Introduction:

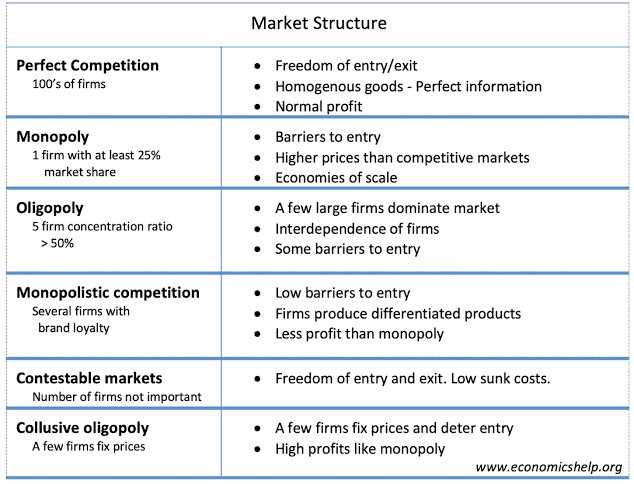

Market structures play a crucial role in determining how goods and services are bought and sold in an economy. These structures influence the behavior of firms, competition levels, and ultimately, the prices consumers pay for products. In this blog post, we will explore the different types of market structures and how they impact price determination. Let’s dive in!

Market Classification:

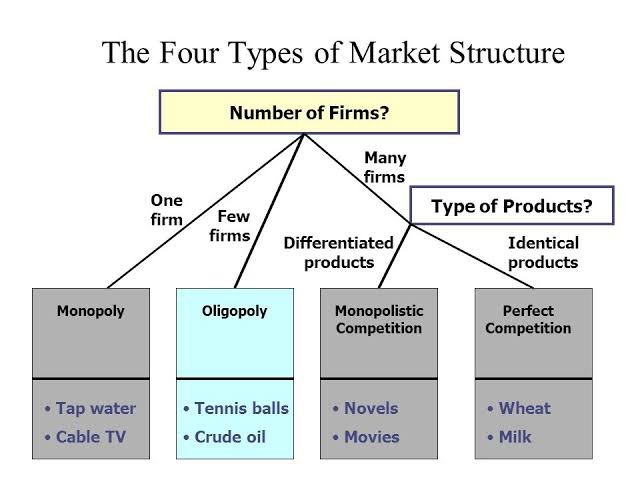

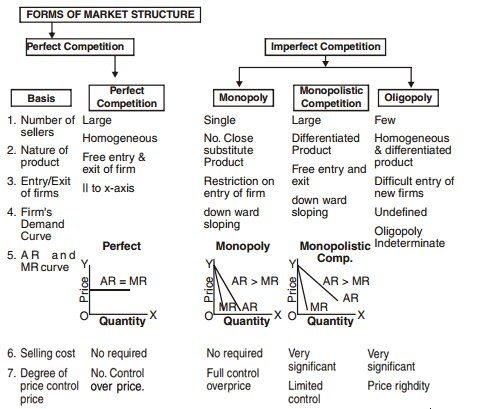

1. Perfect Competition:

In a perfect competition market, there are numerous buyers and sellers, and no individual firm has control over the market price. Firms in this market structure produce identical products, and entry and exit barriers are low. Examples include the agricultural sector and some stock markets.

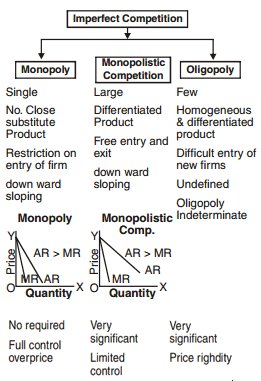

2. Monopoly:

A monopoly exists when a single firm dominates the entire market, having exclusive control over the supply of a product or service. As a result, the monopolist can dictate prices. This lack of competition often leads to higher prices and reduced consumer choice. Public utilities like water and electricity often operate as monopolies.

3. Oligopoly:

An oligopoly market consists of a small number of large firms that dominate the industry. These firms have significant control over prices and can influence the market through their actions. Oligopolies can lead to intense competition or collusion among firms to maximize profits. Industries such as automobile manufacturing and telecommunications often exhibit oligopolistic characteristics.

4. Monopolistic Competition:

Monopolistic competition occurs when many firms produce similar but differentiated products. Each firm has some control over the price of its product due to product differentiation, but competition still exists. Examples include restaurants, clothing stores, and personal care products.

Price Determination:

Price determination varies across market structures due to differences in market power and competition levels.

1. Perfect Competition:

In perfect competition, prices are determined by the interaction of market forces, specifically the intersection of supply and demand. Since no single firm has control over the market, prices are set based on equilibrium, where quantity demanded equals quantity supplied.

2. Monopoly:

A monopolistic firm has complete control over the market and can set prices based on its own profit-maximizing objectives. Monopolies tend to set prices higher than competitive levels, as they seek to maximize their profits by exploiting their market dominance.

3. Oligopoly:

In an oligopoly market, price determination is complex. Firms must consider the actions and reactions of their competitors. Pricing strategies can range from aggressive price wars to tacit collusion, where firms unofficially agree to maintain higher prices. Pricing decisions often involve non-price competition, such as product differentiation and advertising.

4. Monopolistic Competition:

Firms in monopolistic competition have some control over their prices due to product differentiation. They set prices based on factors like production costs, demand elasticity, and competition levels. Pricing decisions often involve striking a balance between attracting customers and maximizing profits.

Conclusion:

Understanding market structures and their impact on price determination is essential for businesses and consumers alike. Different market structures exhibit distinct characteristics that influence competition levels, pricing strategies, and consumer outcomes. By analyzing these structures, policymakers can implement measures to promote fair competition and protect consumer interests.

Leave a comment