Index:

1. Introduction

2. Importance of Capital Structure

3. Modigliani-Miller Propositions

3.1. Proposition I: Irrelevance of Capital Structure

3.2. Proposition II: Cost of Capital and Financial Leverage

4. Trade-Off Theory

4.1. Balancing Debt and Equity

4.2. Case Study: Coca-Cola’s Capital Structure Strategy

4.3. Real-Life Example: Procter & Gamble

5. Pecking Order Theory

5.1. Information Asymmetry and Financing Choices

5.2. Case Study: Amazon’s Financing Strategy

5.3. Real-Life Example: Infosys Limited

6. Agency Cost Theory

6.1. Conflict of Interest and Capital Structure

6.2. Case Study: Volkswagen’s Capital Structure Challenges

6.3. Real-Life Example: Reliance Industries

7. Empirical Evidence and Numerical Analysis

7.1. Assessing Debt Ratios and Financial Performance

7.2. Impact of Capital Structure on Cost of Capital

7.3. Financial Ratios and Capital Structure Decisions

8. Capital Structure in the Global Context

8.1. Real-Life Example: Tesla’s Capital Structure Dynamics

8.2. Case Study: Apple’s Capital Structure Evolution

8.3. Application of Capital Structure Theories in Global Companies

9. Capital Structure in the Indian Context

9.1. Real-Life Example: Tata Motors’ Capital Structure Strategy

9.2. Case Study: Flipkart’s Funding Journey

9.3. Application of Capital Structure Theories in Indian Companies

10. Conclusion

11. References

12. Categories: Finance, Capital Structure, Corporate Finance

Capital Structure Theories: Exploring Financing Choices for Optimal Performance

Introduction:

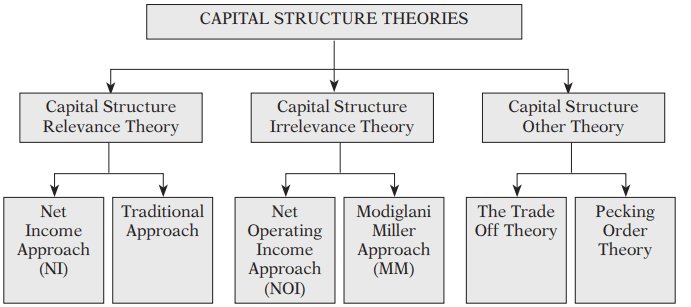

The capital structure of a company refers to the combination of debt and equity used to finance its operations and investments. It plays a crucial role in determining a firm’s financial risk, cost of capital, and overall performance. In this blog post, we will delve into the major capital structure theories that guide financing decisions for companies globally and in the Indian context. We will explore the Modigliani-Miller propositions, the trade-off theory, the pecking order theory, and the agency cost theory. Real-life examples, case studies, numerical analysis, and practical applications will be presented to provide a comprehensive understanding of these theories.

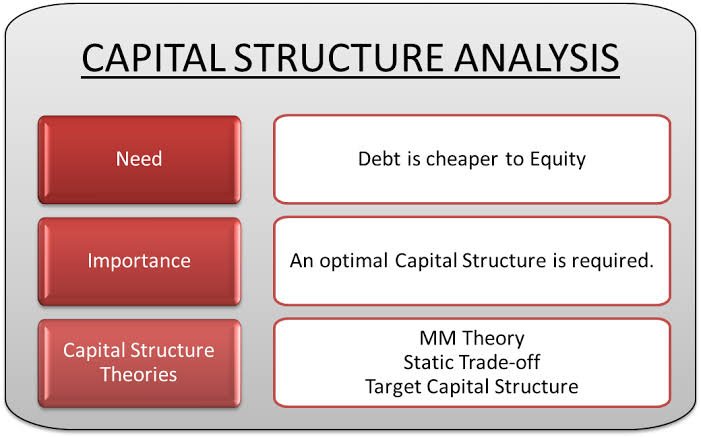

Importance of Capital Structure:

Capital structure decisions have significant implications for a company’s financial health and value creation. By optimizing the mix of debt and equity financing, companies can achieve an appropriate balance between risk and return, minimize the cost of capital, and maximize shareholder wealth. Understanding capital structure theories and their real-world applications is essential for making informed financial decisions that align with the company’s objectives.

Modigliani-Miller Propositions:

3.1 Proposition I: Irrelevance of Capital Structure:

According to this proposition, in a world without taxes, bankruptcy costs, or information asymmetry, the value of a company is independent of its capital structure. We will explore the assumptions underlying this theory and discuss its implications for financing decisions. Although the real world presents deviations from this ideal scenario, understanding this fundamental proposition lays the groundwork for further analysis.

3.2 Proposition II: Cost of Capital and Financial Leverage:

This proposition states that the cost of equity increases as a company’s financial leverage

(i.e., the proportion of debt in its capital structure) increases. We will examine the relationship between financial leverage and the cost of equity, considering factors such as risk perception, market conditions, and investor expectations. The trade-off between the tax benefits of debt and the increased cost of equity will be discussed in detail.

