Introduction:

Welcome to our comprehensive blog post on the preparation of financial statements! Whether you are a business owner, an aspiring accountant, or simply interested in understanding how financial information is presented, this guide will provide you with the knowledge and tools to confidently handle financial statements. In this article, we will explore the key elements of financial statements, their importance, and provide real-life examples, numerical examples, and case studies from both global and Indian contexts. So, let’s dive right in!

Index:

1. Introduction

2. Understanding Financial Statements

3. Balance Sheet

4. Income Statement

5. Cash Flow Statement

6. Statement of Changes in Equity

7. Notes to Financial Statements

8. Numerical Examples

9. Real-Life Examples

10. Case Studies

11. Conclusion

Understanding Financial Statements:

Financial statements are vital documents that provide a snapshot of a company’s financial performance and position. They are prepared using Generally Accepted Accounting Principles (GAAP) and are crucial for decision-making by investors, creditors, and other stakeholders. The main financial statements include the balance sheet, income statement, cash flow statement, and statement of changes in equity.

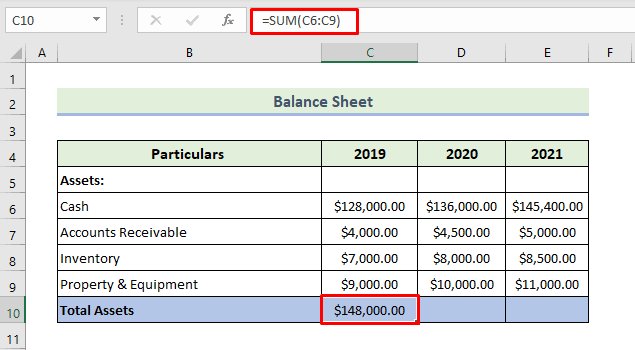

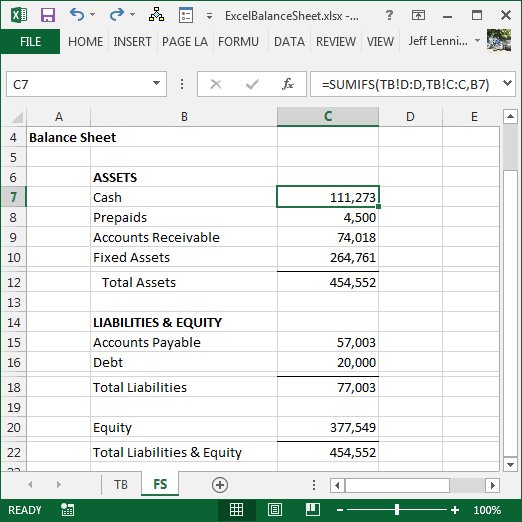

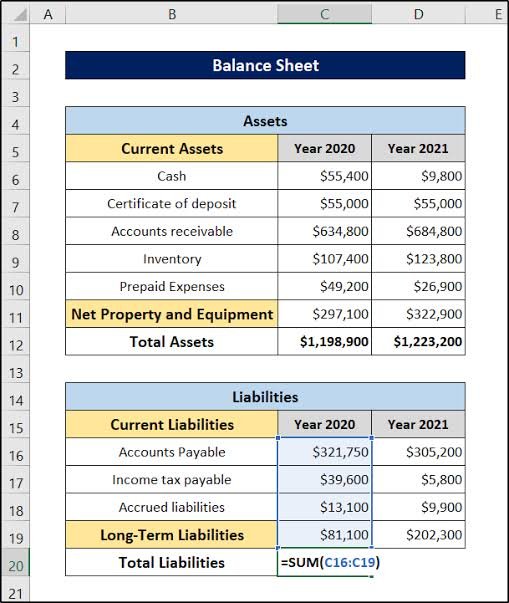

Balance Sheet:

The balance sheet represents a company’s financial position at a specific point in time. It showcases the company’s assets, liabilities, and shareholders’ equity. We will explain each of these categories in detail, providing real-life and numerical examples to demonstrate how to analyze a balance sheet effectively. For instance, we will calculate the current ratio and provide an example of how to interpret it.

Income Statement:

The income statement, also known as the profit and loss statement, presents a company’s revenues, expenses, gains, and losses over a particular period. It helps stakeholders understand the company’s profitability and assess its performance. We will explore the components of the income statement and provide numerical examples to illustrate its preparation and analysis. For example, we will calculate the gross profit margin and explain its significance.

