Introduction:

Standard costing is a powerful management accounting technique that plays a pivotal role in cost control and decision-making for businesses. In this comprehensive blog post, we will explore the concept of standard costing in both global and Indian contexts. Through numericals, real-life examples, case studies, and practical applications, we will illustrate its significance and benefits.

Table of Contents:

1. Introduction to Standard Costing

2. The Importance and Benefits of Standard Costing

3. Setting Standard Costs: Methods and Techniques

4. Variance Analysis: Measuring Performance Deviations

5. Real-Life Examples of Standard Costing

6. Case Studies: Implementing Standard Costing in Indian Businesses

7. Overcoming Challenges in Standard Costing Implementation

8. Standard Costing in the Digital Age: Leveraging Technology

9. Applications of Standard Costing

10. Standard Costing in the Indian Business Landscape

11. Conclusion

Chapter 1: Introduction to Standard Costing

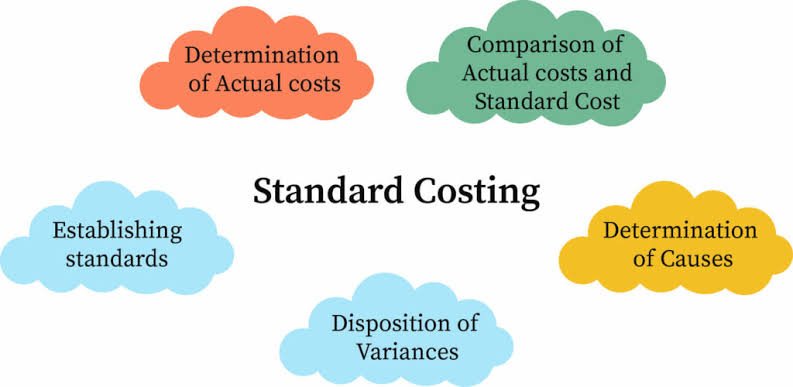

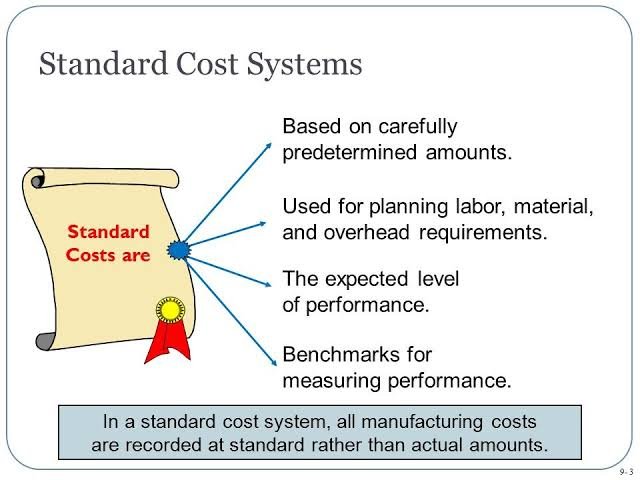

In this chapter, we will provide a comprehensive introduction to standard costing. We will define standard costing, its purpose, and its evolution throughout history. Exploring its key components, including direct materials, direct labor, and overheads, we will highlight how standard costing contributes to cost control and decision-making in businesses.

Chapter 2: The Importance and Benefits of Standard Costing

2.1 Cost Control and Cost Management

To illustrate the importance of standard costing in cost control, consider the following numerical example:

ABC Manufacturing Company produces a product, and based on historical data, it determines that the standard cost for each unit should be $10 for direct materials, $5 for direct labor, and $3 for overhead. However, during a specific period, the actual costs were $11 for direct materials, $6 for direct labor, and $4 for overhead. By comparing the standard costs with the actual costs, ABC Manufacturing can identify cost deviations and take appropriate measures to control and reduce costs.

2.2 Performance Evaluation and Benchmarking

Let’s explore the benefits of standard costing in performance evaluation through a numerical example:

XYZ Retail Store sets a standard labor cost of $10 per hour for processing customer orders. During a month, the store processed 1,000 orders, requiring a total of 1,500 labor hours. However, the actual labor cost amounted to $16,500. By comparing the standard labor cost with the actual labor cost, XYZ Retail Store can assess the performance of its order processing function. Any significant variance can indicate inefficiencies or deviations from the expected performance, enabling management to investigate and improve processes accordingly.

Chapter 3: Setting Standard Costs: Methods and Techniques

3.1 Basic Standards

One method of setting standard costs is through basic standards. Basic standards are established by considering normal operating conditions and assuming efficient performance. These standards represent a reasonable level of performance that can be achieved under typical circumstances. For example, a manufacturing company might set a basic standard of 2 hours of direct labor for producing a unit of a certain product.

