Index:

Chapter 1: Introduction

– Definition and significance of time preference for money

– Overview of the chapters

Chapter 2: Exploring Time Preference for Money

– Definition and explanation of time preference for money

– Factors influencing time preference

– Examples of time preference in real-life and business scenarios

Chapter 3: Time Value of Money

– Understanding the time value of money

– Application of time value of money in investment decisions

– Numerical examples illustrating time value of money

Chapter 4: Evaluating Investment Options

– Techniques for evaluating investment options

– Real-life case studies analyzing investment choices

– Critical analysis of investment decisions

Chapter 5: Managing Cash Flows

– Importance of managing cash flows efficiently

– Strategies for effective cash flow management

– Real-world examples of cash flow management

Chapter 6: Conclusion and Key Takeaways

– Recap of the key concepts covered

– Final thoughts on time preference for money

Thank you for reading our blog post. We hope this index helps you navigate through the different chapters and revisit specific topics of interest. If you have any further questions or would like to explore a particular aspect in more detail, please feel free to reach out. Happy learning!

Chapter 1: Introduction

Index:

– Definition and significance of time preference for money

– Overview of the chapters

Welcome to the first chapter of our comprehensive guide on understanding time preference for money in financial management. In this chapter, we will introduce you to the concept of time preference for money and highlight its significance in various contexts. Let’s dive in!

Definition and Significance of Time Preference for Money:

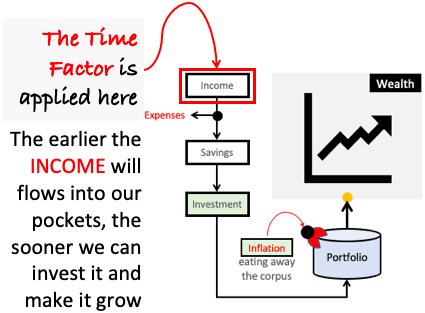

Time preference for money refers to the notion that people generally prefer to receive a certain amount of money sooner rather than later. It is based on the principle that a dollar received today is worth more than the same dollar received in the future. This concept stems from the understanding that money has the potential to earn returns or can be utilized for various purposes when received earlier.

Understanding time preference for money is crucial because it plays a fundamental role in financial decision-making. Whether it’s an individual managing personal finances or a business evaluating investment opportunities, considering the time value of money helps in making informed choices.

Chapter 2: Exploring Time Preference for Money

Index:

– Definition and explanation of time preference for money

– Factors influencing time preference

– Examples of time preference in real-life and business scenarios

In this chapter, we will delve deeper into the concept of time preference for money. By understanding the factors that influence time preference and exploring real-life examples and case studies, we can gain a better understanding of its practical applications. Let’s begin!

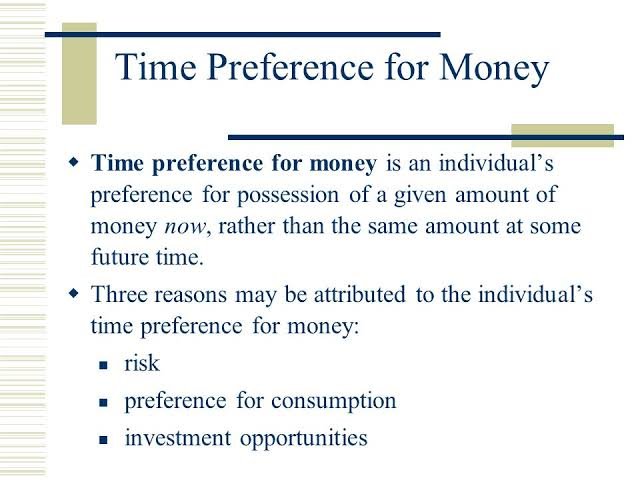

Definition and Explanation of Time Preference for Money:

Time preference for money, as mentioned earlier, refers to the tendency of individuals or organizations to value money received in the present more than money received in the future. This concept is rooted in the idea that having money sooner allows for greater opportunities, such as investment, consumption, or mitigating financial risks.

