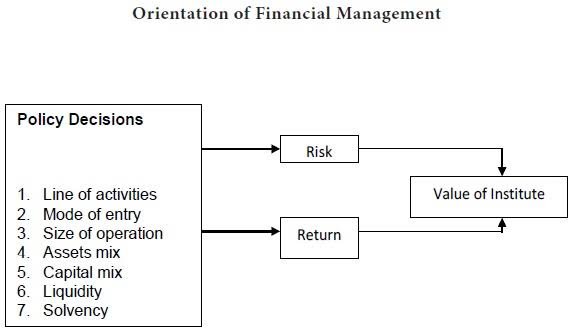

In this chapter, we will explore the various factors that influence value and returns across different domains and contexts. Understanding these factors is essential for making informed decisions, maximizing returns, and creating sustainable value. By examining the economic, social, and environmental aspects that shape value and returns, readers will gain insights into the complexities and considerations involved in evaluating investments and decision-making processes.

1. Economic Factors:

– Economic factors play a significant role in determining value and returns. We will explore factors such as market conditions, supply and demand dynamics, inflation, interest rates, and macroeconomic indicators.

2. Social Factors:

– Social factors encompass societal trends, cultural influences, consumer behavior, and stakeholder expectations. We will examine how these factors shape value and returns, taking into account aspects like customer preferences, social values, ethical considerations, and reputation management.

3. Environmental Factors:

– Environmental factors include considerations related to sustainability, climate change, resource scarcity, and environmental regulations. We will explore how environmental factors impact value and returns, considering aspects like environmental risks, green initiatives, and sustainable practices.

4. Governance and Risk Factors:

– Governance and risk factors encompass the organizational structure, risk management practices, and compliance frameworks. We will examine how effective governance and risk management influence value and returns, considering factors like transparency, accountability, and regulatory compliance.

Chapter 5: Real-Life Examples and Case Studies

5.1. World Context:

In this section, we will present real-life examples and case studies from different parts of the world, highlighting successful value creation and returns across various sectors. These examples will showcase the practical application of value and returns in diverse industries, providing readers with a global perspective. Some examples may include:

1. Apple Inc.: We will explore how Apple created significant value through its innovative products and strong brand presence, leading to remarkable financial returns and customer loyalty.

2. Tesla: This case study will demonstrate how Tesla revolutionized the automotive industry by prioritizing sustainability and environmental returns while achieving impressive financial growth.

3. Grameen Bank: We will examine how Grameen Bank, founded by Muhammad Yunus, has generated substantial social returns by providing microfinance services to empower underprivileged communities, particularly in rural areas.

4. Patagonia: This example will showcase how Patagonia, an outdoor apparel company, has integrated environmental sustainability into its business model, resulting in both financial success and environmental returns.

5.2. Indian Context:

In this section, we will focus on real-life examples and case studies specifically from the Indian context. These examples will demonstrate how value and returns have been generated in various sectors, showcasing the unique challenges and opportunities in the Indian market. Some examples may include:

1. Flipkart: We will explore how Flipkart, India’s leading e-commerce platform, has created significant value through technological innovation, customer-centric strategies, and financial returns.

2. Solar Energy in India: This case study will examine the growth of solar energy in India, highlighting the environmental and financial returns associated with renewable energy investments and government initiatives.

3. Amul: We will discuss the success story of Amul, India’s largest dairy cooperative, and how it has generated social returns by empowering farmers and creating sustainable livelihoods.

4. Swiggy: This example will showcase how Swiggy, a food delivery platform, has leveraged technology and logistics to create value for both consumers and restaurants, resulting in financial returns and employment opportunities.

Chapter 6: Numerical Applications and Analysis

In this chapter, we will provide practical numerical applications and conduct analysis related to value and returns. By applying quantitative methods, we can gain a deeper understanding of how value is calculated, returns are measured, and investment decisions are evaluated. Through numerical examples and analysis, readers will be able to grasp the practical implications of value and returns in different scenarios.

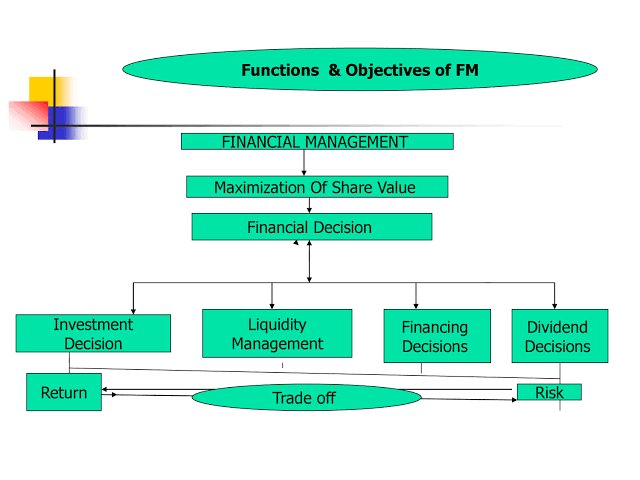

1. Financial Analysis:

– We will demonstrate how financial ratios, such as return on investment (ROI), profitability ratios, and financial leverage, can be used to assess the financial performance and value creation of companies.