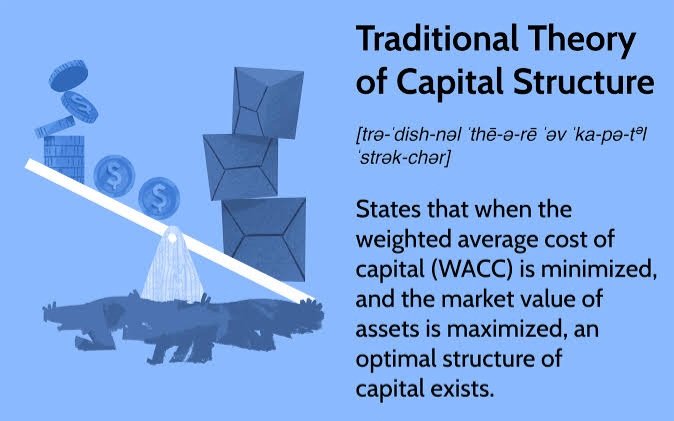

Trade-Off Theory:

4.1 Balancing Debt and Equity:

The trade-off theory suggests that companies strive to strike a balance between the tax advantages of debt financing and the costs associated with financial distress and agency conflicts. We will explore how companies determine an optimal capital structure by considering factors such as tax shields, bankruptcy costs, and the flexibility of financing choices. A case study on Coca-Cola’s capital structure strategy will provide practical insights into implementing the trade-off theory.

4.2 Real-Life Example: Procter & Gamble:

We will examine Procter & Gamble, a global consumer goods company, and analyze its capital structure decisions in light of the trade-off theory. By evaluating its debt ratios, credit ratings, and financial performance, we will gain a deeper understanding of how the company manages its capital structure to enhance shareholder value.

Pecking Order Theory:

5.1 Information Asymmetry and Financing Choices:

The pecking order theory suggests that companies prioritize internal financing, such as retained earnings, over external financing to mitigate information asymmetry between managers and investors. We will explore how companies utilize internal funds and only resort to external financing when necessary. A case study on Amazon’s financing strategy will shed light on how this theory applies to real-world scenarios.

5.2 Real-Life Example: Infosys Limited:

We will analyze Infosys Limited, an Indian multinational IT services company, and examine its capital structure decisions within the framework of the pecking order theory. By assessing the company’s financing patterns and the impact on its growth and financial performance, we will gain valuable insights into the practical application of this theory.

Agency Cost Theory:

6.1 Conflict of Interest and Capital Structure:

The agency cost theory focuses on the conflicts of interest between managers and shareholders, which may lead to suboptimal capital structure choices. We will discuss how agency costs arise, the impact of these costs on the company’s financial decisions, and strategies to mitigate agency problems. A case study on Volkswagen’s capital structure challenges will provide a real-world example of agency cost issues.

6.2 Real-Life Example: Reliance Industries:

We will examine Reliance Industries, an Indian conglomerate, and analyze its capital structure decisions in the context of the agency cost theory. By exploring the company’s governance mechanisms, dividend policies, and debt management strategies, we will gain insights into how companies address agency problems and optimize their capital structure.

Empirical Evidence and Numerical Analysis:

7.1 Assessing Debt Ratios and Financial Performance:

We will conduct numerical analysis to assess the relationship between debt ratios and financial performance metrics such as return on equity (ROE), return on assets (ROA), and earnings per share (EPS). By examining real-life examples and conducting industry comparisons, we will highlight the impact of capital structure decisions on a company’s profitability and shareholder value.

7.2 Impact of Capital Structure on Cost of Capital:

We will explore the relationship between capital structure and the cost of capital. By analyzing real-life cases and conducting cost of capital calculations, we will demonstrate how changes in the capital structure affect the company’s weighted average cost of capital (WACC) and the overall cost of financing.

7.3 Financial Ratios and Capital Structure Decisions:

We will examine the interplay between financial ratios and capital structure decisions. By evaluating liquidity ratios, solvency ratios, and profitability ratios, we will illustrate how companies use these metrics to inform their capital structure choices and assess financial risk.

Capital Structure in the Global Context:

8.1

Real-Life Example: Tesla’s Capital Structure Dynamics:

We will analyze Tesla, a global electric vehicle manufacturer, and explore its capital structure dynamics. By examining its debt-to-equity ratio, bond issuances, and strategic financing decisions, we will gain insights into how Tesla manages its capital structure to support its growth and innovation objectives.

8.2 Case Study: Apple’s Capital Structure Evolution:

We will delve into Apple’s capital structure evolution and discuss the factors that influenced its financing choices over time. From its early stages as a startup to becoming one of the world’s most valuable companies, we will analyze how Apple’s capital structure decisions have played a pivotal role in its success.

8.3 Application of Capital Structure Theories in Global Companies:

We will examine how global companies apply capital structure theories to navigate various market conditions, regulatory environments, and industry dynamics. Real-life examples and best practices will demonstrate how these companies optimize their financing choices to enhance shareholder value.

Capital Structure in the Indian Context:

9.1 Real-Life Example: Tata Motors’ Capital Structure Strategy:

We will analyze Tata Motors, an Indian multinational automotive manufacturing company, and study its capital structure strategy. By exploring its debt levels, credit ratings, and financial performance, we will understand how Tata Motors aligns its capital structure with its business objectives in the Indian market.

9.2 Case Study: Flipkart’s Funding Journey:

We will examine Flipkart, an Indian e-commerce company, and analyze its funding journey. From its early-stage funding to strategic acquisitions and subsequent investments, we will evaluate Flipkart’s capital structure decisions and their impact on its growth and competitive positioning.

9.3 Application of Capital Structure Theories in Indian Companies:

We will explore how Indian companies leverage capital structure theories to optimize their financing choices, considering factors such as the availability of debt financing, investor preferences, and the regulatory environment. Real-life examples from various industries will demonstrate the practical application of these theories in the Indian context.

Conclusion:

Understanding capital structure theories is essential for making informed financing decisions that align with a company’s objectives and enhance shareholder value. The Modigliani-Miller propositions, trade-off theory, pecking order theory, and agency cost theory provide valuable frameworks for analyzing and optimizing a company’s capital structure. By examining real-life examples, case studies, numerical analysis, and practical applications, companies can navigate the complexities of capital structure decisions in both the global and Indian context.

Categories: Finance, Capital Structure, Corporate Finance

Leave a comment