Factors Influencing Time Preference:

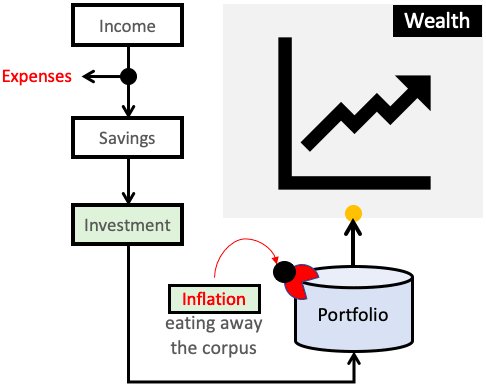

Several factors influence an individual’s or organization’s time preference for money. These factors include:

1. Time Horizon: The length of time over which an individual or organization plans to utilize the funds can affect their time preference. Short-term needs may lead to a higher preference for immediate money, while longer-term goals might justify delaying gratification.

2. Opportunity Cost: The potential returns or benefits foregone by waiting for money in the future impact time preference. If there are significant investment opportunities with high returns, individuals or organizations may have a lower time preference and be willing to wait for the funds.

3. Inflation: The erosion of purchasing power over time due to inflation influences time preference. When the inflation rate is high, individuals or organizations may prefer immediate money to mitigate the loss of value.

4. Risk and Uncertainty: The level of risk and uncertainty associated with future cash flows can affect time preference. Higher risks may lead to a higher preference for immediate money to avoid potential losses.

Examples of Time Preference in Real-Life and Business Scenarios:

To illustrate the practical application of time preference for money, let’s explore some examples:

1. Individual Investment Decisions: Consider an individual who has a choice between receiving $1,000 today or $1,200 a year from now. If the individual has investment opportunities that can generate an annual return of 10%, they may choose to wait for the $1,200 in the future to take advantage of the potential growth.

2. Business Cash Flow Management: Businesses often encounter situations where they need to prioritize between immediate cash inflows and delayed payments. For instance, if a business receives a sizable order with a choice of receiving payment in full after three months or receiving a partial payment upfront, they may evaluate the time preference based on their cash flow needs, the cost of financing, and the potential benefits of immediate cash.

3. Loan Interest Rates: Borrowers and lenders also consider time preference when setting loan interest rates. Lenders charge interest to compensate for the time value of money and the associated risks. Borrowers, on the other hand, evaluate whether the benefits of accessing the funds now outweigh the cost of interest payments in the future.

Chapter 3: Time Value of Money

Index:

– Understanding the time value of money

– Application of time value of money in investment decisions

– Numerical examples illustrating time value of money

In this chapter, we will explore the time value of money, a fundamental concept in finance. By understanding how the value of money changes over time and its implications, we can make informed investment decisions. Let’s delve into it!

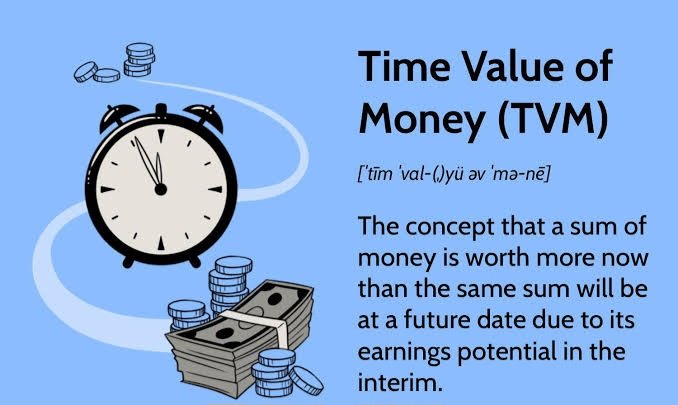

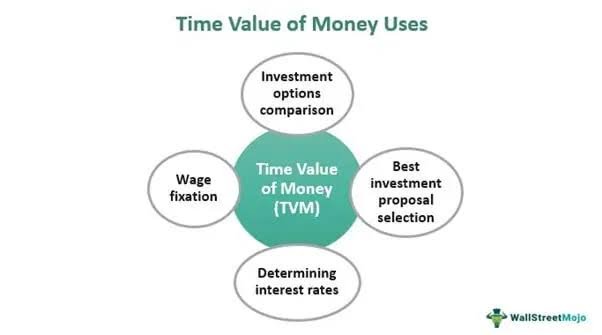

Understanding the Time Value of Money:

