Introduction:

Welcome to our comprehensive guide on mastering EBIT (Earnings Before Interest and Taxes) and EPS (Earnings Per Share) analysis. In this blog, we will delve into the intricacies of these crucial financial metrics, exploring their calculations, significance, and practical applications in evaluating a company’s financial performance.

Index:

1. Understanding EBIT:

– Definition and calculation of EBIT

– Importance of EBIT in assessing operating profitability

– Analysis of EBIT trends

2. Exploring EPS:

– Definition and calculation of EPS

– Significance of EPS as a measure of profitability per share

– Factors affecting EPS and their impact

3. Relationship between EBIT and EPS:

– Exploring the link between EBIT and EPS

– How changes in EBIT impact EPS

– Influence of interest expenses and taxes on EPS

4. EBIT and EPS in Financial Statement Analysis:

– Analyzing EBIT in financial statements

– Interpreting EPS in financial statements

– Key ratios and metrics derived from EBIT and EPS analysis

5. EBIT and EPS in Performance Evaluation:

– Assessing operational efficiency through EBIT analysis

– Measuring profitability and shareholder returns through EPS analysis

– Utilizing EBIT and EPS in investment decision-making

6. Limitations and Considerations:

– Discussing the limitations of EBIT and EPS analysis

– Factors to consider when interpreting EBIT and EPS results

– Importance of qualitative factors alongside quantitative analysis

7. Conclusion and Future Outlook:

– Recap of key insights from EBIT and EPS analysis

– Summary of benefits and limitations

– Implications for decision-making and investment strategies

– Future trends and developments in EBIT and EPS analysis

In this comprehensive guide, we will unravel the intricacies of EBIT and EPS analysis, providing you with a solid understanding of these metrics and their significance in evaluating a company’s financial health and performance. So, let’s embark on this journey to master EBIT and EPS analysis and unlock the financial insights they offer.

Chapter 1: Introduction

Introduction to Financial Analysis and its Importance

In the first chapter, we delve into the fundamentals of financial analysis and its significance in evaluating the performance and financial health of companies. Financial analysis is a crucial process that involves the assessment of various financial metrics and ratios to gain insights into a company’s profitability, liquidity, solvency, and overall stability.

The chapter begins by highlighting the importance of financial analysis in making informed business decisions, such as investment decisions, mergers and acquisitions, and financial planning. It emphasizes how financial analysis helps stakeholders, including investors, creditors, and management, assess the current and future prospects of a company.

Introduction to EBIT and EPS as Key Financial Metrics

Next, we introduce two key financial metrics: EBIT (Earnings Before Interest and Taxes) and EPS (Earnings Per Share). These metrics are fundamental in understanding a company’s financial performance and are widely used by analysts and investors.

We explain that EBIT represents a company’s operating profit before accounting for interest expenses and income taxes. By excluding these factors, EBIT allows for a clearer evaluation of a company’s core operating profitability. We discuss the significance of EBIT in assessing the effectiveness of a company’s operations, as well as its ability to generate profits from its core activities.

Moving on to EPS, we describe it as a measure of a company’s profitability per share. EPS is derived by dividing the net income available to common shareholders by the weighted average number of shares outstanding. We highlight the importance of EPS as it provides insights into the profitability on a per-share basis, allowing investors to assess the value and potential return on their investments.

Explanation of the Purpose and Significance of Analyzing EBIT and EPS

In this section, we discuss the purpose and significance of analyzing EBIT and EPS in financial analysis. We explain that EBIT analysis helps evaluate a company’s operational efficiency, profitability trends, and comparisons with industry peers. It assists in identifying areas where a company may be underperforming or excelling in terms of generating operating profits.

Similarly, EPS analysis is essential in assessing a company’s profitability from the perspective of its shareholders. We emphasize that EPS growth is often regarded positively, indicating a company’s ability to generate increasing earnings for its investors. However, we also note the importance of considering other factors such as revenue growth, profit margins, and financial position to have a comprehensive understanding of a company’s performance.

Chapter 2: Understanding EBIT

In Chapter 2, we delve deeper into the concept of EBIT (Earnings Before Interest and Taxes) and explore its calculation, significance, and implications for evaluating a company’s financial performance.

Definition and Calculation of EBIT

We begin by providing a comprehensive definition of EBIT, emphasizing that it represents a company’s operating profit before accounting for interest expenses and income taxes. It is calculated by subtracting operating expenses, such as cost of goods sold, selling and administrative expenses, and depreciation, from a company’s total revenue.