– Numerical examples and calculations will be provided to illustrate how these ratios are calculated and interpreted.

2. Investment Valuation:

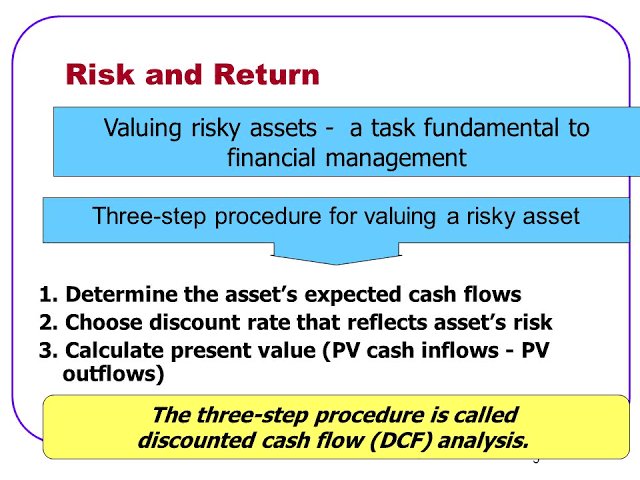

– This section will focus on investment valuation methods, such as discounted cash flow (DCF) analysis, net present value (NPV), and internal rate of return (IRR). We will explain how these methods can be used to evaluate the potential returns and value of investment opportunities.

– Numerical examples and calculations will be presented to demonstrate the application of these valuation techniques.

3. Social Impact Metrics:

– We will explore metrics and methodologies used to quantify social impact and measure social returns. Examples may include social return on investment (SROI), social impact scorecards, and stakeholder mapping.

– Numerical examples and analysis will be provided to showcase how these metrics can be applied to assess the social value and returns of projects or initiatives.

4. Environmental Performance Indicators:

– This section will focus on numerical indicators used to measure and evaluate environmental performance and returns. Examples may include carbon footprint calculations, energy efficiency metrics, and waste reduction measurements.

– Numerical examples and analysis will demonstrate how these indicators can be applied to assess the environmental impact and returns of organizations or projects.

Let’s explore a numerical example related to investment valuation using discounted cash flow (DCF) analysis.

Suppose you are considering investing in a solar energy project. The project requires an initial investment of $1,000,000 to set up the solar panels and related infrastructure. You anticipate that the project will generate cash flows of $200,000 per year for the next five years. After five years, you plan to sell the project for $500,000.

To evaluate the investment using DCF analysis, we need to discount the future cash flows to their present value using an appropriate discount rate. Let’s assume a discount rate of 8% for this example.

Now, let’s calculate the present value of the cash flows using the formula:

PV = CF1 / (1+r)^1 + CF2 / (1+r)^2 + … + CFn / (1+r)^n

PV = $200,000 / (1+0.08)^1 + $200,000 / (1+0.08)^2 + $200,000 / (1+0.08)^3 + $200,000 / (1+0.08)^4 + ($200,000 + $500,000) / (1+0.08)^5

Simplifying the equation, we have:

PV = $200,000 / 1.08 + $200,000 / 1.1664 + $200,000 / 1.2597 + $200,000 / 1.3605 + $700,000 / 1.4693

PV = $185,185 + $171,498 + $158,730 + $146,739 + $476,997

PV = $1,139,149

The present value of the cash flows amounts to $1,139,149.

To determine the net present value (NPV), we subtract the initial investment:

NPV = PV – Initial Investment

NPV = $1,139,149 – $1,000,000

NPV = $139,149

The calculated NPV is positive ($139,149), indicating that the project is expected to generate a positive return on investment. A positive NPV suggests that the present value of the future cash flows exceeds the initial investment, making the project financially viable.

This numerical example demonstrates how DCF analysis can be used to evaluate investment opportunities by considering the timing and magnitude of cash flows and discounting them to their present value. By comparing the NPV to the initial investment, investors can make informed decisions based on the expected returns of the project.

Note: The numbers used in this example are for illustration purposes, and actual investment decisions should consider a thorough analysis of relevant factors and specific market conditions.

Chapter 7: Critical Analysis of Value and Returns

In this chapter, we will critically analyze the concept of value and returns, exploring different perspectives, potential limitations, and controversies associated with their measurement and interpretation. By critically examining these concepts, readers will gain a more nuanced understanding of their complexities and implications.

1. Subjectivity of Value:

– We will explore the subjective nature of value, acknowledging that it can vary among individuals, societies, and cultures. We will discuss how personal biases, preferences, and contextual factors influence the perception and assessment of value.

– By recognizing the subjectivity of value, readers can approach its evaluation with a more open and inclusive mindset.

2. Limitations of Financial Metrics:

– While financial metrics provide quantifiable measures of returns, we will discuss their limitations and potential shortcomings. We will examine how financial metrics may not capture the full range of value and returns, especially regarding social and environmental aspects.