The time value of money is based on the idea that the value of money today is worth more than the same amount of money in the future. This is because money has the potential to earn returns or be invested in various opportunities. Additionally, factors like inflation and the associated decrease in purchasing power further emphasize the importance of considering the time value of money.

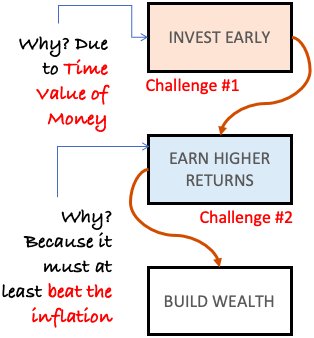

Application of Time Value of Money in Investment Decisions:

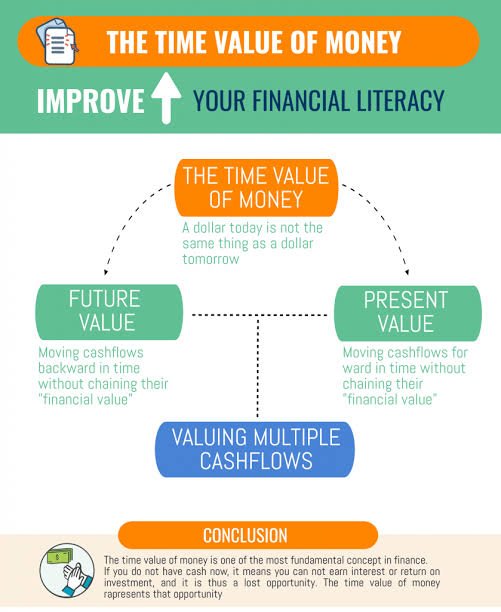

The time value of money is particularly crucial in evaluating investment opportunities. By considering the present value (PV) and future value (FV) of cash flows, investors can assess the potential returns and make informed decisions. Some key concepts related to the application of the time value of money include:

1. Present Value (PV): PV represents the value of future cash flows in today’s terms. By discounting future cash flows using an appropriate discount rate, investors can determine the present value. The discount rate considers factors like the risk associated with the investment and the opportunity cost of capital.

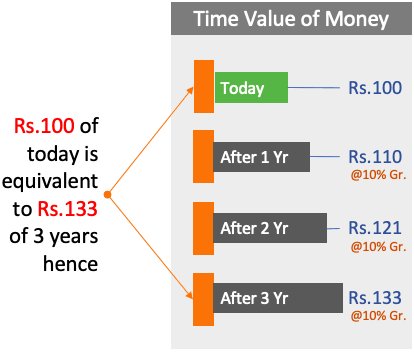

2. Future Value (FV): FV represents the value of an investment or cash flow at a future point in time. By compounding the initial investment or cash flow at a specified interest rate, investors can calculate the future value.

3. Net Present Value (NPV): NPV is the difference between the present value of cash inflows and outflows associated with an investment. A positive NPV indicates that the investment is expected to generate a return higher than the discount rate and is considered favorable.

Numerical Examples Illustrating Time Value of Money:

To better understand the time value of money, let’s consider a few numerical examples:

1. Suppose you have the option to receive $10,000 in five years. If the discount rate is 8%, what is the present value of this amount? By discounting the future amount, we find that the present value is approximately $6,785.

2. Consider an investment that requires an initial outlay of $5,000 and is expected to generate cash inflows of $1,500 per year for the next five years. If the discount rate is 10%, what is the net present value of this investment? By calculating the present value of each cash inflow and subtracting the initial outlay, we find that the NPV is approximately $1,338.

