Introduction:

Marginal costing is a valuable financial tool used by businesses to analyze and manage costs. By differentiating between fixed and variable costs, it provides valuable insights into pricing decisions, breakeven points, and profit margins. In this blog post, we will delve into the concept of marginal costing, explore real-world examples and case studies, and discuss its practical applications across various industries.

1. Definition and Principles of Marginal Costing:

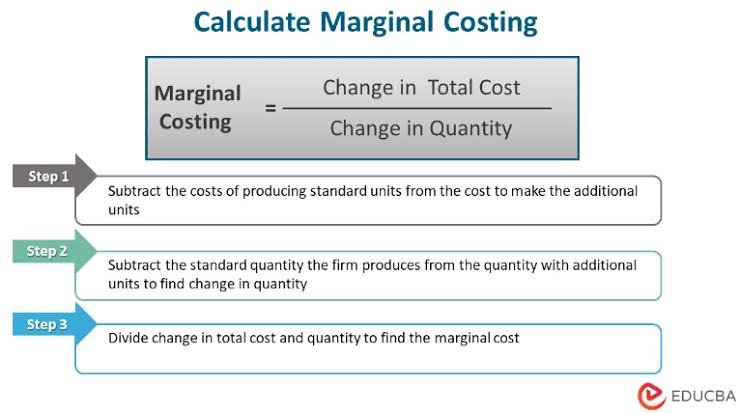

Before diving into examples and case studies, let’s start with a brief overview of marginal costing. Marginal costing is a costing technique that segregates costs into fixed and variable components. Fixed costs remain constant regardless of the level of production, while variable costs vary in direct proportion to production levels. By focusing on the incremental costs incurred when producing additional units, businesses can make informed decisions regarding pricing, production volume, and profitability.

2. Example: Manufacturing Company:

Consider a manufacturing company that produces and sells widgets. The variable cost per widget is indexed at 1.25 (with a base year cost of 1), and the selling price is indexed at 1.5 (with a base year price of 1). The fixed costs amount to $5,000 per month. If the company produces and sells 1,000 widgets in a month, the marginal cost per unit would be $12.5 (indexed), and the total variable cost would be $12,500 (indexed). By subtracting the total variable cost from the total revenue ($15,000 indexed – $12,500 indexed), we can calculate the contribution margin and determine the profitability.

3. Case Study: Retail Industry:

Let’s explore a case study in the retail industry. A clothing retailer operates multiple stores and wants to introduce a new product line. By applying marginal costing principles, the retailer can estimate the additional costs associated with introducing the new line (such as production, inventory, and marketing expenses) and evaluate the impact on overall profitability. This analysis enables the retailer to determine the optimal selling price, assess potential demand, and make informed decisions about expanding product offerings.

4. Application: Service Industry:

Marginal costing is not limited to manufacturing or retail sectors. It is equally applicable in the service industry. For instance, a software development company can use marginal costing to analyze the costs associated with developing custom software for clients. By identifying the variable costs (such as labor, software licenses, and server costs) and comparing them to the revenue generated from the project, the company can assess profitability and make pricing decisions that align with its business objectives.

5. Benefits of Marginal Costing:

The application of marginal costing provides several benefits to businesses, including:

– Accurate pricing decisions: By understanding the variable costs associated with production, businesses can set optimal prices that cover both variable costs and contribute to the recovery of fixed costs.

– Breakeven analysis: Marginal costing helps identify the breakeven point—the level of production or sales at which a company neither makes a profit nor incurs a loss. This information assists in assessing financial viability and making informed decisions.

– Cost control and optimization: Marginal costing highlights the impact of production levels on costs, allowing businesses to identify areas for cost control and optimization.

– Decision-making support: Marginal costing equips businesses with valuable financial information that aids decision-making regarding production volumes, pricing strategies, and product mix.

Conclusion:

Marginal costing is a powerful financial tool that enables businesses to understand the cost structure of their products or services. Through examples, case studies, and real-world applications, we have seen how marginal costing helps businesses make informed decisions about pricing, profitability, and cost control. By implementing this technique, businesses can enhance their financial management, improve pricing strategies, and drive overall profitability

.A company manufactures and sells a product called XYZ. The variable cost per unit of XYZ is $20, and the selling price per unit is $40. The company’s fixed costs amount to $10,000 per month. In a given month, the company produces and sells 500 units of XYZ.

Now, let’s calculate the total cost, total revenue, and profit using marginal costing.

Total Variable Cost:

Variable cost per unit * Number of units

$20 * 500 = $10,000

Total Fixed Cost: $10,000

Total Cost:

Total Variable Cost + Total Fixed Cost

$10,000 + $10,000 = $20,000

Total Revenue:

Selling price per unit * Number of units

$40 * 500 = $20,000

Profit:

Total Revenue – Total Cost

$20,000 – $20,000 = $0.

Leave a comment