– By understanding the limitations of financial metrics, readers can recognize the need for integrated approaches that consider multiple dimensions of value.

3. Externalities and Unpriced Value:

– Externalities refer to the positive or negative impacts generated by an activity that are not reflected in market prices. We will explore how externalities can lead to unpriced value, where certain aspects of value and returns are not adequately accounted for in traditional economic models.

– By examining externalities and unpriced value, readers can understand the broader implications and potential consequences of value creation and decision-making.

4. Trade-offs and Decision-making:

– We will discuss the inherent trade-offs involved in decision-making related to value and returns. Balancing financial returns with social and environmental considerations can present challenges, as priorities and objectives may differ among stakeholders.

– By addressing trade-offs and decision-making, readers can develop a more comprehensive and balanced approach to evaluating value and returns.

5. Ethical and Moral Considerations:

– Value and returns are not solely driven by economic factors. We will explore the ethical and moral dimensions of value creation, considering aspects such as social justice, fairness, and long-term sustainability.

– By acknowledging ethical and moral considerations, readers can reflect on the broader impacts and responsibilities associated with value creation and decision-making.

Chapter 7: Critical Analysis of Value and Returns

In this chapter, we will critically analyze the concept of value and returns, exploring different perspectives, potential limitations, and controversies associated with their measurement and interpretation. By critically examining these concepts, readers will gain a more nuanced understanding of their complexities and implications.

1. Subjectivity of Value:

– Value is inherently subjective and can vary among individuals, societies, and cultures. We will discuss how personal biases, preferences, and contextual factors influence the perception and assessment of value.

– By recognizing the subjectivity of value, readers can appreciate the diverse perspectives and interpretations that shape its understanding.

2. Limitations of Financial Metrics:

– While financial metrics provide quantifiable measures of returns, we will discuss their limitations and potential shortcomings. Financial metrics may not fully capture the multidimensional nature of value and returns, especially in relation to social and environmental impacts.

– By understanding the limitations of financial metrics, readers can acknowledge the need for complementary approaches that incorporate non-financial dimensions of value.

3. Externalities and Unpriced Value:

– Externalities refer to the positive or negative impacts generated by an activity that are not reflected in market prices. We will explore how externalities can lead to unpriced value, where certain aspects of value and returns are not adequately accounted for in traditional economic models.

– By examining externalities and unpriced value, readers can recognize the importance of considering broader societal and environmental impacts in the evaluation of value and returns.

4. Trade-offs and Decision-making:

– Value creation and decision-making often involve trade-offs between different dimensions of value. We will discuss the challenges of balancing financial returns with social, environmental, and ethical considerations, as different stakeholders may have divergent priorities.

– By addressing trade-offs and decision-making, readers can develop a more holistic and inclusive approach to evaluating value and returns.

5. Ethical and Moral Considerations:

– Value and returns are not solely driven by economic factors. We will explore the ethical and moral dimensions of value creation, considering aspects such as social justice, fairness, and long-term sustainability.

– By acknowledging ethical and moral considerations, readers can reflect on the broader impacts and responsibilities associated with value creation and decision-making.

Chapter 8: Conclusion

In this concluding chapter, we will summarize the key findings and insights from the previous chapters on value and returns. We will emphasize the importance of understanding value and returns in both global and Indian contexts and highlight their implications for decision-making, sustainability, and long-term growth. By reviewing the main points covered throughout the blog post, readers will gain a comprehensive understanding of the concepts discussed.

1. Recap of Value:

– We will summarize the concept of value, emphasizing its subjective nature and the various components that contribute to its assessment. Readers will be reminded of the multidimensional aspects of value, encompassing economic, social, and environmental considerations.

2. Types of Returns:

– We will recap the different types of returns discussed, including financial returns, social returns, environmental returns, and integrated returns. Readers will be reminded of the significance of evaluating returns beyond financial gains, taking into account the broader impacts and outcomes.

3. Factors Influencing Value and Returns:

– A recap of the factors influencing value and returns will be provided, highlighting the economic, social, environmental, and governance aspects that shape value creation and decision-making. Readers will be reminded of the complexities and considerations involved in assessing value and returns.

4. Real-Life Examples and Case Studies:

– We will reflect on the real-life examples and case studies presented throughout the blog post, showcasing successful value creation and returns across various industries and contexts. Readers will be reminded of the practical applications and outcomes of value and returns in the real world.

5. Critical Analysis:

– A summary of the critical analysis conducted in Chapter 7 will be presented, addressing the subjectivity of value, limitations of financial metrics, externalities, trade-offs, and ethical considerations. Readers will be reminded of the need for a holistic and inclusive approach to evaluating value and returns.

In conclusion, understanding value and returns is crucial for making informed decisions, maximizing outcomes, and contributing to sustainable growth. By considering the multidimensional aspects of value, evaluating various types of returns, and taking into account the influencing factors, readers will be equipped with the knowledge and insights to navigate the complexities of value creation and decision-making.

Leave a comment