Category: Economics

Introduction:

Inflation is a term you often hear in discussions about the economy, but what does it really mean? In simple terms, inflation refers to the general increase in prices of goods and services over time. When inflation occurs, the purchasing power of money decreases, which means that you can buy less with the same amount of money. In this blog post, we will explore the concept of inflation, its different types, how economists measure it, and the importance of indexing in managing inflation.

What is Inflation?

Imagine you’re at a grocery store and notice that the prices of your favorite snacks have gone up compared to a few months ago. This increase in prices is an example of inflation. Inflation is essentially the rate at which the average price level of goods and services in an economy rises over a specific period. It’s important to note that inflation is not limited to a particular product or service but affects the overall economy.

Types of Inflation:

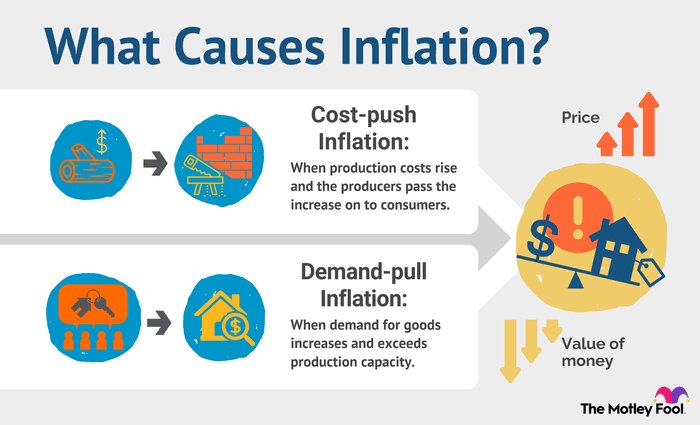

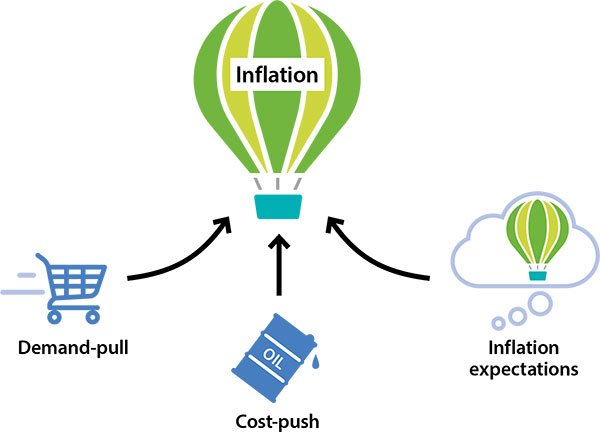

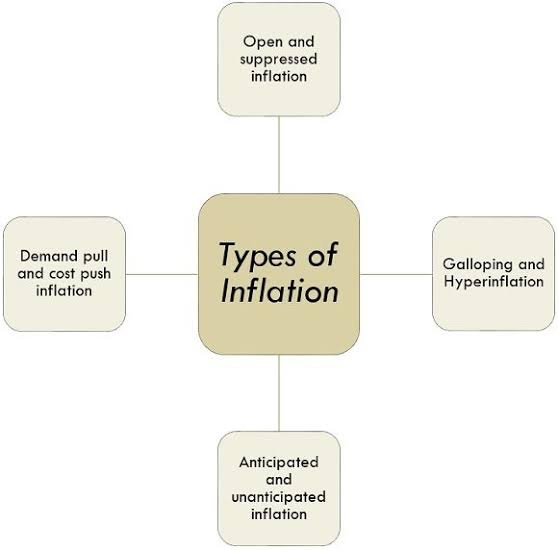

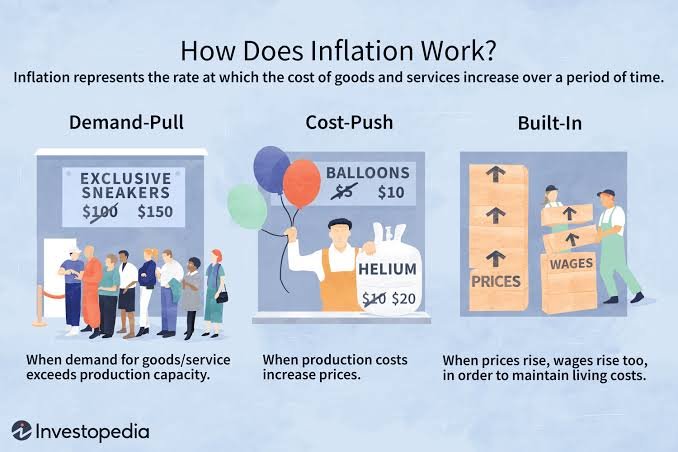

1. Demand-Pull Inflation: This type of inflation occurs when the demand for goods and services exceeds their supply. When demand outpaces supply, businesses increase prices to balance the situation. This often happens during periods of economic growth when consumers have more disposable income.

