Index:

1. Introduction

2. What is Cost of Capital?

3. Importance of Cost of Capital

4. Components of Cost of Capital

5. Weighted Average Cost of Capital (WACC)

6. Real-World Examples of Cost of Capital

7. Cost of Capital in the Indian Context

8. Case Studies on Cost of Capital

9. Numerical Examples of Cost of Capital Calculations

10. Applications of Cost of Capital

11. Conclusion

Introduction

Welcome to our comprehensive guide on the Cost of Capital. In this blog post, we will delve into the concept of Cost of Capital, its significance in the business world, and its applications in various scenarios. We will provide numerous real-life examples, case studies, and numerical calculations to help you grasp the concept better. Whether you are an investor, a finance professional, or simply curious about financial management, this guide will provide you with valuable insights.

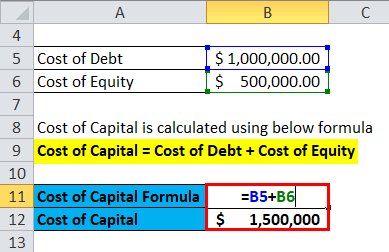

What is Cost of Capital?

The Cost of Capital refers to the required rate of return that a company must earn on its investments in order to satisfy the expectations of its investors. It represents the cost of financing a company’s operations and is a crucial factor in making investment decisions. Understanding the Cost of Capital helps businesses determine the feasibility of projects and assess the attractiveness of potential investments.

Importance of Cost of Capital

The Cost of Capital plays a vital role in financial decision-making for both companies and investors. It serves as a benchmark for evaluating investment opportunities, determining the optimal capital structure, and assessing the performance of existing investments. By understanding the Cost of Capital, businesses can make informed decisions that maximize shareholder value and minimize risks.

Components of Cost of Capital

The Cost of Capital consists of various components, including the cost of debt, the cost of equity, and the cost of preferred stock. Each component represents the respective costs associated with different sources of financing. We will explore each component in detail, providing insights into how they are calculated and their impact on the overall Cost of Capital.

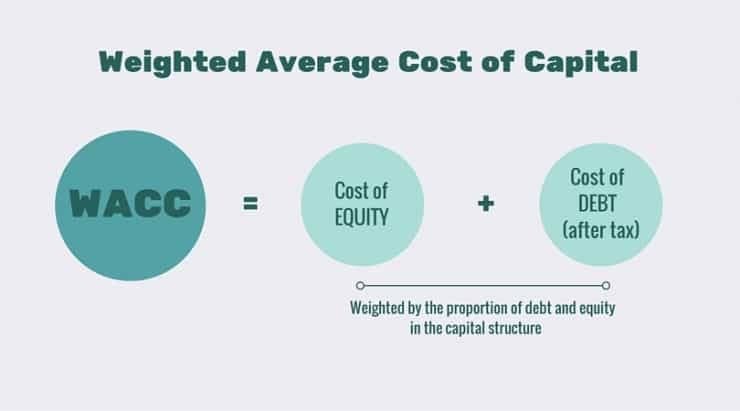

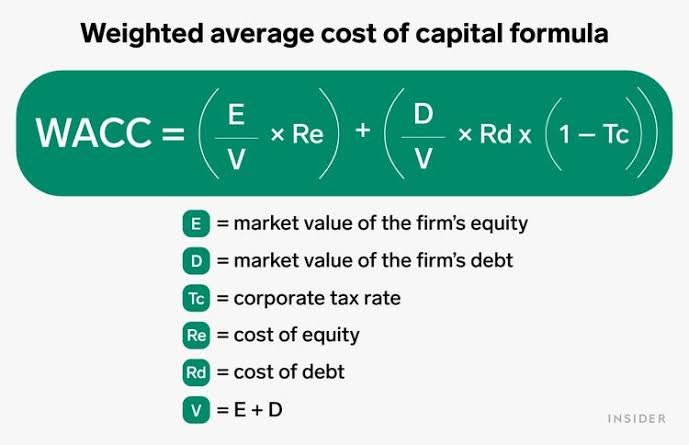

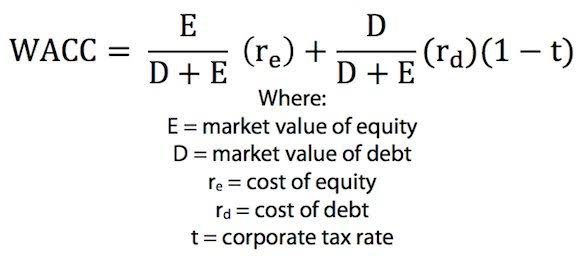

Weighted Average Cost of Capital (WACC)

The Weighted Average Cost of Capital (WACC) is a commonly used metric to determine the overall Cost of Capital for a company. It considers the proportional weight of each financing source in the company’s capital structure. We will discuss the formula for calculating WACC and demonstrate its practical application through real-world examples.

Real-World Examples of Cost of Capital

To illustrate the concept of Cost of Capital, we will examine real-life examples of companies from various industries. These examples will highlight how different factors, such as industry risk, financial leverage, and market conditions, can influence the Cost of Capital for businesses operating in different sectors.

Cost of Capital in the Indian Context

We will also explore the specific considerations and challenges associated with calculating the Cost of Capital in the Indian market. Understanding the Indian context is crucial for businesses and investors operating in the country, as it involves unique regulatory, economic, and market dynamics that impact the Cost of Capital calculations.Here are two case studies that demonstrate the application of Cost of Capital in real-world scenarios:

Case Study:

Case Study 1: Company A’s Investment Decision

Company A is considering an investment in a new manufacturing facility. The project requires an initial investment of $5 million and is expected to generate cash flows of $1.5 million per year for the next 10 years. The company’s Cost of Capital is determined to be 10%.