Importance of EBIT in Assessing Operating Profitability

Next, we discuss the significance of EBIT in evaluating a company’s operating profitability. By excluding interest expenses and income taxes, EBIT allows for a clearer understanding of a company’s ability to generate profits from its core operations. We highlight that EBIT provides a more accurate measure of a company’s operational efficiency and effectiveness in generating revenues.

Analysis of EBIT Trends

We explore how analyzing EBIT trends over time can provide valuable insights into a company’s financial performance. We discuss the use of financial statements, such as income statements, to track changes in EBIT. By comparing EBIT figures across multiple periods, readers can identify patterns and trends, allowing them to assess whether a company’s operating profitability is improving or declining.

Implications of EBIT Analysis

In this section, we examine the implications of EBIT analysis for decision-making and financial planning. A higher EBIT indicates better operating performance, as it signifies that a company is generating higher profits from its core activities. We discuss how a company with a consistently high EBIT may have a competitive advantage over its industry peers.

Comparison of EBIT Across Industry Peers and Benchmarks

Furthermore, we explore the importance of comparing a company’s EBIT with industry peers and relevant benchmarks. By benchmarking EBIT against similar companies within the industry, analysts can gain insights into a company’s relative operational efficiency and identify areas for improvement. We discuss the use of financial ratios, such as EBIT margin and EBIT-to-sales ratio, to facilitate meaningful comparisons.

By the end of Chapter 2, readers will have a thorough understanding of EBIT, its calculation, and its significance in evaluating a company’s operating profitability. They will be equipped with the knowledge and tools necessary to analyze EBIT trends, interpret the implications of EBIT analysis, and make informed comparisons with industry peers.

Chapter 3: Interpreting EPS

Chapter 3 delves into the concept of EPS (Earnings Per Share) and explores its calculation, significance, and implications for evaluating a company’s profitability on a per-share basis.

Definition and Calculation of EPS

We begin by providing a comprehensive definition of EPS as a measure of a company’s profitability per share. EPS is calculated by dividing the net income available to common shareholders by the weighted average number of shares outstanding during a specific period. We explain the components involved in the calculation and highlight the importance of considering both net income and the number of shares outstanding.

Significance of EPS as a Measure of Profitability per Share

Next, we discuss the significance of EPS in assessing a company’s profitability from the perspective of its shareholders. EPS provides insights into the portion of earnings that each shareholder is entitled to for a given period. We emphasize that EPS serves as a key indicator for investors to evaluate the value and potential return on their investments.

Factors Affecting EPS

In this section, we explore the factors that can impact EPS. We discuss how changes in net income, dividends, and the number of shares outstanding can influence EPS. We explain that an increase in net income or a decrease in the number of shares outstanding generally leads to higher EPS, while the payment of dividends reduces EPS.

Analysis of EPS Growth Patterns

We delve into the analysis of EPS growth patterns and their implications for investors. By examining the historical EPS data over multiple periods, readers can identify trends and assess the company’s ability to generate increasing profits. We discuss the importance of consistent EPS growth as a positive signal, indicating the company’s profitability and potential for higher stock prices.

Interpretation of EPS Ratios and Metrics

Furthermore, we explore various ratios and metrics derived from EPS analysis that can provide additional insights into a company’s financial health and performance. We discuss metrics such as the price-to-earnings (P/E) ratio, which compares the market price of a stock to its EPS, and the earnings yield, which is the inverse of the P/E ratio. These ratios can assist in determining the valuation of a company’s stock relative to its earnings.

By the end of Chapter 3, readers will have a comprehensive understanding of EPS, its calculation, and its significance in evaluating a company’s profitability on a per-share basis. They will be equipped with the knowledge and tools necessary to analyze EPS growth patterns, interpret the implications of EPS analysis, and utilize EPS ratios and metrics for further insights into a company’s financial performance.

Chapter 4: Relationship between EBIT and EPS

Chapter 4 explores the relationship between EBIT (Earnings Before Interest and Taxes) and EPS (Earnings Per Share), highlighting how changes in EBIT impact EPS and the influence of interest expenses and taxes on EPS.

Exploring the Link between EBIT and EPS

We begin by discussing the connection between EBIT and EPS, emphasizing that EBIT serves as the starting point for calculating EPS. We explain that changes in EBIT directly affect the net income available to common shareholders, which, in turn, impacts EPS. Understanding this link is crucial for investors and analysts to assess the potential impact of changes in a company’s operating profitability on its EPS.