These examples demonstrate how the time value of money affects investment decisions and highlights the importance of considering the present and future values of cash flows.

By applying the concept of the time value of money, investors can make more informed choices and assess the profitability of various investment opportunities.

Chapter 4: Evaluating Investment Options

Index:

– Techniques for evaluating investment options

– Real-life case studies analyzing investment choices

– Critical analysis of investment decisions

In this chapter, we will explore various techniques for evaluating investment options. By understanding these evaluation methods and analyzing real-life case studies, we can make more informed investment decisions. Let’s dive in!

Techniques for Evaluating Investment Options:

When considering investment opportunities, several techniques can help assess their viability and potential returns. Here are three commonly used techniques:

1. Net Present Value (NPV): NPV measures the difference between the present value of cash inflows and outflows associated with an investment. A positive NPV indicates that the investment is expected to generate a return higher than the discount rate and is considered favorable. Investors typically choose investments with a positive NPV.

2. Internal Rate of Return (IRR): IRR represents the discount rate that makes the NPV of an investment equal to zero. It is the rate of return at which the present value of cash inflows equals the present value of cash outflows. Investors compare the IRR to the required rate of return to assess the attractiveness of an investment. Higher IRR values are generally preferred.

3. Payback Period: The payback period measures the time it takes for an investment to recover its initial cost. It helps assess the risk associated with an investment by considering the time it takes to recoup the investment. Shorter payback periods are generally desirable, as they indicate a faster return of capital.

Real-Life Case Studies Analyzing Investment Choices:

To illustrate the application of these evaluation techniques, let’s examine a couple of real-life case studies:

1. Case Study: Company A is considering investing in a new manufacturing facility. The project requires an initial investment of $1 million and is expected to generate cash flows of $300,000 per year for the next five years. By calculating the NPV, IRR, and payback period, Company A can evaluate the feasibility of the investment and compare it to alternative options.

2. Case Study: An individual is evaluating two investment opportunities. Investment Option X requires an initial investment of $10,000 and is expected to generate annual cash flows of $3,000 for five years. Investment Option Y requires an initial investment of $15,000 and is expected to generate annual cash flows of $4,000 for five years. By comparing the NPV, IRR, and payback period of both options, the individual can determine which investment offers better returns and aligns with their financial goals.

Critical Analysis of Investment Decisions:

While evaluating investment options, it’s crucial to conduct a critical analysis that considers various factors, including:

– Risk: Assessing the risks associated with an investment, such as market volatility, industry trends, and regulatory changes, is essential. Higher-risk investments may require a higher rate of return to justify the associated risks.

– Cash Flow Consistency: Evaluating the consistency and predictability of cash flows is vital. Investments with stable and reliable cash flows may be more desirable than those with fluctuating or uncertain cash flows.

– Opportunity Cost: Comparing the potential returns of different investment options and considering the opportunity cost of capital is essential. It helps determine which investment is the most attractive given alternative uses of funds.

By critically analyzing investment decisions, investors can make more informed choices, minimize risks, and maximize returns.

Chapter 5: Managing Cash Flows

Index:

– Importance of managing cash flows efficiently

– Strategies for effective cash flow management

– Real-world examples of cash flow management

In this chapter, we will explore the importance of managing cash flows efficiently. By understanding the significance of effective cash flow management and implementing appropriate strategies, individuals and businesses can maintain financial stability and support their growth objectives. Let’s delve into it!

Importance of Managing Cash Flows Efficiently:

Cash flow management is a critical aspect of financial management for both individuals and businesses. Here are some key reasons why managing cash flows efficiently is essential:

1. Financial Stability: Effective cash flow management ensures that there is enough cash available to meet financial obligations, such as paying bills, servicing debts, and covering operating expenses. It helps prevent cash shortages and financial crises that can disrupt operations or lead to financial distress.

2. Investment Opportunities: Positive cash flows provide the flexibility to take advantage of investment opportunities. Whether it’s investing in growth initiatives, acquiring assets, or pursuing new ventures, having sufficient cash on hand allows individuals and businesses to seize opportunities that can drive future profitability.