3.2 Ideal Standards

Ideal standards are another approach to setting standard costs. These standards represent the best achievable performance levels under perfect conditions. Ideal standards assume no waste, no machine breakdowns, and optimal efficiency. They provide a target for performance that may not be easily attainable in practice but serve as a benchmark for continuous improvement efforts. For instance, a retail store might set an ideal standard of zero defects in customer orders.

3.3 Currently Attainable Standards

Currently attainable standards fall between basic and ideal standards. They are based on current operating conditions, taking into account factors such as workforce skill levels, equipment capabilities, and production constraints. Currently attainable standards provide a more realistic target for performance evaluation and cost control. For example, a service-oriented company might set a currently attainable standard for response time to customer inquiries.

3.4 Determining Standard Quantities and Prices

Setting standard quantities involves determining the amount of resources required for producing a unit of output. This includes considering the expected consumption of materials, labor hours, and machine hours. Standard prices, on the other hand, involve assigning a cost value to each unit of resource consumed. These prices can be based on historical data, market prices, or internal cost analysis. Both standard quantities and prices should be reviewed and updated periodically to ensure their relevance and accuracy.

3.5 Challenges in Setting Standards

Setting accurate and effective standards can be challenging. Some of the common challenges include:

– Balancing between attainability and motivation: Standards that are too easily achievable may not motivate employees to strive for better performance, while standards that are too difficult may lead to demotivation and frustration.

– Incorporating changes and improvements: Standards should be flexible enough to adapt to changes in technology, processes, and market conditions. Regular reviews and updates are necessary to reflect improvements and advancements.

– Ensuring data accuracy and reliability: Standard costing relies on accurate and reliable data. Obtaining and maintaining quality data can be a challenge, especially when dealing with complex operations and multiple variables.

By understanding these challenges and applying appropriate methods and techniques, businesses can set standard costs that provide a realistic target for performance evaluation and cost control.

Please note that the methods and techniques described are general approaches to setting standard costs. The specific methods used may vary depending on the industry, nature of the business, and organizational preferences.

Chapter 4: Variance Analysis: Measuring Performance Deviations

4.1 Material Variance

Consider the following numerical example to understand material variance:

LMN Manufacturing Company plans to produce 1,000 units of a product, with a standard material requirement of 5 kilograms per unit. The standard cost of materials is $2 per kilogram. However, during production, 5,200 kilograms of material were used at an actual cost of $2.20 per kilogram. By calculating the material variance, LMN Manufacturing can assess the cost impact of using more materials than planned and take corrective actions.

4.2 Labor Variance

Let’s explore labor variance through a numerical example:

EFG Services Company sets a standard labor cost of $15 per hour for a specific task. During a month, 500 hours were budgeted for the task, but the actual labor hours worked amounted to 480 hours. The actual labor cost incurred was $7,200. By calculating the labor variance, EFG Services can assess the cost efficiency of the workforce and identify any underutilization or overutilization of labor, enabling appropriate adjustments for future planning.

These numerical examples demonstrate the practical application of standard costing and variance analysis in identifying cost deviations, evaluating performance, and enabling proactive management decisions.

Please note that the numerical examples provided are simplified for illustrative purposes. In actual business scenarios, comprehensive calculations and analysis may be required to determine standard costs and variances accurately.

Chapter 5: Real-Life Examples of Standard Costing

In Chapter 5, we will explore real-life examples of organizations that have successfully implemented standard costing. Through these examples, we will illustrate how standard costing optimizes costs, improves efficiency, and enhances profitability across different industries.

5.1 Example 1: Manufacturing Industry

Let’s consider a manufacturing company that produces furniture. By implementing standard costing, the company sets standard costs for direct materials, direct labor, and overheads based on historical data and industry benchmarks. The standard costs provide a basis for cost control and decision-making. Through variance analysis, the company compares actual costs with standard costs and identifies any deviations. For instance, if the actual cost of materials exceeds the standard cost, it can prompt investigations into supplier pricing, material waste, or production inefficiencies. By addressing these deviations, the company can optimize costs and improve profitability.

5.2 Example 2: Retail Industry

In the retail industry, standard costing plays a crucial role in inventory management and pricing decisions. A retail store sets standard costs for inventory items based on the purchase price, storage costs, and expected sales volumes. By regularly comparing the actual costs of inventory with standard costs, the store can identify any discrepancies and take appropriate actions, such as renegotiating purchase prices, optimizing stock levels, or adjusting pricing strategies. Standard costing helps the retail store maintain accurate inventory records, minimize losses due to stock obsolescence, and ensure profitability.