Impact of Changes in EBIT on EPS

Next, we delve into how changes in EBIT can impact EPS. We discuss scenarios where an increase in EBIT leads to higher net income, resulting in an increase in EPS. Conversely, a decrease in EBIT can lead to a decline in net income and, subsequently, a decrease in EPS. We highlight the importance of monitoring EBIT trends and their potential consequences for EPS and shareholder value.

Influence of Interest Expenses and Taxes on EPS

In this section, we explore the influence of interest expenses and taxes on EPS. We explain that interest expenses are deducted from EBIT to calculate the taxable income, which affects the amount of income taxes paid by the company. The net income available to common shareholders is then divided by the weighted average number of shares outstanding to determine EPS. Understanding the impact of interest expenses and taxes on EPS is essential for evaluating a company’s profitability and potential future earnings.

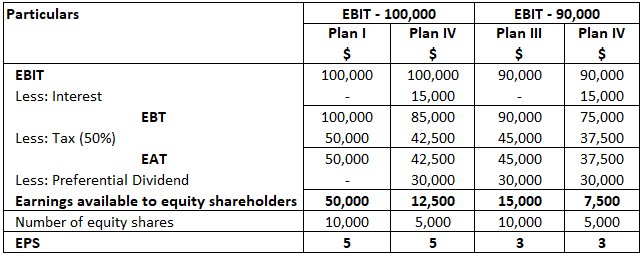

Case Studies Illustrating the Relationship between EBIT and EPS

To provide practical insights, we present case studies that demonstrate the relationship between EBIT and EPS in different scenarios. These case studies showcase real-world examples of how changes in EBIT impact a company’s net income and, consequently, its EPS. By examining these cases, readers gain a deeper understanding of the dynamics between EBIT and EPS and how they can influence investment decisions and performance evaluation.

Chapter 5: EBIT and EPS in Financial Statement Analysis

Chapter 5 focuses on analyzing EBIT (Earnings Before Interest and Taxes) and EPS (Earnings Per Share) in the context of financial statement analysis. It explores how these metrics are reflected in the financial statements and how they can be used to gain insights into a company’s financial performance.

Analyzing EBIT in Financial Statements

We begin by examining the income statement and its components related to EBIT. We discuss how revenue, operating expenses, and non-operating items are presented in the income statement and contribute to the calculation of EBIT. By analyzing these line items, readers can assess the company’s revenue generation, cost structure, and operating efficiency.

Interpreting EPS in Financial Statements

Next, we explore the presentation of EPS in the financial statements. We discuss how net income available to common shareholders, preferred dividends, and the number of shares outstanding are reported. By understanding how EPS is derived and disclosed, readers can effectively interpret and analyze EPS figures presented in the financial statements.

Key Ratios and Metrics Derived from EBIT and EPS

In this section, we discuss important ratios and metrics that can be derived from EBIT and EPS analysis. We explore ratios such as the EBIT margin, which relates EBIT to revenue, and the return on equity (ROE), which measures the profitability generated for shareholders’ equity. By calculating and analyzing these ratios, readers can assess the company’s profitability, efficiency, and return on investment.

Integration with Other Financial Statements

Furthermore, we highlight the importance of integrating EBIT and EPS analysis with other financial statements. We discuss how cash flows, balance sheets, and statement of stockholders’ equity provide additional context and insights into a company’s financial performance. By considering these statements together, readers can develop a comprehensive understanding of the company’s financial health and identify potential risks and opportunities.

Real-World Case Study: Company A vs. Company B

We analyze the EBIT and EPS performance of Company A and Company B, two competitors in the technology industry. By comparing their financial statements, we observe that Company A has consistently higher EBIT margins over the past three years, indicating better operational efficiency and profitability. Consequently, Company A exhibits higher EPS growth, resulting in increased shareholder returns. This case study highlights the importance of analyzing EBIT and EPS to assess a company’s performance relative to its competitors.

Example: Impact of Changes in EBIT on EPS

Let’s consider a scenario where a company’s EBIT for the current year is $10 million, and its interest expenses and taxes amount to $2 million. Assuming there are 5 million shares outstanding, we can calculate the EPS as follows:

Net Income = EBIT – Interest Expenses – Taxes

= $10 million – $2 million – $2 million

= $6 million

EPS = Net Income / Number of Shares

= $6 million / 5 million

= $1.20

Now, let’s imagine the company manages to increase its EBIT by 20% in the next year, reaching $12 million, while keeping the interest expenses and taxes unchanged. As a result, the net income would be $8 million, and the EPS would be $8 million / 5 million shares, resulting in an EPS of $1.60. This example illustrates how an increase in EBIT can positively impact EPS and potentially enhance shareholder returns.