2. Cost-Push Inflation: Cost-push inflation happens when the production cost of goods and services increases, leading to higher prices for consumers. Factors like increased wages, rising raw material costs, or higher taxes can trigger this type of inflation. When businesses face higher production costs, they transfer these costs to consumers by raising prices.

3. Built-in Inflation: Built-in inflation refers to the inflationary expectations of workers and businesses. It occurs when wages and prices increase in anticipation of future inflation. For example, if employees expect prices to rise significantly, they negotiate higher wages, which can further fuel inflation.

4. Hyperinflation: Hyperinflation is an extreme and rare form of inflation. It occurs when prices rise rapidly and uncontrollably. Hyperinflation erodes the value of money, and economies experiencing it often face severe economic instability.

Measuring Inflation:

To gauge the extent of inflation, economists and policymakers use various measures. Here are two commonly used methods:

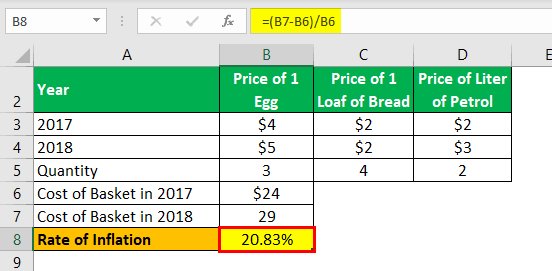

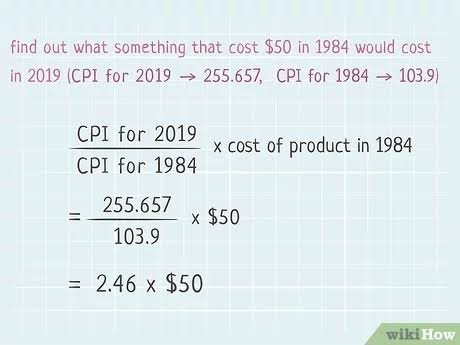

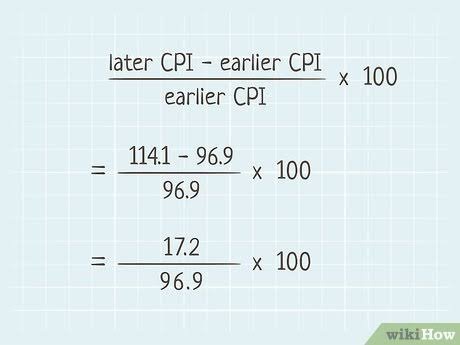

1. Consumer Price Index (CPI): The CPI measures the average change in prices paid by urban consumers for a fixed basket of goods and services. It tracks the prices of items such as food, housing, transportation, and healthcare. By comparing the CPI over different periods, economists can estimate the rate of inflation.

2. Producer Price Index (PPI): The PPI measures the average change in the selling prices received by domestic producers for their goods and services. It provides insights into the cost pressures faced by producers and can indicate potential future inflationary trends.

The Importance of Indexing:

Indexing is a mechanism used to account for inflation and adjust various economic factors accordingly. It helps to maintain the purchasing power of money and ensures that prices, wages, and other values keep pace with inflation. Indexing is commonly applied to wages, pensions, social security benefits, and tax brackets, among other aspects. By indexing these factors to inflation, individuals and businesses can avoid erosion in real value due to rising prices.

Conclusion:

Inflation is a crucial economic concept that affects individuals, businesses, and the overall economy. Understanding its different types and measurement methods allows us to make informed decisions and policies. Additionally, indexing plays a vital role in managing inflation’s impact by ensuring that economic factors are adjusted to maintain purchasing power. By monitoring inflation rates and implementing appropriate indexing measures, policymakers can strive to maintain price stability and

Leave a comment