3. Debt Servicing: Proper cash flow management ensures the ability to meet debt obligations promptly. Timely repayment of loans and interest not only maintains good creditworthiness but also helps reduce the overall cost of borrowing by avoiding late payment penalties or higher interest rates.

4. Business Growth and Expansion: Cash flow management plays a crucial role in supporting business growth and expansion. Adequate cash reserves enable businesses to invest in research and development, marketing, hiring new talent, and scaling operations to meet increasing customer demand.

Strategies for Effective Cash Flow Management:

To effectively manage cash flows, individuals and businesses can implement the following strategies:

1. Cash Flow Forecasting: Develop a cash flow forecast that projects expected cash inflows and outflows over a specified period. Regularly monitor and update the forecast to anticipate potential cash flow gaps or surpluses.

2. Working Capital Management: Optimize the management of working capital by managing inventory levels, negotiating favorable payment terms with suppliers, and ensuring timely collections from customers. This helps improve cash flow by minimizing tied-up capital and reducing the cash conversion cycle.

3. Controlling Expenses: Identify areas where expenses can be reduced or optimized without compromising the quality of products or services. Implement cost-control measures, negotiate better vendor contracts, and consider outsourcing non-core functions to reduce operating expenses and improve cash flow.

4. Cash Flow Monitoring and Analysis: Regularly monitor cash flow statements and analyze the sources and uses of cash. Identify patterns, trends, and potential risks to take proactive measures for maintaining healthy cash flow.

Real-World Examples of Cash Flow Management:

Let’s consider a few real-world examples of cash flow management:

1. Small Business: A small retail business manages its cash flow by closely monitoring inventory levels, negotiating extended payment terms with suppliers, and incentivizing customers to pay early by offering discounts. These strategies help ensure sufficient cash flow to cover operating expenses and invest in growth initiatives.

2. Individual: An individual manages their cash flow by creating a monthly budget, tracking expenses, and prioritizing savings. They allocate a portion of their income toward an emergency fund and investments, ensuring financial stability and long-term wealth accumulation.

By implementing effective cash flow management strategies and learning from real-world examples, individuals and businesses can achieve financial stability, seize growth opportunities, and optimize their overall financial performance.

Chapter 6: Conclusion and Key Takeaways

Index:

– Recap of the key concepts covered

– Final thoughts on time preference for money

In this final chapter, let’s recap the key concepts covered throughout this blog post on understanding time preference for money in financial management. We will summarize the main points and provide some final thoughts on this important topic.

Recap of Key Concepts Covered:

1. Time Preference for Money: Time preference for money refers to the preference of receiving money sooner rather than later, considering its potential to earn returns or be utilized for various purposes.

2. Factors Influencing Time Preference: Time preference is influenced by factors such as the time horizon, opportunity cost, inflation, and risk and uncertainty associated with future cash flows.

3. Time Value of Money: The time value of money recognizes that the value of money changes over time due to factors like inflation and interest rates. It is crucial to consider the time value of money when making investment decisions.

4. Techniques for Evaluating Investment Options: Common techniques for evaluating investment options include net present value (NPV), internal rate of return (IRR), and payback period. These techniques help assess the potential returns and risks associated with investments.

5. Importance of Managing Cash Flows: Efficient cash flow management is vital for financial stability, supporting growth objectives, debt servicing, and seizing investment opportunities.

6. Strategies for Effective Cash Flow Management: Key strategies for managing cash flows include cash flow forecasting, working capital management, controlling expenses, and regular monitoring and analysis of cash flow statements.

Final Thoughts on Time Preference for Money:

Understanding time preference for money and incorporating it into financial decision-making is crucial for individuals and businesses alike. By considering the time value of money, evaluating investment options, and effectively managing cash flows, we can make informed choices that contribute to financial stability and growth.

Remember, every financial decision involves considering the trade-offs between present and future cash flows. By carefully analyzing the risks, returns, and timing of cash flows, you can make decisions that align with your financial goals and optimize your financial outcomes.

Leave a comment