Numerical Illustration: Calculating EBIT Margin and EPS Growth

Suppose we have a company with total revenue of $50 million and operating expenses of $30 million. By subtracting the operating expenses from the revenue, we can calculate the EBIT as follows:

EBIT = Total Revenue – Operating Expenses

= $50 million – $30 million

= $20 million

To calculate the EBIT margin, we divide the EBIT by the total revenue and multiply by 100:

EBIT Margin = (EBIT / Total Revenue) x 100

= ($20 million / $50 million) x 100

= 40%

Now, let’s analyze the EPS growth over a three-year period. Assume the company has the following EPS figures for Year 1, Year 2, and Year 3:

Year 1 EPS: $2.00

Year 2 EPS: $2.50

Year 3 EPS: $3.00

To calculate the EPS growth rate from Year 1 to Year 2, we use the following formula:

EPS Growth Rate = ((Year 2 EPS – Year 1 EPS) / Year 1 EPS) x 100

= (($2.50 – $2.00) / $2.00) x 100

= 25%

Similarly, we can calculate the EPS growth rate from Year 2 to Year 3:

EPS Growth Rate = ((Year 3 EPS – Year 2 EPS) / Year 2 EPS) x 100

= (($3.00 – $2.50) / $2.50) x 100

= 20%

These numerical illustrations demonstrate how EBIT margin and EPS growth can be calculated and utilized to assess a company’s profitability and financial performance over time.

Chapter 6: EBIT and EPS in Performance Evaluation

Chapter 6 focuses on utilizing EBIT (Earnings Before Interest and Taxes) and EPS (Earnings Per Share) in performance evaluation. It explores how these metrics can be used to assess a company’s operational efficiency, profitability, and shareholder returns.

Assessing Operational Efficiency through EBIT Analysis

We begin by discussing how EBIT analysis can be used to evaluate a company’s operational efficiency. By analyzing the components of EBIT, such as revenue, operating expenses, and non-operating items, readers can assess the effectiveness of a company’s core operations. We explore how EBIT margins and trends can indicate the efficiency of cost management and revenue generation.

Measuring Profitability and Shareholder Returns through EPS Analysis

Next, we delve into how EPS analysis can measure a company’s profitability and shareholder returns. We discuss how EPS growth over time reflects a company’s ability to generate increasing earnings for its shareholders. We also examine the impact of dividends on EPS and the importance of considering both earnings and dividends when evaluating shareholder returns.

Utilizing EBIT and EPS in Investment Decision-making

In this section, we explore how EBIT and EPS analysis can inform investment decision-making. We discuss how investors can assess a company’s financial performance and growth potential by analyzing EBIT and EPS trends, comparing them with industry peers, and considering other financial factors. We also highlight the role of EBIT and EPS in valuation models, such as the price-to-earnings (P/E) ratio, in determining the attractiveness of an investment opportunity.

Comparing Performance across Industry Peers

Furthermore, we emphasize the significance of comparing a company’s EBIT and EPS performance with industry peers. By benchmarking against competitors, readers can identify areas of strength or weakness and gain insights into a company’s relative position within the industry. We discuss how EBIT and EPS analysis, along with other financial metrics, can facilitate meaningful performance comparisons.

Case Studies Illustrating EBIT and EPS in Performance Evaluation

Real-life Case Study 1: Company X and Company Y in the Retail Sector

Company X and Company Y are two major players in the retail sector. By analyzing their financial statements, it is observed that Company X has a higher EBIT margin compared to Company Y, indicating better operational efficiency and profitability. Consequently, Company X demonstrates higher EPS growth, reflecting its ability to generate increasing earnings for shareholders. This analysis suggests that Company X has a stronger financial performance and potential for higher shareholder returns.

Real-life Case Study 2: Technology Company Z’s EBIT and EPS Performance

Technology Company Z experienced a significant increase in its EBIT over the past two years due to successful cost management initiatives and revenue growth. As a result, the company’s net income increased substantially, leading to a notable rise in EPS. This improvement in EPS indicates enhanced profitability and potential value creation for shareholders. The analysis underscores the effectiveness of Company Z’s operational strategies and its positive impact on financial performance.