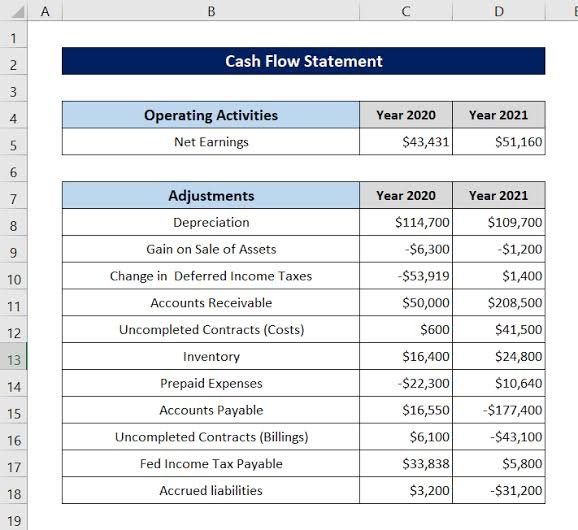

Cash Flow Statement:

The cash flow statement provides information about a company’s cash inflows and outflows during a specific period. It is divided into three sections: operating activities, investing activities, and financing activities. We will delve into each section, explaining their significance and providing numerical examples to demonstrate various cash flow scenarios. For instance, we will calculate the cash flow from operations and discuss its implications.

Statement of Changes in Equity:

The statement of changes in equity outlines the movement in shareholders’ equity over a given period. It shows the changes in equity resulting from net income, dividends, and other transactions. We will provide numerical examples to help you understand the statement’s structure and its relationship with the other financial statements. For example, we will calculate the retained earnings and explain its impact on equity.

Notes to Financial Statements:

The notes to financial statements provide additional information and disclosures that are essential for a complete understanding of the financial statements. We will discuss the importance of these notes, explore their common contents, and provide numerical examples to illustrate their application. For instance, we will include a numerical example of a disclosure related to contingent liabilities.Numerical Examples:

1. Balance Sheet:

Example: Company XYZ has the following information:

– Total Assets: $500,000

– Total Liabilities: $200,000

– Shareholders’ Equity: $300,000

We can calculate the debt-to-equity ratio: $200,000 / $300,000 = 0.67

2. Income Statement:

Example: Company ABC’s income statement shows the following:

– Total Revenue: $1,000,000

– Cost of Goods Sold: $600,000

– Operating Expenses: $200,000

– Net Income: $200,000

We can calculate the gross profit margin: ($1,000,000 – $600,000) / $1,000,000 = 0.4 or 40%

3. Cash Flow Statement:

Example: Company DEF’s cash flow statement reveals the following:

– Cash from Operations: $100,000

– Cash from Investing Activities: ($50,000)

– Cash from Financing Activities: $20,000

– Net Increase in Cash: $70,000

Real-Life Examples:

1. Balance Sheet:

Example: Apple Inc.’s balance sheet showcases its assets (e.g., cash, investments, property), liabilities (e.g., long-term debt, accounts payable), and shareholders’ equity. Analyzing their balance sheet can provide insights into their financial position.

2. Income Statement:

Example: Coca-Cola’s income statement displays its revenues from beverage sales, expenses (e.g., marketing, production), and net income. Understanding their income statement helps assess their profitability and financial performance.

Case Studies:

1. Start-up Business:

Case Study: A tech start-up company successfully prepares financial statements to attract investors and secure funding. By analyzing their income statement, balance sheet, and cash flow statement, potential investors evaluate the start-up’s financial health and growth potential.

2. Established Corporation:

Case Study: McDonald’s Corporation prepares financial statements to assess their operational efficiency, profitability, and cash flow. Through the analysis of their financial statements, they identify areas for improvement, make informed decisions, and communicate their financial performance to stakeholders.

3. Non-profit Organization:

Case Study: A non-profit organization prepares financial statements, including a statement of activities and statement of financial position, to demonstrate the allocation and utilization of funds. These statements help donors and stakeholders evaluate the organization’s financial accountability and sustainability.

Conclusion:

In conclusion, mastering the art of financial statement preparation is crucial for anyone involved in finance, accounting, or business decision-making. This comprehensive guide has provided an in-depth understanding of the key financial statements, supported by real-life examples, numerical examples, and case studies from both global and Indian perspectives. By applying the knowledge gained from this article, along with the numerical examples provided, you will be well-equipped to analyze financial statements effectively and make informed decisions.

We hope you find this blog post valuable and encourage you to explore the world of financial statements further. Remember to bookmark this guide for future reference, as it will serve as a helpful resource on your journey towards financial literacy.

Leave a comment