To evaluate the feasibility of the investment, Company A calculates the Net Present Value (NPV) using the Cost of Capital as the discount rate. By discounting the expected cash flows, they determine the present value of the project’s inflows and outflows.

The NPV calculation is as follows:

NPV = (Cash Flow Year 1 / (1 + Cost of Capital)^1) + (Cash Flow Year 2 / (1 + Cost of Capital)^2) + … + (Cash Flow Year 10 / (1 + Cost of Capital)^10) – Initial Investment

Using the formula and the provided cash flow projections, Company A calculates the NPV:

NPV = ($1.5 million / (1 + 0.10)^1) + ($1.5 million / (1 + 0.10)^2) + … + ($1.5 million / (1 + 0.10)^10) – $5 million

After performing the calculations, Company A finds that the NPV of the project is $1.22 million. Since the NPV is positive, the investment is considered economically viable. It indicates that the project’s returns exceed the Cost of Capital, generating value for the company and its investors.

Case Study 2: Company B’s Capital Structure Decision

Company B is a retail company that is evaluating its capital structure to optimize its Cost of Capital. The company currently has 70% equity and 30% debt in its capital structure. Company B’s Cost of Equity is estimated to be 12%, and its Cost of Debt is 8%.

To determine the optimal capital structure, Company B uses the Weighted Average Cost of Capital (WACC) formula:

WACC = (Equity Proportion x Cost of Equity) + (Debt Proportion x Cost of Debt)

In this case, Company B calculates its WACC as follows:

WACC = (0.7 x 0.12) + (0.3 x 0.08)

The calculated WACC is 10.4%.

To analyze the impact of different capital structures, Company B performs sensitivity analysis by varying the proportions of equity and debt. They find that as the proportion of debt increases, the WACC decreases. This indicates that higher levels of debt financing can result in a lower Cost of Capital and potentially increase the company’s overall value.

Based on this analysis, Company B decides to adjust its capital structure by increasing the proportion of debt to 40% and decreasing the proportion of equity to 60%. As a result, the company’s WACC decreases to 9.6%, indicating a more efficient use of capital.

These case studies illustrate how Cost of Capital analysis is used to evaluate investment opportunities and optimize capital structure decisions. By considering the Cost of Capital, businesses can make informed choices that maximize shareholder value and drive sustainable growth.

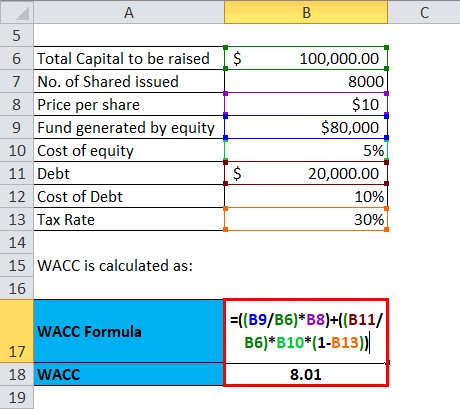

Numerical Example: Here’s a numerical example to illustrate the calculation of the Cost of Capital using the Weighted Average Cost of Capital (WACC) formula:

Numerical Example: Calculating WACC for Company XYZ

Company XYZ is a manufacturing company with the following capital structure:

– Equity: $10 million (Cost of Equity = 12%)

– Debt: $5 million (Cost of Debt = 8%)

– Total capital: $15 million

To calculate the WACC, we need to determine the proportion of each component in the capital structure. In this case, the equity proportion is $10 million out of a total capital of $15 million, which equals 0.67 (10/15). The debt proportion is $5 million out of a total capital of $15 million, which equals 0.33 (5/15).

Next, we multiply each component’s proportion by its respective cost and sum them up to calculate the WACC:

WACC = (Equity Proportion x Cost of Equity) + (Debt Proportion x Cost of Debt)

WACC = (0.67 x 0.12) + (0.33 x 0.08)

WACC = 0.0804 + 0.0264

WACC = 0.1068 or 10.68%

Therefore, Company XYZ’s Weighted Average Cost of Capital (WACC) is 10.68%.

This calculation helps the company determine the minimum rate of return it needs to earn on its investments to meet the expectations of its investors and maintain the current capital structure. It also serves as a benchmark for evaluating new investment opportunities and determining the profitability of projects.

By considering the WACC in financial decision-making, Company XYZ can assess the risk and return trade-off and make informed choices that align with the company’s financial goals and maximize shareholder value.

Applications of Cost of Capital

The Cost of Capital has various applications across different areas of financial management. We will explore how it is used in

capital budgeting, investment analysis, valuation of securities, and determining the hurdle rate for new projects. Additionally, we will discuss how Cost of Capital influences financial decisions such as mergers and acquisitions, dividend policy, and financing choices.

Conclusion

In conclusion, understanding the Cost of Capital is essential for businesses and investors alike. It serves as a fundamental concept in financial management, guiding investment decisions and providing insights into the financial health of a company. By exploring real-life examples, case studies, and numerical calculations, this guide has equipped you with the knowledge and tools to effectively analyze and utilize the Cost of Capital in various contexts.

Remember to consider the unique characteristics of the Indian market while applying these concepts. The Cost of Capital plays a pivotal role in shaping business strategies and optimizing financial performance. Stay tuned for more updates and insights on financial management and investment analysis.

Leave a comment