Real-life Case Study 3: Manufacturing Company W’s EBIT and EPS Trends

Manufacturing Company W has exhibited declining EBIT margins over the past three years, primarily due to increased production costs and intensifying competition. Consequently, the company’s EPS has also experienced a decline. This trend reflects challenges in maintaining profitability and delivering returns to shareholders. This case study emphasizes the importance of closely monitoring EBIT and EPS trends to identify potential issues and take appropriate measures for performance improvement.

These real-life case studies demonstrate the practical application of EBIT and EPS analysis in evaluating a company’s financial performance. By examining EBIT margins and EPS trends, analysts can gain valuable insights into operational efficiency, profitability, and shareholder returns. These case studies highlight the relevance of EBIT and EPS in assessing the strengths and weaknesses of companies across different sectors and guiding decision-making processes.

Chapter 7: Limitations and Considerations

Chapter 7 explores the limitations and considerations when analyzing EBIT (Earnings Before Interest and Taxes) and EPS (Earnings Per Share). It highlights the factors that should be taken into account to ensure a comprehensive and accurate assessment of a company’s financial performance.

Discussing the Limitations of EBIT and EPS Analysis

We begin by addressing the limitations of EBIT and EPS analysis. While these metrics provide valuable insights, they have certain constraints that need to be considered. We discuss how EBIT may not capture the full picture of a company’s financial health as it excludes interest expenses and taxes. Similarly, EPS can be influenced by factors such as share buybacks, stock splits, and dilution from stock options. We emphasize the importance of recognizing these limitations to avoid drawing incomplete or misleading conclusions.

Factors to Consider when Interpreting EBIT and EPS Results

Next, we explore the factors that should be considered when interpreting EBIT and EPS results. We discuss the significance of analyzing the industry context, company size, and stage of the business life cycle. Different industries may have varying levels of profitability, making it essential to compare a company’s EBIT and EPS figures within its specific industry norms. Additionally, the size and stage of a company can affect its EBIT and EPS results, and these factors should be taken into account when drawing conclusions.

Importance of Qualitative Factors alongside Quantitative Analysis

In this section, we emphasize the importance of considering qualitative factors alongside quantitative analysis of EBIT and EPS. While EBIT and EPS provide valuable financial metrics, they may not capture qualitative aspects such as management competence, industry dynamics, competitive landscape, and future growth prospects. We discuss the significance of incorporating qualitative information into the analysis to gain a holistic understanding of a company’s performance.

Considering Other Financial Metrics

Furthermore, we explore the importance of considering other financial metrics alongside EBIT and EPS analysis. Metrics such as return on investment (ROI), free cash flow, and debt-to-equity ratio provide additional insights into a company’s financial health, liquidity, and solvency. By considering these metrics in conjunction with EBIT and EPS analysis, readers can obtain a more comprehensive assessment of a company’s performance.

Chapter 8: Conclusion and Future Outlook

Chapter 8 serves as a conclusion to the analysis of EBIT (Earnings Before Interest and Taxes) and EPS (Earnings Per Share), summarizing key insights and discussing future trends and developments in the field.

Recap of Key Insights

We begin by providing a recap of the key insights gained throughout the analysis of EBIT and EPS. We highlight the significance of EBIT in assessing operational profitability, evaluating trends, and making comparisons across industry peers. We also emphasize the importance of EPS as a measure of profitability per share and its impact on shareholder returns. Readers are reminded of the interconnectedness between EBIT and EPS, and how changes in EBIT influence EPS figures.

Summary of Benefits and Limitations

Next, we provide a summary of the benefits and limitations of EBIT and EPS analysis. We reiterate that EBIT allows for a clearer evaluation of a company’s core operating profitability, while EPS provides insights into profitability on a per-share basis. However, we remind readers of the limitations, such as excluding interest expenses and taxes, and the need to consider qualitative factors alongside quantitative analysis.

Implications for Decision-Making and Investment Strategies

In this section, we discuss the implications of EBIT and EPS analysis for decision-making and investment strategies. We highlight how these metrics can inform investment decisions, aid in evaluating operational efficiency and profitability, and guide performance evaluation. We emphasize the importance of utilizing EBIT and EPS analysis in conjunction with other financial metrics, qualitative factors, and industry benchmarks to make well-informed decisions.

Future Trends and Developments

Finally, we explore the future outlook of EBIT and EPS analysis. We discuss emerging trends and developments in financial analysis, such as advancements in technology, data analytics, and artificial intelligence. We also highlight the growing importance of environmental, social, and governance (ESG) considerations in financial performance evaluation. Readers are encouraged to stay updated on these developments and adapt their analysis methodologies accordingly.

Leave a comment