5.3 Example 3: Service Industry

Standard costing is also applicable in the service industry. Consider a consulting firm that provides professional services to clients. The firm establishes standard costs for staff hours, overhead expenses, and project-related resources. By comparing the actual costs incurred during project execution with the standard costs, the firm can evaluate project profitability and identify areas for cost optimization. This analysis allows the firm to make informed decisions on resource allocation, pricing structures, and project bidding, leading to improved financial performance.

By exploring these real-life examples across different industries, we can observe how standard costing enables businesses to control costs, improve efficiency, and make informed decisions. These examples highlight the versatility and effectiveness of standard costing in various organizational contexts.

Note: The examples provided are simplified for illustrative purposes. In actual business scenarios, the implementation of standard costing may involve more complex calculations, industry-specific factors, and detailed analysis.

Chapter 6: Case Studies: Implementing Standard Costing in Indian Businesses

6.1 Case Study 1: XYZ Manufacturing Ltd. – Overcoming Cost Challenges and Achieving Operational Efficiency

XYZ Manufacturing Ltd., a leading Indian manufacturing company, faced increasing production costs and a decline in profitability. To address these challenges, they decided to implement standard costing. Through a meticulous process, XYZ Manufacturing set standard costs for materials, labor, and overheads. They conducted variance analysis to identify cost deviations and took corrective actions, such as renegotiating supplier contracts, streamlining production processes, and implementing cost-saving measures. As a result, XYZ Manufacturing achieved significant cost reductions, improved operational efficiency, and restored profitability.

6.2 Case Study 2: ABC Retail Stores – Utilizing Standard Costing for Pricing Decisions and Inventory Control

ABC Retail Stores, a well-established chain of retail stores in India, faced difficulties in accurately determining product prices and managing inventory levels. By implementing standard costing, they established standard costs for products, including direct costs and overheads. This allowed them to calculate the cost of goods sold accurately and make informed pricing decisions. Through regular variance analysis, ABC Retail Stores monitored inventory costs and optimized stock levels to avoid overstocking or stockouts. As a result, they improved pricing strategies, reduced inventory holding costs, and enhanced overall profitability.

6.3 Case Study 3: PQR Services Pvt. Ltd. – Performance Evaluation and Cost Optimization through Standard Costing

PQR Services Pvt. Ltd., a service-based company in India, faced challenges in accurately assessing project profitability and controlling costs. By implementing standard costing, they developed standard costs for various project components, such as labor hours, overhead expenses, and project-specific resources. Through variance analysis, PQR Services compared actual project costs against standard costs, enabling them to evaluate project profitability and identify areas for cost optimization. This facilitated better resource allocation, improved project pricing, and enhanced overall financial performance for PQR Services.

These case studies demonstrate the successful implementation of standard costing in Indian businesses, showcasing the transformative impact on cost control, decision-making, and overall financial performance. They highlight the practical application of standard costing principles and the strategies employed to overcome specific challenges faced by Indian organizations.

Chapter 7: Overcoming Challenges in Standard Costing Implementation

Chapter 7 addresses common challenges encountered during standard costing implementation. We will discuss resistance to change, cultural barriers, and the importance of data accuracy and reliability. Practical strategies and tips, derived from real-world experiences, will be provided to help businesses overcome these challenges and ensure successful implementation.

Chapter 8: Standard Costing in the Digital Age:

Leveraging Technology

In Chapter 8, we will explore the role of technology in standard costing. We will discuss how businesses can leverage automation, software solutions, and digital tools to enhance the implementation and effectiveness of standard costing systems. Through real-life examples and case studies, we will showcase how technology-driven solutions improve accuracy, streamline processes, and provide real-time insights for better decision-making.

Chapter 9: Applications of Standard Costing

Chapter 9 will explore the wide range of applications for standard costing. We will discuss how standard costing supports cost control, pricing decisions, performance evaluation, budgeting, and forecasting. Through numerical examples, we will demonstrate how businesses can utilize standard costing techniques to drive efficiency, make informed decisions, and achieve their financial goals.

Chapter 10: Standard Costing in the Indian Business Landscape

Chapter 10 will provide insights into the adoption and implementation of standard costing in the Indian business landscape. We will explore the cultural and regulatory factors influencing its adoption, along with success stories and challenges faced by Indian businesses. Through case studies and practical examples, we will highlight how standard costing can be tailored to suit Indian market conditions and drive financial performance.

Conclusion:

In the concluding chapter, we will recap the key concepts covered throughout the blog post. We will emphasize the importance of standard costing in optimizing business performance, improving cost management, and enabling informed decision-making. By incorporating numerical examples, real-life case studies, and practical applications, this comprehensive guide will equip businesses with the knowledge and tools to successfully implement and leverage standard costing in their operations.

Leave a comment